Child Tax Credit Increased to $2200: Tax Planning Strategies for 2025

The adjustment of the Child Tax Credit (CTC) to $2,200 per child for the 2025 tax year necessitates an immediate review of household Adjusted Gross Income (AGI) management and tax withholding strategies to capture the full benefit, especially concerning the refundable portion.

Child Tax Credit Increased to $2200 per Child: Tax Planning for 2025

The legislative adjustment increasing the Child Tax Credit Increased to $2200 per Child: Tax Planning for 2025 represents a material shift in the financial landscape for millions of American families. This change, effective for the 2025 tax year, requires immediate and sophisticated tax planning, particularly for middle-to-upper-income earners navigating complex phase-out rules and the mechanics of refundability. Analysis confirms that for a family with two qualifying children, this increase translates into a potential $400 boost in non-refundable credit or a higher refundable amount, impacting liquidity and consumption patterns across the U.S. economy, according to preliminary estimates from the Tax Policy Center.

Understanding the $2,200 Credit Mechanics and Refundability Thresholds

The fundamental structure of the Child Tax Credit (CTC) remains dual-faceted: a non-refundable portion that reduces tax liability dollar-for-dollar, and a refundable portion, known as the Additional Child Tax Credit (ACTC), which taxpayers can receive as a refund even if they owe no federal income tax. The increase of the maximum credit to $2,200, up from the previous $2,000, demands a precise understanding of how this new ceiling interacts with existing income requirements and the threshold for refundability. Financial advisors must model scenarios based on the client’s specific Adjusted Gross Income (AGI) to determine the optimal strategy for maximizing the benefit.

The refundable portion of the CTC is often tied to earned income. Historically, the ACTC has been capped and subject to a calculation based on earned income that exceeds a specific minimum threshold, often adjusted for inflation. For 2025, while the maximum credit amount has risen, the critical variable remains the earned income required to unlock the refundable portion. This is not merely a nominal increase; for lower-income families, the ability to claim a larger refundable credit directly impacts household cash flow and poverty reduction efforts. The IRS mandates careful documentation of qualifying children, who must generally be under age 17 and meet the residency and relationship tests.

Calculating the Additional Child Tax Credit (ACTC)

The complexities surrounding the ACTC often cause confusion. While the maximum credit is $2,200, the refundable portion is subject to its own limits. For the 2025 tax year, analysts project that the maximum refundable amount will also see a slight increase, potentially mirroring the $200 bump in the non-refundable amount, though legislative specifics are still being finalized. Taxpayers must look closely at their earned income, as the credit generally phases in at a rate of 15% of earned income above the statutory minimum. This means maximizing earned income, particularly for those near the lower end of the income spectrum, becomes a critical tax planning objective.

- Earned Income Threshold: Maintaining accurate records to demonstrate earned income above the specified threshold (e.g., $2,500 in previous years, adjusted for inflation) is essential for claiming the refundable credit.

- Phase-In Rate: The 15% phase-in rate dictates that every marginal dollar of earned income above the threshold generates 15 cents of refundable credit until the maximum refundable amount is reached.

- AGI Impact: High AGI earners must monitor the credit’s phase-out, as discussed below, which significantly limits or eliminates the benefit, making AGI management a priority.

The critical implication for financial planning is the timing of income. Business owners and self-employed individuals have greater flexibility in accelerating or deferring income to meet the minimum earned income requirement or to stay below the phase-out range. For W-2 employees, strategic adjustments to retirement contributions or deferred compensation plans are often the only viable levers for AGI management.

