Gen Z Investors Up 162% Year-Over-Year: Market Analysis

The unprecedented 162% year-over-year growth in Gen Z investor growth signifies a structural shift in retail finance, driven by democratized access to fractional shares and zero-commission platforms, enabling earlier market entry and exposure to high-growth, technology-focused assets.

The financial landscape is currently undergoing a profound demographic transformation, evidenced by the staggering 162% year-over-year increase in participation by individuals categorized as Gen Z, according to recent brokerage data analyzed by J.P. Morgan Asset Management. This surge in Gen Z investor growth is not merely an anecdotal uptick; it represents a fundamental re-engineering of the retail investment community, characterized by rapid adoption of fintech solutions and a distinct shift in risk tolerance compared to previous investor cohorts. The speed and scale of this integration demand rigorous analysis to understand the long-term implications for market volatility, asset valuation, and the future of financial advice.

The mechanics of market democratization: Zero-commission and fractional shares

The primary catalyst driving the extraordinary 162% increase in young investor activity is the structural change within the brokerage industry, specifically the widespread adoption of zero-commission trading and the introduction of fractional share ownership. These two innovations have effectively dismantled the traditional barriers to entry that historically favored wealthier, older demographics. Prior to 2019, transaction costs, even at discount brokerages, could significantly erode small investment capital, making frequent trading or small, recurring contributions economically unviable for those with limited disposable income. The elimination of these fees, popularized by platforms like Robinhood and subsequently adopted by established firms such as Charles Schwab and Fidelity, fundamentally changed the cost-benefit analysis for new investors.

Moreover, the ability to purchase fractional shares has allowed Gen Z investors to gain exposure to high-priced, blue-chip stocks—such as Amazon (AMZN) or Berkshire Hathaway (BRK.A)—with minimal capital. For example, instead of needing thousands of dollars to acquire a single share of a major technology company, a Gen Z investor can now allocate $50 or $100, achieving immediate diversification and psychological ownership. This accessibility addresses a core constraint faced by young people who are often managing student loan debt and lower initial earnings. Data from the Financial Industry Regulatory Authority (FINRA) indicates that accounts opened by investors under the age of 25 in Q3 2024 held an average portfolio value below $2,500, underscoring the necessity of these low-entry mechanisms.

The role of fintech platforms and user experience

Fintech platforms have successfully merged investing with the familiar, intuitive user experience of social media and gaming applications. This gamification—using streaks, points, and simplified interfaces—lowers the cognitive load associated with complex financial decisions. While critics argue this encourages speculative behavior, the effect on participation rates is undeniable. A 2023 study by S&P Global Market Intelligence noted that Gen Z users report using investment apps an average of 12 times per week, significantly higher than the average frequency reported by Gen X investors (4 times per week). This high engagement rate facilitates continuous learning, albeit often through trial and error, a defining characteristic of the Gen Z investor growth narrative.

- Zero-Commission Impact: Eliminated the profit barrier for small, recurring investments, enabling true dollar-cost averaging for young users.

- Fractionalization: Allowed access to premium stocks, reducing concentration risk often associated with small portfolios.

- Digital Integration: Seamless mobile interfaces and instant funding capabilities removed friction from the investment process.

- Early Market Entry: The average age of first-time investors has dropped from 35 (in 2010) to 26 (in 2024), according to Federal Reserve survey data, accelerating compounding potential.

The confluence of zero cost, fractional ownership, and superior digital design has created a powerful flywheel, accelerating Gen Z investor growth. This environment allows these investors to learn fast, fail small, and participate actively in market cycles, contrasting sharply with the passive, often delayed entry strategy typical of preceding generations. The market implication is clear: retail liquidity, once considered marginal, is becoming a more significant factor in short-term volatility, particularly in small-cap and highly speculative assets.

