Credit Card Rates Exceed 20%: When Debt Consolidation Actually Works

As average credit card annual percentage rates (APR) consistently exceed 20%, debt consolidation becomes a viable strategy only when coupled with a lower, fixed interest rate and stringent behavioral changes to prevent future reliance on high-interest credit.

AI Stocks Rally 27% YTD: Bubble or Genuine Growth?

The remarkable 27% year-to-date surge in the AI stocks sector is driven by tangible revenue growth in infrastructure providers and software licensing, forcing investors to scrutinize whether current valuations reflect genuine technological transformation or speculative overheating.

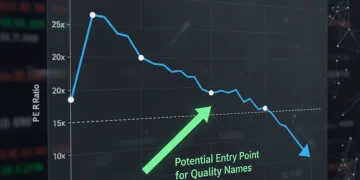

Tech Stock Valuations Compressed: When to Buy Quality Names

Amid rising rate uncertainty and sector rotation, quality growth companies in the technology sector are experiencing compressed valuations, creating strategic entry points for investors focused on durable earnings growth and strong free cash flow generation.

Mortgage Rates at 5.99%: Refinance Analysis and Market Outlook

The 5.99% mortgage rate threshold presents a complex refinancing decision driven by homeowners' current rate, the cost of closing, and expectations regarding the Federal Reserve's future monetary policy trajectory into 2025.

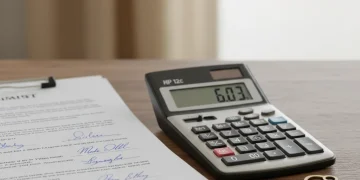

30-Year Mortgage Rates Near 6.03%: Refinance Now or Wait for 2026?

As 30-year mortgage rates hover near 6.03%, the decision to refinance now versus waiting for potential cuts in 2026 depends heavily on the trajectory of core inflation and the Federal Reserve's commitment to normalizing the yield curve.

December FOMC Meeting: 87% Probability of 25 Basis Point Rate Cut

The high probability (87%) of a 25 basis point rate cut at the December FOMC Meeting reflects slowing inflation momentum and increasing labor market deceleration, signaling a pivotal shift in Federal Reserve monetary policy strategy.