How to Pay Off Debt Faster: Proven Strategies for 2024

“`html

Discover proven strategies to pay off debt faster, including budgeting, the debt snowball method, balance transfers, and increasing your income, empowering you to achieve financial freedom.

Feeling weighed down by debt? You’re not alone. The good news is that there are how to pay off debt faster: proven strategies you can implement today to regain control of your finances and accelerate your journey to financial freedom.

Understand Your Debt Landscape

Before diving into strategies, it’s crucial to understand the specifics of your debt. This involves taking stock of what you owe, to whom, and at what interest rates. This understanding forms the foundation for an effective debt repayment plan.

List All Your Debts

Start by creating a comprehensive list of all your debts. This includes credit card balances, student loans, personal loans, auto loans, and any other outstanding obligations.

Identify Interest Rates and Minimum Payments

For each debt, note the interest rate and the minimum payment due each month. This information will be critical when prioritizing which debts to tackle first.

- Credit Cards: Often have the highest interest rates.

- Student Loans: May have lower rates but can be substantial in amount.

- Personal Loans: Typically have fixed interest rates and repayment terms.

Understanding your debt landscape is the crucial first step towards effectively managing and paying off your obligations. By listing your debts and identifying interest rates, you can create a targeted plan to accelerate your debt repayment journey.

Create a Realistic Budget

Budgeting is the cornerstone of any successful debt repayment strategy. A well-crafted budget allows you to track your income and expenses, identify areas where you can cut back, and allocate more funds towards debt repayment. A budget is not about restriction; it’s about empowerment.

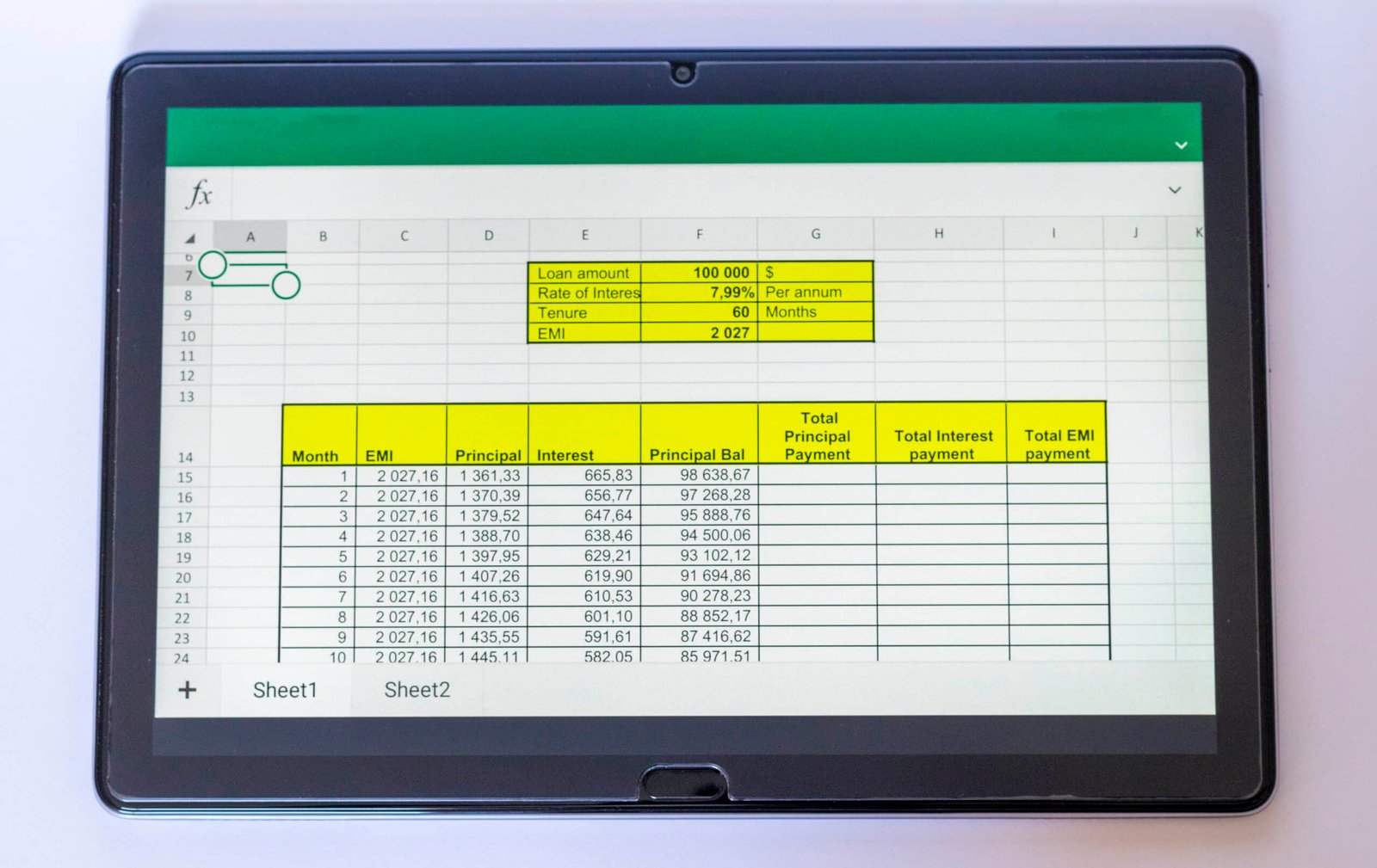

Track Your Income and Expenses

Start by tracking your income and expenses for a month. You can use budgeting apps, spreadsheets, or even a notebook to record every dollar that comes in and goes out.

