ACA Insurance Premiums Rising 26% in 2026: Cost Planning Essentials

The projected 26% surge in ACA premiums by 2026, primarily fueled by the expiration of enhanced subsidies and persistent medical inflation, demands immediate recalibration of household and corporate healthcare cost planning strategies.

The financial landscape of American healthcare is bracing for significant turbulence, with projections indicating that the cost of coverage obtained through the Affordable Care Act (ACA) marketplaces could experience a dramatic acceleration. Specifically, the potential for ACA insurance premiums rising 26% in 2026: Healthcare cost planning essentials becomes a critical focus for both consumers and policymakers. This projected increase, cited by various economic modeling groups and actuarial firms, is not merely statistical noise; it represents a tangible threat to household budgets and the stability of the individual insurance market, requiring immediate strategic financial adjustments.

The macroeconomic drivers behind the 2026 premium surge

The anticipated 26% spike in ACA premiums is rooted in a confluence of expiring legislation, structural healthcare costs, and persistent medical inflation. While premium growth has generally been stable in recent years—averaging single digits annually through 2024, according to the Kaiser Family Foundation—the stability was heavily subsidized. The primary catalyst for the 2026 acceleration is the scheduled expiration of enhanced premium tax credits established under the American Rescue Plan Act (ARPA) and extended by the Inflation Reduction Act (IRA).

These enhanced subsidies significantly lowered the net cost of coverage for millions of Americans, capping premium contributions as a percentage of household income. When these enhanced credits sunset at the end of 2025, the full, unsubsidized cost of the premium will be passed back to consumers, resulting in an effective rate increase that, for many, will feel like a sudden, severe shock. Furthermore, underlying medical inflation continues unabated, driven by pharmaceutical costs, technological advancements, and labor shortages in the healthcare sector, which directly influence the base rates that insurers must charge.

The impact of subsidy expiration on consumer budgets

The enhanced subsidies dramatically expanded eligibility and affordability. For example, a 60-year-old earning $50,000 annually might currently pay only $300 per month for a benchmark silver plan, thanks to the credit. Without the enhanced credit, that monthly premium could jump to over $1,200, representing a four-fold increase in out-of-pocket costs, according to Congressional Budget Office (CBO) estimates. This change disproportionately affects middle-income households who were newly eligible for substantial federal assistance.

- Income Cliff Reinstatement: The removal of the income cap (400% of the federal poverty level) allowed many middle-income families to qualify for subsidies. Its return threatens to reinstate the notorious “subsidy cliff,” where earning one dollar too much results in the loss of thousands of dollars in premium assistance.

- Enrollment Volatility: Analysts at the Peterson Center on Healthcare project that a sudden, unsubsidized premium increase could lead to a net reduction of 5 to 7 million Americans enrolled in ACA marketplace plans, reversing years of coverage gains.

- State-Level Mitigation: Several states, including Colorado and Washington, have implemented state-level reinsurance programs or subsidy extensions. However, these localized efforts are insufficient to counteract the massive federal policy shift, leaving most consumers exposed.

The expiration of these subsidies acts as a financial shockwave, requiring households to integrate this anticipated cost increase into their long-term financial modeling immediately. Ignoring this looming regulatory deadline is fiscally imprudent, given its magnitude.

Navigating the complexities of medical inflation and supply chain pressures

Beyond regulatory changes, persistent medical inflation forms the structural foundation of rising premiums. Medical costs historically outpace general inflation, often by a margin of 2 to 3 percentage points, according to data from the Bureau of Labor Statistics (BLS). Key drivers include the cost of specialty drugs, the accelerating adoption of expensive medical technologies, and significant wage increases for nurses and other specialized medical personnel following post-pandemic labor shortages.

The cost of pharmaceuticals, particularly biologics and personalized medicine, is a major contributor to insurer risk profiles. While the IRA introduced some drug price negotiation mechanisms for Medicare, these provisions do not directly impact the commercial market, which includes ACA plans, leading to continued high expenditure for cutting-edge treatments. Furthermore, the consolidation of hospital systems and physician practices reduces market competition, granting providers greater leverage in negotiating reimbursement rates with insurers, who then pass these higher costs onto consumers via premiums.