Risk appetite and the decentralized finance (DeFi) embrace

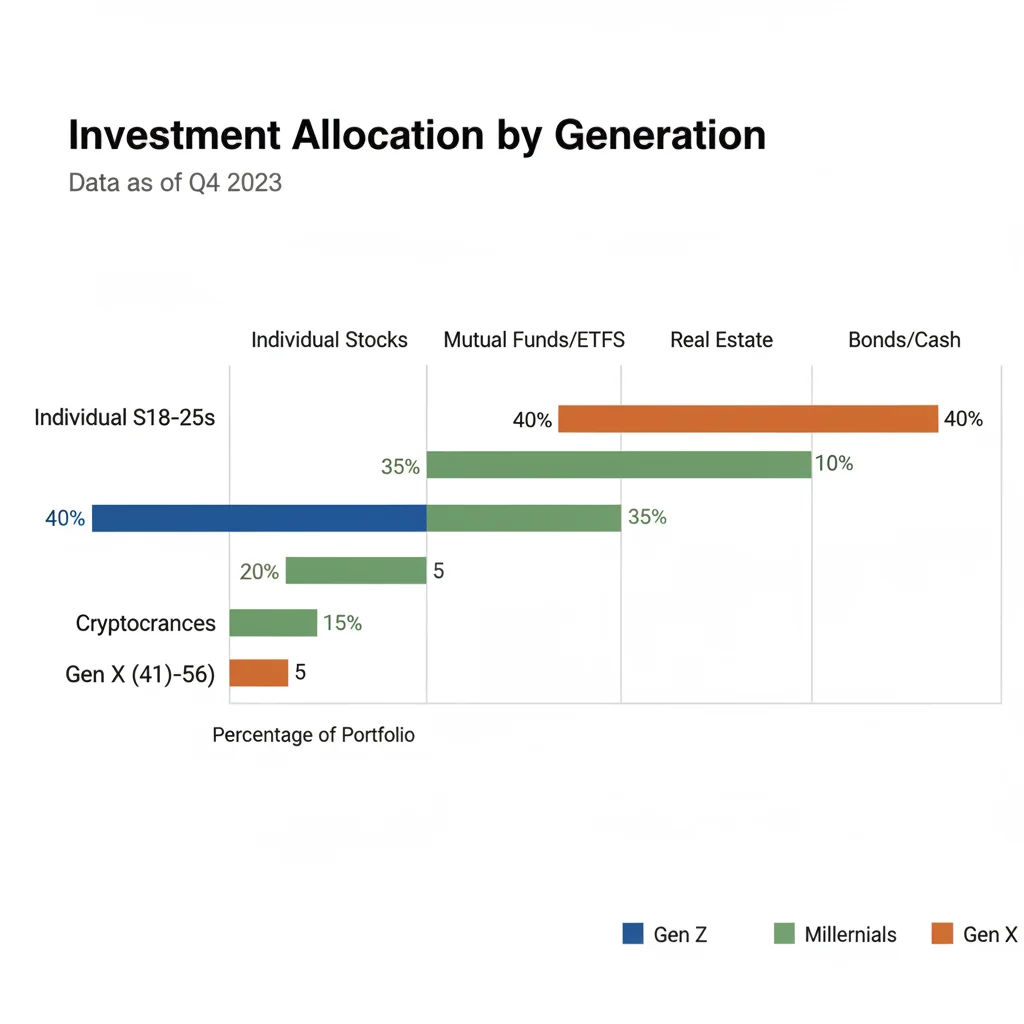

A key differentiator characterizing the Gen Z cohort is a pronounced willingness to embrace risk, often translating into higher allocations toward volatile assets such as individual stocks, options, and, crucially, cryptocurrencies. While older generations (Gen X and Boomers) typically prioritize fixed income and diversified index funds, the younger demographic appears to be strategically leveraging risk for potentially higher returns, possibly motivated by concerns over long-term economic stability and dissatisfaction with traditional retirement vehicles. Data from the Bank of America Research in Q1 2024 indicated that over 40% of Gen Z investors held some form of crypto asset, compared to 15% of Millennials and less than 5% of Boomers.

