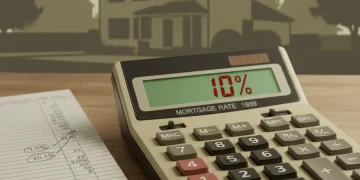

10% Down Payment: Housing Market Shift Mirrors 1989 Levels

The resurgence of the 10% down payment as a standard in U.S. housing finance, a level not commonly seen since 1989, signals a recalibration of risk and accessibility, particularly benefiting creditworthy first-time buyers navigating high interest rates and elevated home prices.

Fed December Rate Cut: Mortgage Rate Impact Analysis for US Homeowners

The projected Federal Reserve December rate cut is anticipated to lower short-term funding costs, potentially influencing the benchmark 10-year Treasury yield and subsequently easing 30-year fixed mortgage rates, offering relief to prospective US homebuyers.

HELOC Rates at 7.81%: Should You Tap Home Equity Before Rates Rise?

As the average Home Equity Line of Credit (HELOC) rate hovers near 7.81%, driven by sustained high Federal Reserve policy rates, homeowners must urgently evaluate tapping equity for renovations or debt consolidation, balancing current costs against the probability of future rate hikes.

S&P 500’s 12.75% YoY Surge: Key Sectors Driving 2026 Returns

The S&P 500's robust 12.75% year-over-year growth signals sustained momentum, primarily fueled by resilience in the Information Technology and Healthcare sectors, setting the stage for continued market expansion through 2026.

Emerging Markets Up 30% YTD: Why 2026 is a Breakout Year

The significant 30% YTD rally in Emerging Markets (EM) equity indices signals a potential regime shift, driven by anticipated Federal Reserve rate cuts, stabilizing commodity prices, and improving fiscal balances across key developing economies.

Unemployment Stable at 4.4%: Labor Market Data and Economic Outlook

The stability of the unemployment stable 4.4% rate suggests a resilient but cooling labor market, maintaining wage growth pressures that complicate the Federal Reserve's path toward achieving the 2% inflation target without triggering a deeper economic slowdown.