S&P 500 Earnings Growth at 8.5%: Q4 2025 Sector Leadership Analysis

With the S&P 500 projected to achieve 8.5% earnings growth in Q4 2025, market attention is shifting to sectors like Information Technology and Healthcare, which possess the structural tailwinds and pricing power necessary to significantly outperform broader index expectations.

Bitcoin Drop Below $86k: Crypto Volatility and Portfolio Risk Management

The recent 6% decline in Bitcoin, pushing the asset momentarily below $86,000, underscores the persistent crypto volatility portfolio risk inherent in digital assets, necessitating robust, data-driven risk management strategies for institutional and retail investors alike.

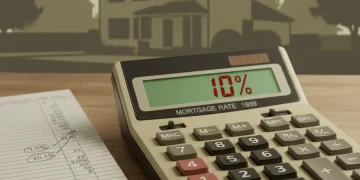

Inflation at 3% Annually: Protecting Savings in 2025

Sustained 3% annual inflation in 2025 necessitates a strategic shift from cash holdings to inflation-protected assets, prioritizing real returns over nominal gains to maintain purchasing power.

Olá, mundo!

Boas-vindas ao WordPress. Esse é o seu primeiro post. Edite-o ou exclua-o, e então comece a escrever!