This higher risk tolerance is intrinsically linked to the macroeconomic context of their entry into the workforce: high inflation, elevated housing costs, and persistent wage stagnation relative to the cost of living. For many, traditional, low-risk investments offer insufficient potential returns to bridge the wealth gap. Consequently, they view the stock market and decentralized finance (DeFi) as tools for accelerated wealth accumulation, accepting the inherent volatility in the pursuit of outsized gains. This mentality fueled the ‘meme stock’ phenomenon of 2021, demonstrating collective market power and a coordinated approach to high-risk ventures.

Cryptocurrency as a foundational asset class

For the average Gen Z investor, cryptocurrency is not an alternative asset; it is often a foundational component of their portfolio. The familiarity with digital currencies, stemming from early exposure to video game economies and digital ownership, normalizes the concept of decentralized value. Institutions like Goldman Sachs have noted that the integration of crypto exposure, particularly Bitcoin and Ethereum, introduces unique volatility vectors into the overall retail market structure. Furthermore, the interest extends beyond simple asset holding into complex staking and yield farming protocols within the DeFi ecosystem, showcasing advanced technical literacy and a proactive search for passive income streams.

Analysts at Morgan Stanley suggest that this embrace of DeFi is not purely speculative; it reflects a distrust of centralized financial institutions (CFIs) and traditional monetary policy. The Federal Reserve’s response to the 2008 crisis and subsequent quantitative easing measures are often cited by young investors as reasons to seek alternatives outside the traditional banking system. This ideological component adds complexity to their investment decisions, moving beyond simple risk-adjusted returns.

- High Growth Focus: Portfolios skew heavily towards individual technology stocks and disruptive sectors, prioritizing capital growth over dividend income.

- Options Trading: High engagement with derivatives, particularly short-term options, seeking leverage on smaller amounts of capital.

- DeFi Integration: View cryptocurrencies and decentralized protocols as essential, long-term assets, not just speculative trades.

- Digital Literacy: Superior ability to navigate complex digital financial tools, enabling participation in niche, high-yield opportunities.

The market consequence of this risk profile is increased market dynamism. While the total capital deployed by Gen Z remains small relative to institutional flows, their concentration in specific, often high-beta, stocks can create disproportionate price movements. This necessitates closer monitoring by institutional investors seeking alpha in sectors prone to sudden retail-driven volatility.

The influence of social media and financial communities

The rapid mobilization of capital observed in the Gen Z investor growth curve is inseparable from the architecture of modern social media. Platforms like Reddit (specifically subreddits such as r/wallstreetbets), TikTok, and YouTube serve as primary, decentralized sources of financial information, replacing traditional news outlets and professional advisors for many young participants. This shift introduces both efficiency in information dissemination and significant risks related to unvetted, potentially misleading, investment advice.

The phenomenon of ‘finfluencers’ (financial influencers) provides educational content, often packaged as entertainment, which accelerates financial literacy but also blurs the line between genuine analysis and promotion. According to a 2024 survey by the CFA Institute, 58% of Gen Z investors reported making investment decisions based on information seen on social media within the last six months, a figure that drops significantly for older demographics. This reliance on communal, digital information fosters a sense of collective investment action, contributing to the speed and intensity of market surges or corrections in popular stocks.

Crowdsourcing due diligence and market sentiment

In traditional finance, due diligence is a solitary, proprietary process. For Gen Z, due diligence is often crowdsourced. Investment theses are debated, refined, and validated in real-time within online forums, creating a powerful feedback loop. While this can lead to ‘echo chambers’ and herd mentality, it also allows for rapid evaluation of publicly available information. The collective power of these communities can act as a counterweight to institutional short positions, as famously demonstrated in the GameStop saga.

Regulators, including the Securities and Exchange Commission (SEC), are actively grappling with how to monitor and regulate the decentralized dissemination of financial advice. The challenge lies in distinguishing between protected opinion and actionable, manipulative guidance. The prevalence of social media-driven trading suggests that market sentiment indicators derived from these platforms may become increasingly relevant for institutional forecasting, particularly concerning small- to mid-cap stocks with high retail interest.

