Palantir Stock Up 162% in One Year: Is it Too Late to Buy?

Palantir Technologies (PLTR) experienced a 162% stock surge over the past year, fueled by robust performance in its commercial segment and optimism surrounding its Artificial Intelligence Platform (AIP), leading institutional analysts to scrutinize whether the current valuation still offers a compelling entry point.

Black Friday 2025: Record $11.8B Online Spending Amidst Inflation Fears

Black Friday 2025 saw record e-commerce sales hitting $11.8 billion, a 9.5% increase year-over-year, driven by deep discounting and 'buy now, pay later' adoption, even as consumer sentiment surveys indicated elevated financial anxiety.

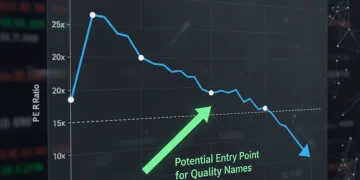

Tech Stock Valuations Compressed: When to Buy Quality Names

Amid rising rate uncertainty and sector rotation, quality growth companies in the technology sector are experiencing compressed valuations, creating strategic entry points for investors focused on durable earnings growth and strong free cash flow generation.

ACA Marketplace Premiums Doubling: Consumer Financial Risks Explained

The potential expiration of critical federal subsidies could lead to ACA Marketplace Premiums Doubling for millions of Americans, translating into sharp increases in household debt and significant budgetary strain for middle-income families across the United States.

Child Tax Credit Increased to $2200: Tax Planning Strategies for 2025

The adjustment of the Child Tax Credit Increased to $2200 per Child: Tax Planning for 2025 significantly alters household cash flow projections, requiring proactive analysis of phase-out thresholds, refundability rules, and investment strategies to optimize the tax benefit.

Holiday Sales Growth Hits 4% in 2025: The Low-Income Drag

While projections indicate a 4% increase in 2025 holiday sales, this aggregate growth masks a critical divergence, with high-income spending offsetting deepening financial constraints and rising revolving debt among the lower-income households, impacting the breadth of the retail recovery.

AI Weakness Signals Rotation: Market Down 0.4% This Week

The stock market's marginal 0.4% dip this week was primarily attributed to significant selling pressure within the artificial intelligence (AI) sector, indicating a critical shift in investor sentiment toward broader market diversification and away from concentrated tech leadership.

Mortgage Points Strategy for First-Time Buyers: Navigating the Affordability Crisis

Amidst the deepening housing affordability crisis, first-time buyers should strategically analyze the cost-benefit of purchasing mortgage points strategy to secure a lower interest rate, optimizing long-term housing costs against high upfront capital requirements.

Fed Rate Cut Odds at 87%: 401k Impact and Investor Strategy

The 87% probability of a Federal Reserve rate cut by December signals a potential shift toward monetary easing, profoundly impacting fixed income, equity valuations, and the long-term growth trajectory of retirement accounts like the 401k.

Gen Z Investors Up 162% Year-Over-Year: Market Analysis

The remarkable 162% year-over-year increase in Gen Z investor participation is reshaping the retail investment landscape, fueled by zero-commission trading and enhanced digital access that lowers entry barriers and promotes diversification.