IRA Contribution Limits Rise to $7,500: Strategic 2026 Retirement Planning Moves

The projected rise in IRA contribution limits to $7,500 in 2026, driven by persistent inflation adjustments, necessitates immediate strategic review of retirement savings allocations and tax optimization for maximizing long-term wealth accumulation.

S&P 500’s 12.75% YoY Surge: Key Sectors Driving 2026 Returns

The S&P 500's robust 12.75% year-over-year growth signals sustained momentum, primarily fueled by resilience in the Information Technology and Healthcare sectors, setting the stage for continued market expansion through 2026.

Emerging Markets Up 30% YTD: Why 2026 is a Breakout Year

The significant 30% YTD rally in Emerging Markets (EM) equity indices signals a potential regime shift, driven by anticipated Federal Reserve rate cuts, stabilizing commodity prices, and improving fiscal balances across key developing economies.

Unemployment at 4.4%: Labor market cooling and investment implications

The increase in the US unemployment rate to 4.4% suggests a decisive shift in the labor market cooling narrative, potentially paving the way for Federal Reserve rate cuts and creating distinct opportunities in interest-rate sensitive investment sectors.

ACA Insurance Premiums Rising 26% in 2026: Cost Planning Essentials

Projected increases in ACA insurance premiums, potentially reaching 26% by 2026, necessitate proactive financial planning, driven by expiring subsidies, rising medical inflation, and complex regulatory dynamics.

Retail Sales Slowdown: 0.2% Growth Signals Consumer Spending Fatigue

The deceleration of retail sales growth slowdown to a mere 0.2% monthly rise indicates significant consumer fatigue, potentially signaling a shift in economic momentum and raising concerns about the sustainability of corporate revenue growth in the face of persistent inflation and high interest rates.

AI Investment Boom Continues: Tech Sector Outperformance Expected into 2026

Fueled by accelerating enterprise adoption and unprecedented capital expenditure from hyperscalers, the AI investment cycle is projected to sustain significant outperformance in the technology sector, particularly among firms enabling foundational AI infrastructure, through 2026.

Bitcoin Below $91,000: December Trading Watch List

The sharp decline as Bitcoin drops below $91,000 signals heightened volatility, compelling traders to prioritize technical support levels, monitor Federal Reserve interest rate guidance, and assess institutional accumulation trends throughout December.

Tax-Loss Harvesting Strategies: Optimizing Portfolios for 2026

Effective tax-loss harvesting strategies are crucial year-end maneuvers; strategic utilization of realized losses against capital gains can potentially reduce investors' taxable income by up to $3,000 annually, maximizing after-tax returns for the 2026 tax year and beyond.

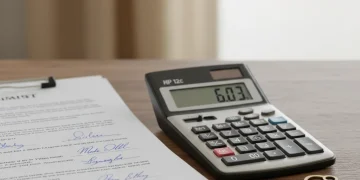

30-Year Mortgage Rates Near 6.03%: Refinance Now or Wait for 2026?

As 30-year mortgage rates hover near 6.03%, the decision to refinance now versus waiting for potential cuts in 2026 depends heavily on the trajectory of core inflation and the Federal Reserve's commitment to normalizing the yield curve.