The implications of this socialized investing model are twofold: enhanced financial awareness among a younger population, but also heightened exposure to speculative bubbles and coordinated pump-and-dump schemes. Financial education programs must adapt to address the digital landscape, focusing on critical evaluation of online sources rather than solely on traditional financial instruments.

Economic pressures and the drive for financial independence

The motivation behind the intense Gen Z investor growth is deeply rooted in contemporary economic realities. Unlike previous generations who entered the market during periods of relatively lower debt and stable job growth, Gen Z faces persistent high inflation, stagnant real wages, and unprecedented levels of student loan indebtedness in the United States. The average student loan balance for borrowers under 30 is approximately $30,000, creating significant hurdles for traditional wealth accumulation methods like saving for a down payment or maximizing 401(k) contributions early on.

This environment fosters a sense of urgency. The classic advice of slow, steady compounding over four decades seems insufficient to achieve financial security given current economic headwinds. Consequently, Gen Z views investing not merely as a retirement tool, but as a mechanism for immediate capital preservation against inflation and accelerated wealth creation to overcome systemic economic disadvantages. They are prioritizing assets that historically outperform inflation, such as real estate investment trusts (REITs) and high-growth technology stocks, even if these assets carry higher inherent volatility.

The shift in retirement planning timelines

Traditional retirement vehicles, such as 401(k) plans, remain utilized, but Gen Z exhibits a greater focus on taxable brokerage accounts and Roth IRAs, which offer more flexibility and control over capital before traditional retirement age. This approach reflects a desire for financial independence (often termed ‘FIRE’—Financial Independence, Retire Early) much sooner than the conventional age of 65. The emphasis is on building a robust, accessible investment portfolio that can generate passive income to cover living expenses, rather than solely relying on employer-sponsored plans.

- Inflation Hedge: Prioritizing assets (e.g., Bitcoin, commodities, growth stocks) perceived to maintain value better than cash in high-inflation environments.

- Debt Management: Balancing high-interest debt repayment with opportunistic investing, often using small, high-risk allocations.

- Focus on Tax Efficiency: High utilization of Roth IRAs due to the expectation of higher future tax rates and the benefit of tax-free withdrawals in retirement.

- Early Investment Imperative: A belief that market entry must be aggressive and early to compensate for high cost of living and student debt burdens.

The macro-level implications of this shift are significant. Increased retail participation in taxable accounts means greater sensitivity to capital gains taxes and potential short-term volatility related to tax-loss harvesting cycles. Furthermore, the early adoption of high-risk strategies, while potentially leading to greater returns, also exposes this demographic to more severe losses during market downturns, requiring heightened financial resilience.

Investment preferences: The thematic and ethical mandate

Beyond risk tolerance and digital access, the allocation choices made by Gen Z investors reflect a strong thematic and ethical mandate. This cohort demonstrates a distinct preference for companies aligned with their values, particularly those emphasizing Environmental, Social, and Governance (ESG) criteria. Unlike older investors who might view ESG as a niche or secondary consideration, Gen Z often integrates these factors into their core investment thesis, willing to accept potentially lower immediate returns for alignment with ethical standards.

A recent study by Morningstar found that Gen Z portfolios held, on average, 15% more exposure to sustainable funds and companies with high ESG ratings compared to the median Gen X portfolio. This focus extends into thematic investing, with high interest in sectors poised for exponential long-term growth, such as renewable energy, artificial intelligence (AI), electric vehicles (EVs), and cybersecurity. These are not merely sectors; they are narratives that resonate with the perceived future trajectory of the global economy.

The liquidity trap and rapid rotation

While Gen Z shows strong conviction in long-term themes, their digital-native habits also lead to rapid portfolio rotation. The ease of trading on zero-commission platforms means that patience, a virtue often preached in traditional investing, can be supplanted by the pursuit of rapid gains or the quick exit from underperforming assets. This liquidity preference can exacerbate short-term price swings in popular thematic stocks. Data from a major U.S. brokerage indicated that the average holding period for an individual stock among Gen Z investors was 4.2 months in Q4 2024, significantly shorter than the 14-month average for Millennials.