Strategic AGI Management to Avoid Phase-Outs

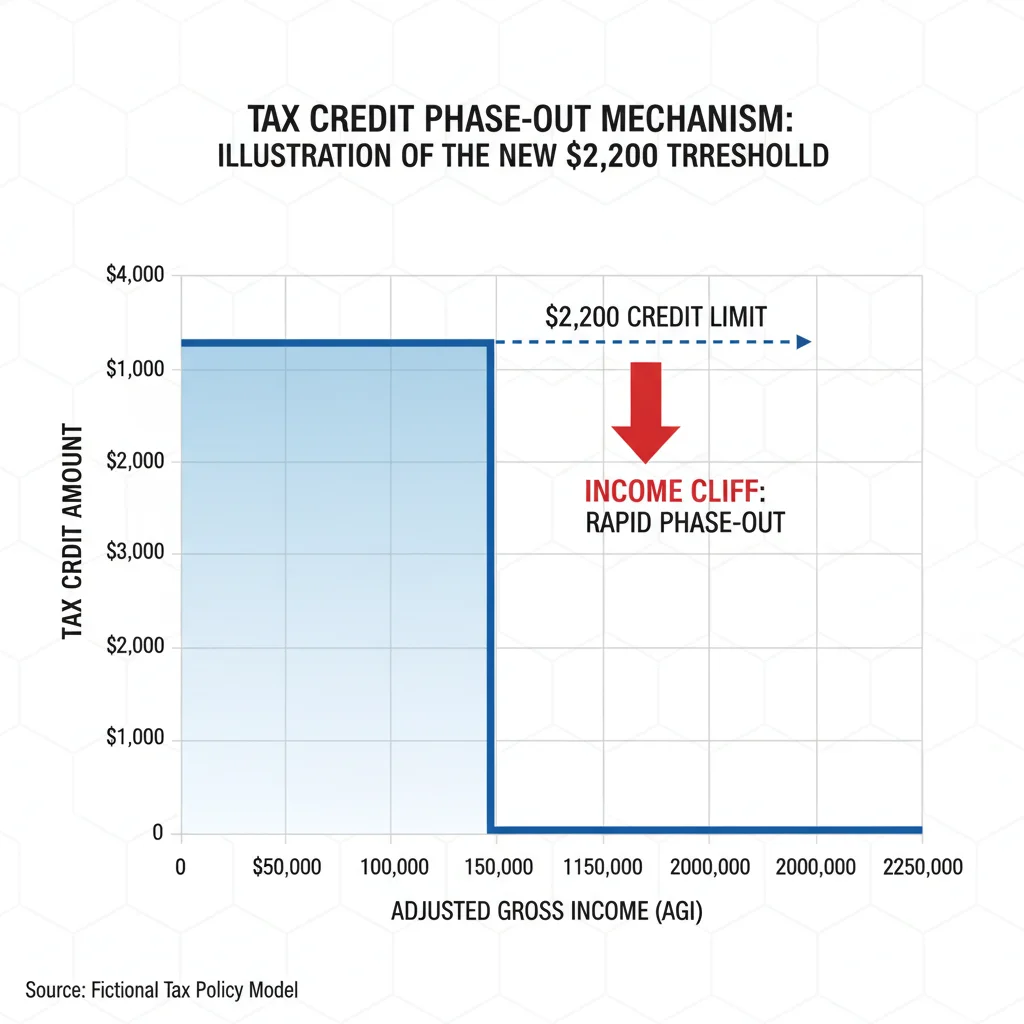

The primary challenge for affluent families benefiting from the increased credit is the structured phase-out based on Adjusted Gross Income (AGI). The CTC begins to phase out for taxpayers with AGIs exceeding certain thresholds ($400,000 for married couples filing jointly and $200,000 for all other filers, based on recent provisions, though subject to 2025 inflation adjustments). The credit reduces by $50 for every $1,000 by which the taxpayer’s AGI exceeds the threshold. This rapid phase-out creates a significant marginal tax rate cliff.

Effective tax planning for 2025 revolves around lowering the AGI. Since the phase-out is dollar-for-dollar based on AGI, every dollar reduced in AGI preserves $0.05 of the CTC benefit, in addition to the standard marginal tax rate savings. This combined effect makes AGI optimization particularly lucrative for those near the phase-out threshold. Strategies typically focus on maximizing deductible contributions, particularly tax-advantaged retirement vehicles.

Tax-Advantaged Contributions as AGI Reducers

Contributions to traditional Individual Retirement Arrangements (IRAs) and 401(k) plans are primary tools for reducing AGI. For 2025, the maximum contribution limits are expected to be further adjusted for inflation. By maximizing these contributions, high-income earners can strategically lower their AGI just enough to qualify for the full $2,200 Child Tax Credit, or at least minimize the phase-out impact. For example, if a married couple filing jointly is $10,000 above the $400,000 threshold, they lose $500 of the CTC. By contributing an additional $10,000 to tax-deferred accounts, they save $500 on the credit plus their marginal income tax rate (which could be 32% or 35%).

- Traditional 401(k) and IRA: Maximize contributions before the tax return filing deadline (April 15, 2026, for the 2025 tax year) to reduce AGI.

- Health Savings Accounts (HSAs): Contributions to HSAs are made pre-tax and reduce AGI, offering a triple tax advantage (deductible contributions, tax-free growth, tax-free withdrawals for medical expenses).

- Above-the-Line Deductions: Utilizing other above-the-line deductions, such as educator expenses or self-employment deductions, also directly lowers AGI, preserving the CTC benefit.

Furthermore, self-employed individuals can utilize Defined Benefit Plans or Simplified Employee Pension (SEP) IRAs, which often allow for substantially higher contribution limits than traditional retirement vehicles, providing a more robust mechanism for AGI reduction. The goal is to view tax-advantaged savings not just as retirement planning but as an active component of current-year tax optimization to secure the maximum $2,200 credit.

