AI Weakness Signals Rotation: Market Down 0.4% This Week

The stock market's marginal 0.4% dip this week was primarily attributed to significant selling pressure within the artificial intelligence (AI) sector, indicating a critical shift in investor sentiment toward broader market diversification and away from concentrated tech leadership.

Consumer Confidence Falls to 88.7: Household Worry Analysis

The recent drop in consumer confidence to 88.7, driven primarily by persistent inflation fears and moderated job growth expectations, indicates a measured, yet growing, anxiety among American households regarding near-term economic stability and future purchasing power.

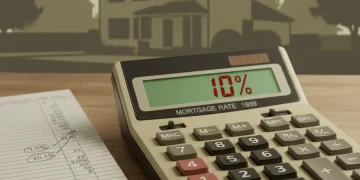

Mortgage Points Strategy for First-Time Buyers: Navigating the Affordability Crisis

Amidst the deepening housing affordability crisis, first-time buyers should strategically analyze the cost-benefit of purchasing mortgage points strategy to secure a lower interest rate, optimizing long-term housing costs against high upfront capital requirements.

Black Friday 2025: $11.8B Online Sales Decoded

Black Friday 2025 established a new benchmark for U.S. e-commerce, with online sales reaching $11.8 billion, a 15% year-over-year increase, signaling unexpected consumer spending resilience amid elevated inflation and interest rates.

Fed Rate Cut Odds at 87%: 401k Impact and Investor Strategy

The 87% probability of a Federal Reserve rate cut by December signals a potential shift toward monetary easing, profoundly impacting fixed income, equity valuations, and the long-term growth trajectory of retirement accounts like the 401k.

Gen Z Investors Up 162% Year-Over-Year: Market Analysis

The remarkable 162% year-over-year increase in Gen Z investor participation is reshaping the retail investment landscape, fueled by zero-commission trading and enhanced digital access that lowers entry barriers and promotes diversification.