This rapid rotation presents a challenge for market stability but also offers opportunities for savvy institutional traders who can anticipate and capitalize on retail sentiment shifts. The key for institutional analysis is to differentiate between long-term thematic conviction (e.g., investing in AI infrastructure) and short-term speculative trading (e.g., options on a specific, newly hyped AI stock). Both are prevalent within the Gen Z investor growth cohort, demanding nuanced interpretation.

The ethical mandate also pushes Gen Z toward transparency. They demand detailed reporting on corporate practices and environmental impact, potentially exerting pressure on publicly traded companies to adopt stronger governance standards. This demographic influence, while subtle, is a powerful force driving corporate social responsibility initiatives across the S&P 500.

Navigating volatility and the need for adaptive financial education

The sheer velocity of Gen Z investor growth, coupled with their high-risk tolerance and reliance on digital information, underscores a critical imperative for adaptive financial education and regulatory oversight. While the accessibility of investing is overwhelmingly positive, the lack of experience navigating severe, protracted bear markets poses a significant systemic risk to this cohort’s long-term financial health. Many current Gen Z investors have only experienced the bullish market conditions following the 2020 pandemic low, leading to potentially unrealistic expectations regarding market corrections.

The concept of ‘buying the dip’ is highly popularized in online communities, but the psychological and capital demands of enduring a 30% drawdown in a broad index or a 60% drop in a concentrated thematic portfolio have yet to be fully tested by this demographic. Analysts at BlackRock emphasize that educational efforts must move beyond basic concepts of compounding to focus on portfolio construction, volatility management, and the crucial distinction between speculation and long-term investment.

Regulatory implications and investor protection

Regulators are focused on ensuring that the digital platforms enabling this growth maintain robust investor protection mechanisms. The SEC has increased scrutiny on features that may encourage excessive trading, such as digital confetti or immediate reward systems. Furthermore, the suitability standard, which dictates that brokers must recommend investments appropriate for a client’s risk profile, becomes complex when dealing with self-directed, digitally-native investors who may rapidly change their strategies based on social media trends. The challenge for regulators is balancing the democratization of finance with the protection of unsophisticated investors from predatory practices or self-inflicted harm through excessive risk-taking.

The data suggests that the average Gen Z portfolio, while growing, often lacks the foundational ballast of fixed income or broad market index funds necessary to cushion extreme downturns. This structural weakness means that a significant market correction could disproportionately affect this cohort, potentially leading to widespread panic selling and a loss of confidence in the markets. Therefore, sophisticated financial institutions are increasingly integrating behavioral finance models into their analysis to predict and mitigate the impacts of retail-driven sentiment shifts.

The successful integration of this new generation of investors depends fundamentally on their ability to learn resilience during adverse market conditions. Educational resources focusing on historical market cycles, risk budgeting, and the disciplined use of stop-loss orders are essential components of future financial literacy programs aiming to sustain this positive growth trend.

Future outlook: Sustaining growth and mitigating systemic risk

The 162% year-over-year increase in Gen Z investor growth is a defining characteristic of the 2020s financial landscape. The continuation of this trend hinges on two primary factors: the sustained accessibility of zero-commission platforms and the ability of this cohort to weather their first major economic recession as active participants. Economists at the Federal Reserve Bank of St. Louis project that if current participation rates continue, Gen Z could command over 15% of total U.S. retail investment capital by 2030, profoundly impacting market liquidity and valuation models.

The shift towards digital, self-directed investing is permanent. Traditional advisory firms are responding by creating specialized digital interfaces and offering lower-cost, subscription-based financial planning services tailored to younger, digitally-savvy clients. Robo-advisors, which offer automated diversification and rebalancing, are seeing increased adoption among Gen Z investors seeking structure without the high cost of human advisors.