Pharmaceutical costs and technological advancements

The development cycle for new medical devices and drug therapies is expensive, and these costs are amortized through high prices once approved. Insurers must price premiums to cover these expected high-cost claims. For instance, the average spending on specialty pharmaceuticals has risen by over 10% annually over the last five years, far exceeding the growth rate of overall healthcare spending.

- High-Cost Claims Frequency: Insurers are observing an increase in the frequency of high-cost claims (those exceeding $100,000), particularly related to cancer therapies and gene treatments, which elevates the required reserve levels and, consequently, premium rates.

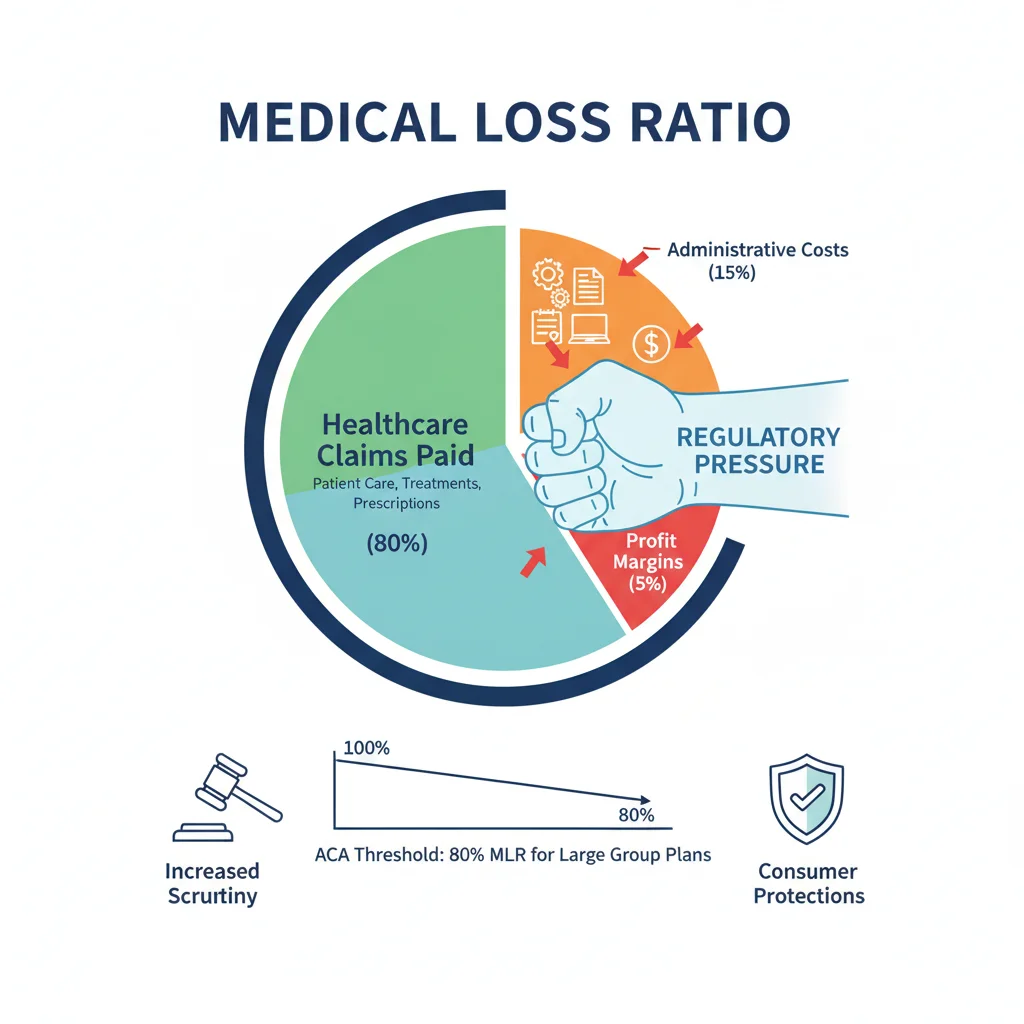

- Hospital System Consolidation: Data from the Health Care Cost Institute suggests that prices for services at providers within consolidated systems are often 15% to 20% higher than those in competitive markets, directly influencing the Medical Loss Ratio (MLR) calculations for insurers.

