S&P 500 Hits 6871: Value, Healthcare Lead Market Surge

Fueled by significant sector rotation, the S&P 500 climbed to 6871 points, indicating a decisive shift toward historically undervalued value stocks and defensive healthcare equities amidst persistent inflation and projected interest rate stability.

Inflation at 3.0%: Protect Purchasing Power Now

As the Consumer Price Index (CPI) stabilizes near the 3.0% annual rate, investors must pivot strategies towards real assets and income-generating securities to effectively mitigate the corrosive effects of sustained inflation on long-term protect purchasing power.

Home Prices Up 0.1% Year-Over-Year: Housing Market Cooling Analysis

The deceleration of U.S. home price appreciation to a mere 0.1% year-over-year signals a significant shift, raising critical questions about the depth of the current housing market cooling driven by elevated mortgage rates and persistent supply issues.

Gen Z Credit Card Usage Surpasses Debit: Financial Shift Alert

The shift in Gen Z's financial behavior, prioritizing credit over debit, signals deeper macroeconomic pressures and a reliance on revolving debt, impacting future credit risk profiles and the financial services sector, according to Q3 2024 data.

Unemployment Stable at 4.4%: Labor Market Data and Economic Outlook

The stability of the unemployment stable 4.4% rate suggests a resilient but cooling labor market, maintaining wage growth pressures that complicate the Federal Reserve's path toward achieving the 2% inflation target without triggering a deeper economic slowdown.

10-Year Treasury at 4.02%: Fixed Income Strategy for December

The 10-year Treasury yield stabilizing near 4.02% presents a pivotal moment for fixed income investors, requiring strategic adjustments focused on managing duration and leveraging current yield levels before potential Federal Reserve policy shifts in the new year.

High-Yield Savings at 4.20% APY: Lock in Rates Before They Fall Further

The current environment featuring high-yield savings accounts (HYSAs) offering 4.20% APY presents a time-sensitive opportunity for capital preservation, driven by the Federal Reserve's sustained elevated interest rate policy, which analysts expect to pivot in the near future.

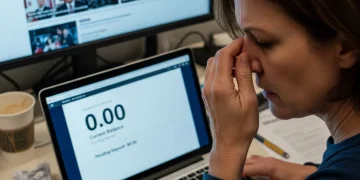

Federal Government Shutdown Impact: Delayed Income and Spending

The **government shutdown spending impact** immediately depresses consumer activity, as delayed paychecks for federal workers and contractors lead to reduced discretionary spending, potentially shaving basis points off quarterly Gross Domestic Product (GDP), according to preliminary estimates from the Congressional Budget Office (CBO).

Bitcoin Drops Below $86,000: Explaining Crypto Market Instability

Bitcoin's steep 6% decline, pushing its price below $86,000, underscores persistent market instability driven by tightening global liquidity, increasing regulatory scrutiny, and significant whale movements, challenging the recent bullish narrative.

Broadcom Stock Tumbles 4.3%: AI Sector Correction or Pullback Signal?

Following a 4.3% single-day decline, the Broadcom stock tumble has intensified scrutiny on the sustainability of AI-driven semiconductor valuations, prompting investors to assess whether this signals a temporary technical pullback or the start of a deeper sector-wide correction.