The long-term impact on capital markets

The long-term impact of this demographic shift includes a greater allocation of capital toward disruptive technology and sustainable investments, potentially accelerating the transition to a greener, more technologically advanced economy. However, the short-term challenge remains managing the volatility inherent in a market where a significant portion of trading volume is driven by sentiment and rapid digital communication. Institutional investors must adapt their models to incorporate these new, unpredictable liquidity pools.

- Technology Acceleration: Consistent flow of retail capital into AI, clean energy, and biotech, funding future innovation.

- Advisory Evolution: Traditional wealth management firms must adopt hybrid digital models to engage the next generation.

- Regulatory Focus: Increased attention from the SEC and FINRA on platform design and financial influencer compliance.

- Market Volatility: Greater risk of sharp, short-term price dislocations in retail-heavy stocks due to coordinated trading activity.

Ultimately, the success of the Gen Z investor growth story will be measured not by the rate of initial participation, but by the financial resilience demonstrated during the inevitable market downturn. The early entry provides a monumental advantage through compounding, provided they can maintain discipline and avoid catastrophic losses driven by speculative excess.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Participation Rate Increase | 162% year-over-year growth signals structural democratization; retail liquidity is now a significant market factor. |

| Asset Allocation Skew | Higher exposure to cryptocurrencies (40% holding rate) and individual growth stocks, indicating elevated risk tolerance. |

| Average Holding Period | Approximately 4.2 months for individual stocks, contributing to higher short-term volatility and rapid thematic rotation. |

| ESG Investment Preference | 15% more exposure to sustainable funds than Gen X, driving corporate governance and thematic investment trends. |

Frequently Asked Questions about Gen Z Investor Growth and Market Impact

The primary drivers are the widespread adoption of zero-commission trading and the availability of fractional shares, which significantly reduced the minimum capital required for market participation. Fintech platforms designed for mobile-first user experiences also lowered the cognitive barrier to entry, fostering high engagement rates among young investors.

Gen Z exhibits a higher risk tolerance, demonstrated by greater portfolio allocations toward individual stocks, options, and volatile assets like cryptocurrencies. This is often driven by a perceived need for accelerated returns to combat high inflation and economic pressures, a strategy sometimes termed ‘risk-on’ investing.

Social media platforms like Reddit and TikTok serve as critical, decentralized sources of financial information, impacting over 58% of investment decisions for many Gen Z individuals. This crowdsourced due diligence facilitates rapid, collective action, potentially fueling short-term volatility in popular stocks.

The main systemic risk is the lack of experience navigating protracted bear markets, combined with concentrated, high-beta portfolios. A significant market downturn could trigger widespread panic selling, disproportionately affecting this cohort and potentially creating short-term market instability.

Yes. Advisors must integrate digital tools, offer lower-cost, subscription-based planning, and focus educational efforts on risk management and long-term behavioral discipline. Emphasizing thematic and ESG investing, aligned with Gen Z values, is also crucial for building trust and relevance.

The Bottom Line: A Permanent Shift in Retail Finance

The 162% surge in Gen Z investor growth marks a definitive, permanent shift in the structure of retail finance, moving control and accessibility away from traditional gatekeepers and into the hands of a digitally native, risk-tolerant generation. This cohort, armed with zero-commission tools and fractional ownership, is fundamentally changing how capital is deployed, prioritizing thematic investments, ESG criteria, and accelerated wealth accumulation over traditional, passive strategies. While the immediate market consequence is heightened short-term volatility in retail-heavy sectors, the long-term implication is a more engaged, financially literate population whose investment choices will exert increasing influence on corporate governance and innovation funding.

Moving forward, market participants must recognize that retail liquidity is no longer a peripheral factor. Institutional strategies must incorporate behavioral finance models to anticipate sentiment shifts driven by social media. For Gen Z investors themselves, the challenge lies in translating early participation advantages into sustainable, long-term wealth by navigating the inevitable market corrections with discipline and resilience. The success of this demographic will depend on the evolution of regulatory frameworks to protect them without stifling the democratization that has made this remarkable growth possible.