ETF Inflows Hit Record $1.16 Trillion in 2025: Investment Trend Analysis

Projected data indicates that ETF record inflows 2025 will reach an unprecedented $1.16 trillion globally, signaling a definitive structural shift toward passive investment vehicles and demanding a reevaluation of traditional asset allocation models by institutional and retail investors alike.

Federal Government Shutdown Cost: Economic Impact and Portfolio Risks

A federal government shutdown can immediately reduce quarterly GDP by 0.1 to 0.2 percentage points per week, driven by furloughing non-essential staff and freezing federal procurement, demanding immediate risk assessment for sensitive investment portfolios.

US Consumer Debt at $18.33T: Overspending Risk into 2026

The surge in total US consumer debt to $18.33 trillion signals potential overspending and reduced household financial flexibility, amplifying recessionary pressures as high interest rates increase debt servicing costs heading into the 2026 fiscal cycle.

High-Yield Savings Accounts Offering 5% APY: Best Banks Compared

The current elevated interest rate environment, driven by Federal Reserve policy, provides a critical window for consumers to secure annual percentage yields (APYs) of 5% or more on cash reserves through competitive high-yield savings accounts (HYSAs).

Mortgage Rates at 6.23%: Lock In Now or Wait for December?

The current environment of 6.23% fixed-rate mortgages requires borrowers to weigh the certainty of today's payment against the high probability of short-term volatility driven by upcoming CPI reports and the Federal Reserve's December meeting.

Retirement Savings Gap Widening: 58% of Americans Behind on 401k Goals

The growing disparity in retirement readiness is underscored by the finding that 58% of Americans are currently short of their 401k savings targets, driven by persistent inflation and stagnant real wage growth, posing significant future economic risks.

S&P 500 Earnings Growth at 8.5%: Q4 2025 Sector Leadership Analysis

With the S&P 500 projected to achieve 8.5% earnings growth in Q4 2025, market attention is shifting to sectors like Information Technology and Healthcare, which possess the structural tailwinds and pricing power necessary to significantly outperform broader index expectations.

Bitcoin Drop Below $86k: Crypto Volatility and Portfolio Risk Management

The recent 6% decline in Bitcoin, pushing the asset momentarily below $86,000, underscores the persistent crypto volatility portfolio risk inherent in digital assets, necessitating robust, data-driven risk management strategies for institutional and retail investors alike.

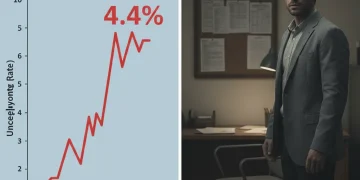

Unemployment Rises to 4.4% in September: Market and Earnings Impact

The unexpected jump in the US unemployment rate to 4.4% in September signals a potential cooling of the tight labor market, directly affecting corporate earnings forecasts and future Federal Reserve interest rate trajectory.

Inflation at 3% Annually: Protecting Savings in 2025

Sustained 3% annual inflation in 2025 necessitates a strategic shift from cash holdings to inflation-protected assets, prioritizing real returns over nominal gains to maintain purchasing power.