Identify Areas to Cut Back

Once you have a clear picture of your spending habits, look for areas where you can cut back. This might involve reducing discretionary spending, such as dining out, entertainment, or subscriptions.

- Dining Out: Cook more meals at home.

- Entertainment: Explore free or low-cost activities.

- Subscriptions: Cancel unused services.

Creating a realistic budget is essential for gaining control over your finances and accelerating your debt repayment. By tracking your income and expenses, you can identify areas to cut back and allocate more funds towards your debt.

The Debt Snowball Method

The debt snowball method, popularized by Dave Ramsey, focuses on paying off debts in order of smallest to largest balance, regardless of interest rate. This approach provides quick wins, which can be highly motivating and help you stay on track.

List Debts from Smallest to Largest

Start by listing all your debts from the smallest balance to the largest balance.

Focus on the Smallest Debt First

Make minimum payments on all debts except the smallest one. Put any extra money you can find towards paying off that smallest debt as quickly as possible.

Roll the Payment to the Next Debt

Once the smallest debt is paid off, take the money you were putting towards it and apply it to the next smallest debt, while continuing to make minimum payments on the remaining debts. This creates a “snowball” effect, where the amount you’re paying towards debt grows larger and larger over time.

The debt snowball method offers a structured approach to debt repayment, providing motivation through quick wins and momentum as smaller debts are eliminated. By focusing on the smallest balances first, you can build confidence and stay committed to your debt-free journey.

The Debt Avalanche Method

The debt avalanche method focuses on paying off debts in order of highest to lowest interest rate. This approach saves you the most money in the long run by minimizing the amount of interest you pay over time.

List Debts from Highest to Lowest Interest Rate

Start by listing all your debts from the highest interest rate to the lowest interest rate.

Focus on the Highest Interest Debt First

Make minimum payments on all debts except the one with the highest interest rate. Put any extra money you can find towards paying off that highest interest debt as quickly as possible.

Continue Down the List

Once the highest interest debt is paid off, move on to the next highest interest debt, and so on, until all your debts are paid off.

- Save on Interest: Minimize the total interest paid.

- Faster Debt Freedom: Can lead to quicker debt repayment.

- Strategic Approach: Prioritizes high-cost debt.

The debt avalanche method is a mathematically sound approach to debt repayment, prioritizing debts with the highest interest rates to minimize long-term costs. By focusing on high-interest debts first, you can save money and accelerate your path to financial freedom.

Consider Balance Transfers

A balance transfer involves moving high-interest debt, such as credit card balances, to a new credit card with a lower interest rate. This can save you money on interest and help you pay off your debt faster.

Find a Balance Transfer Card

Look for a credit card that offers a 0% introductory APR on balance transfers. Be sure to check the balance transfer fee, which is typically a percentage of the amount transferred.

Transfer Your Balances

Once you’ve been approved for a balance transfer card, transfer your high-interest balances to the new card. Be sure to pay off the balance before the 0% introductory APR expires, or the interest rate will likely increase.

Evaluate the Fees

Consider the balance transfer fee. Some cards offer lower fees than others, and some occasionally waive the fees entirely.

Balance transfers can be a powerful tool for reducing interest payments and accelerating debt repayment. By transferring high-interest balances to a card with a lower rate, you can save money and eliminate debt more quickly.

Increase Your Income

While budgeting and debt repayment strategies are essential, increasing your income can significantly accelerate your debt payoff journey. More income means more money to put towards debt each month.

Explore Side Hustles

Consider taking on a side hustle to generate extra income. This could involve freelancing, driving for a ride-sharing service, or selling items online.

Negotiate a Raise

If you’re employed, consider negotiating a raise with your employer. Research industry standards for your position and experience level to make a strong case for a higher salary.

- Freelancing: Offer your skills online.

- Part-Time Job: Supplement your income.

- Sell Unused Items: Declutter and earn.

Increasing your income provides a powerful boost to your debt repayment efforts. By exploring side hustles and negotiating a raise, you can generate additional funds to accelerate your journey to financial freedom.

| Key Point | Brief Description |

|---|---|

| 💡 Budgeting | Track income/expenses to find savings. |

| 🚀 Snowball Method | Pay smallest debt first for quick wins. |

| 💰 Avalanche Method | Target debts with highest interest rates. |

| 💸 Balance Transfers | Move debt to a lower interest card. |

FAQ

▼

The debt snowball method focuses on paying off debts from smallest to largest, regardless of interest rate. This provides quick wins and boosts motivation.

▼

The debt avalanche method prioritizes debts with the highest interest rates. By tackling the most expensive debts first, you save money on interest in the long run.

▼

A budget helps you track income and expenses, identify areas where you can cut back, and allocate more funds towards debt repayment, accelerating your progress.

▼

A balance transfer involves moving high-interest debt to a card with a lower interest rate. This reduces interest payments and helps you pay off debt faster.

▼

Increasing your income gives you more money to put towards debt each month. This can significantly accelerate your debt payoff journey and improve your financial health.

Conclusion

Paying off debt faster requires a combination of strategic planning, disciplined budgeting, and consistent effort. By understanding your debt landscape, creating a realistic budget, choosing the right repayment method, and exploring ways to increase your income, you can take control of your finances and achieve financial freedom.

“`