Impact on Tax Withholding and Quarterly Estimates

The increase in the CTC fundamentally alters the calculation of tax liability, necessitating a timely review of Form W-4 for employees and quarterly estimated payments for the self-employed. If a family is confident they will qualify for the full $2,200 credit per child, failing to adjust their withholding means they are effectively giving the government an interest-free loan throughout the year, only to receive the benefit as a large refund later. Financial discipline suggests minimizing refunds and maximizing current cash flow.

Employees should utilize the IRS Tax Withholding Estimator tool, inputting the increased $2,200 credit amount to accurately predict their final tax liability. Adjusting line 3 (Claim Dependents) on Form W-4 upward will reduce the amount of federal income tax withheld from each paycheck, increasing household liquidity immediately. This is particularly relevant given the current economic climate where marginal cash flow management is crucial for managing inflation and high interest rates.

Adjusting Estimated Quarterly Payments

For independent contractors, freelancers, and small business owners who pay estimated taxes (Form 1040-ES), the increased CTC must be factored into the quarterly projections beginning in Q1 2025. Underpayment of estimated taxes can result in penalties, calculated using Form 2210. Conversely, overpayment ties up capital that could be earning interest or invested elsewhere.

The prudent approach involves a meticulous re-forecasting of 2025 income, accounting for the new $2,200 credit, and adjusting the four quarterly payments accordingly. For a self-employed couple with two children, the combined $4,400 credit represents a significant reduction in expected tax liability, potentially lowering each quarterly payment by $1,100, assuming they meet all eligibility and AGI requirements. This immediate liquidity injection can be strategically deployed into business operations or high-yield savings accounts.

Interplay with Other Family-Oriented Tax Provisions

Tax planning for the CTC does not occur in a vacuum; it must be integrated with other family-related tax benefits. Understanding the interaction between the CTC, the Child and Dependent Care Credit (CDCC), and Head of Household filing status is critical for maximizing overall tax efficiency. While the CTC is generally more valuable due to its higher maximum amount and partial refundability, the CDCC helps offset expenses for childcare necessary for the taxpayer to work or look for work.

One common planning point involves the definition of a qualifying child. The same child generally qualifies for both the CTC and the CDCC, but the criteria for each credit differ slightly (e.g., age limits). Moreover, AGI management undertaken to secure the full $2,200 CTC may also inadvertently qualify taxpayers for higher benefits under the CDCC, which also features phase-outs based on AGI.

Maximizing Education Savings and Tax Benefits

Families often use tax savings from credits like the CTC to fund future education. The increased CTC provides an excellent opportunity to bolster contributions to 529 education savings plans. While 529 contributions are not federally deductible, the tax-free growth and withdrawals for qualified education expenses make them highly valuable. The additional $200 per child from the CTC can be viewed as dedicated educational funding, providing a stable, tax-advantaged source of capital for college costs.

Furthermore, taxpayers must consider the interplay with the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). Although these credits typically apply to college-age children, effective long-term planning ties current CTC benefits—which reduce tax liability now—to future education funding needs. The immediate cash injection from the higher CTC offers a low-risk, high-certainty funding source that can be locked into tax-advantaged growth vehicles like the 529 plan, maximizing the time value of money.

- 529 Plan Synchronization: Direct the marginal increase from the $2,200 CTC directly into a 529 plan to compound tax-free growth.

- CDCC Utilization: Ensure all eligible childcare expenses are meticulously documented to claim the CDCC, stacking benefits on top of the CTC.

- Filing Status Review: Periodically review filing status (e.g., Head of Household vs. Married Filing Separately) as it significantly impacts AGI thresholds and overall credit eligibility.

Documentation and Compliance Requirements for the $2,200 CTC

As the maximum credit amount increases, so does the scrutiny from the Internal Revenue Service (IRS) regarding eligibility. Accurate documentation is not merely a formality; it is a foundational requirement for claiming the Child Tax Credit 2025. Taxpayers must be prepared to substantiate all criteria, including the child’s Social Security Number (required for the CTC), residency tests, and the relationship test. The IRS continues to utilize advanced data analytics to flag returns that show inconsistencies, particularly concerning dependents.

The residency requirement mandates that the child must have lived with the taxpayer for more than half the year. Documentation such as school records, medical bills, and utility statements addressed to the parent at the claimed residence address are crucial. In cases of divorce or separation, the custodial parent generally claims the credit, but the non-custodial parent may be allowed to claim it if the custodial parent signs a written declaration (Form 8332) waiving the right to claim the child as a dependent.

Avoiding IRS Audits and Penalties

Errors related to the CTC are among the most common triggers for IRS audits. Claiming the credit improperly, particularly the refundable portion, can result in significant penalties and interest charges, and potentially a multi-year ban on claiming the credit if the error is deemed reckless or fraudulent. The increase to $2,200 amplifies the financial incentive for compliance and accuracy.

Tax professionals recommend conducting a ‘dry run’ of the 2025 tax return using projected income figures late in the year to identify any potential documentation gaps. Special attention should be paid to children born late in the year or those who turned 17 during the tax year, as their qualifying status is time-sensitive. Furthermore, taxpayers must ensure they have received and accurately reported all necessary tax forms, such as Form 1099 or Form W-2, as discrepancies between reported income and IRS records are primary audit flags.

Economic Implications and Future Policy Outlook

The legislative decision to raise the Child Tax Credit to $2,200 per child carries broader macroeconomic implications. This marginal increase acts as a direct fiscal stimulus, primarily targeting households with children. Based on historical data, tax credits aimed at lower and middle-income families tend to have a high marginal propensity to consume, meaning a significant portion of the credit is immediately injected into the economy through purchases of goods and services, supporting sectors like retail and education.

However, the future sustainability and structure of the CTC remain subject to political and economic cycles. The current $2,200 level is a result of specific legislative action, and absent further extensions or permanent changes, aspects of the credit may revert to pre-existing levels or structures. Financial analysts must continually monitor Washington D.C. for discussions surrounding major tax legislation, particularly concerning the refundability provision and the AGI phase-out thresholds, which are the most volatile components of the credit.

Monitoring Legislative Risk

The expiration or modification of tax legislation poses a significant planning risk. If the $2,200 maximum credit is temporary, families should structure their finances to maximize the benefit while it is available. This might involve accelerating planned expenditures or reallocating savings into tax-advantaged accounts during the years the higher credit is in effect. Economists project that extending credits like the CTC would require substantial federal outlay, placing it under constant budgetary scrutiny.

For financial institutions, the increased CTC impacts consumer behavior. Banks may see changes in deposit patterns and loan demand, particularly around tax refund season. The injection of billions of dollars in tax refunds can briefly boost liquidity in the banking system, although the effect is generally temporary. Market participants should view the CTC increase not just as a family benefit, but as a minor, targeted fiscal stimulus mechanism that influences short-term consumer spending metrics.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Maximum CTC Increase | Rises from $2,000 to $2,200 per child for 2025, offering up to $400 additional tax reduction for a family with two children. |

| AGI Phase-Out Thresholds | Requires high-earners to utilize tax-deferred contributions (401(k), HSA) to manage AGI and preserve the credit benefit. |

| Refundability (ACTC) | Tied to earned income; essential for low-income families. Planning must ensure earned income meets the statutory minimum to unlock the refundable portion. |

| Withholding Adjustment | Immediate W-4 review necessary to adjust withholdings, preventing an interest-free loan to the government and maximizing current household liquidity. |

Frequently Asked Questions about the Child Tax Credit Increased to $2200 per Child: Tax Planning for 2025

The increased credit reduces your overall tax liability. You should file a new Form W-4 with your employer, claiming a higher number of dependents or credits to reduce the amount of federal tax withheld from your paychecks, thereby increasing your monthly net income immediately.

While the exact figures are subject to 2025 inflation adjustments, the phase-out generally starts at $400,000 AGI for married couples filing jointly and $200,000 for other filers. The credit reduces by $50 for every $1,000 over these thresholds, demanding careful AGI management.

Yes, while the credit itself is not directly tied to the 529 plan, the resultant increase in household liquidity from the $2,200 credit can be strategically directed into a 529 account. This move optimizes the tax benefit by converting current tax savings into future tax-advantaged educational growth.

Taxpayers must retain proof of the child’s Social Security Number, documentation proving the child lived with them for more than half the year (residency test), and evidence meeting the relationship test. Accurate documentation minimizes the risk of IRS scrutiny and potential penalties.

For those near the phase-out range, reducing AGI through tax-deductible contributions (e.g., traditional 401(k) or HSA) can prevent or minimize the reduction of the credit. This dual benefit—tax savings plus credit preservation—makes AGI management a powerful planning tool for 2025.

The Bottom Line

The elevation of the Child Tax Credit to $2,200 per child for the 2025 tax year is a clear mandate for proactive financial restructuring. This policy change is not a passive benefit; it is an economic lever that must be actively engaged through strategic planning. Households, particularly those bordering the AGI phase-out thresholds, must immediately model the impact of maximizing tax-deferred savings vehicles—such as traditional retirement plans and HSAs—to ensure they capture the full value of the credit. Furthermore, the adjustment of W-4 forms or quarterly estimated payments is critical to optimizing cash flow throughout the year, rather than waiting for a large refund. While the increased credit provides considerable relief, the potential for future legislative adjustments and the complexity of the refundability rules necessitate continuous monitoring of IRS guidance and macroeconomic shifts. Analysts recommend treating the increased CTC as guaranteed capital that should be immediately deployed into high-return or tax-advantaged savings, maximizing the long-term benefit of this temporary fiscal boost.