- Labor Cost Pass-Through: Wage inflation for healthcare workers, driven by shortages and unionization efforts, is reported by major hospital groups like HCA Healthcare and Tenet Healthcare to be a primary driver of operational cost increases, which are inevitably reflected in insurance pricing models.

For individuals and small businesses planning for 2026, understanding that these underlying cost pressures exist independently of political decisions is crucial. Premium increases are a function of both policy and market economics, demanding a dual-pronged approach to mitigation.

The insurer perspective: Risk pooling, MLR, and regulatory uncertainty

Insurance carriers operate under strict financial requirements, including the ACA’s Medical Loss Ratio (MLR) rule, which mandates that at least 80% of premium revenue must be spent on healthcare claims and quality improvement, rather than administrative costs or profits. When carriers anticipate higher claim costs due to medical inflation or changes in the risk pool composition, they must adjust premiums upward to maintain solvency and meet MLR targets.

The risk pool, the aggregation of all individuals covered by a plan, is central to premium setting. If the expiration of enhanced subsidies causes younger, healthier, and lower-income individuals to drop coverage—as projected by some econometric models—the remaining risk pool becomes older and sicker. This adverse selection drives up the average cost per enrollee dramatically, forcing insurers to raise rates for everyone else to cover the higher projected claims, compounding the impact of the subsidy loss.

Strategic adjustments by carriers and potential market exits

In response to increased regulatory uncertainty and the volatility associated with the potential lapse of federal subsidies, major carriers may adjust their market participation. While the ACA marketplace has stabilized since 2018, a significant cost shock could prompt some insurers to reduce their geographic footprint or exit certain markets entirely, limiting consumer choice and further increasing prices through lack of competition.

- Rate Filing Complexity: Insurance rate filings for 2026 must be submitted to state regulators in 2025. These filings must explicitly account for the absence of the enhanced subsidies, requiring carriers to justify the full, unsubsidized rate of the premium, a process that inherently locks in the projected 26% increase based on current data.

- Reinsurance Mechanisms: Some states utilize reinsurance programs, which reimburse carriers for a portion of high-cost claims. While effective at dampening premium growth (by an estimated 5% to 10% in participating states), these programs are not universally adopted and may not be scalable enough to absorb the shock of federal subsidy expiration.

- Product Strategy Shifts: Carriers may increasingly pivot towards high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs) to shift more first-dollar risk onto consumers, keeping premium costs lower but increasing out-of-pocket exposure.

The market response from carriers will be characterized by risk aversion and actuarial precision. Consumers should anticipate fewer generous plan designs and a strong push toward consumer-driven healthcare options that require greater personal financial engagement in managing routine medical expenses.

Essential financial strategies for mitigating the 2026 cost increase

Proactive financial planning is the only effective defense against the projected 26% premium hike. Households and financial advisors must model scenarios based on the full, unsubsidized cost of coverage and integrate these costs into 2026 budgets starting now. This involves optimizing deductible savings, maximizing the use of tax-advantaged accounts, and rigorously reviewing plan options during the open enrollment period.

Optimizing tax-advantaged healthcare savings

The Health Savings Account (HSA) remains the most powerful tool for mitigating rising healthcare costs for those eligible through an HDHP. Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free—a triple tax advantage. For 2025, the maximum contribution limits are expected to rise, providing an opportunity to shelter more income while building a dedicated reserve for future medical costs.

Similarly, Flexible Spending Arrangements (FSAs), while requiring funds to be spent within the plan year (with limited carryover), offer pre-tax savings for known expenses. Financial modeling should prioritize maximizing these accounts to offset the inevitable increase in out-of-pocket maximums and deductibles that often accompany rising premiums.

- HSA Catch-up Contributions: Individuals aged 55 and older can contribute an additional $1,000 annually, a critical advantage for those nearing retirement and facing the highest unsubsidized premium rates.

- Deductible Stress Testing: Families should calculate the total annual cost exposure—premiums plus the maximum out-of-pocket—and ensure liquid savings cover this amount. For a family, this figure could easily exceed $20,000 in 2026.

- Preventive Care Utilization: Maximizing preventive care, which is generally covered at 100% under ACA plans, helps mitigate the risk of high-cost claims later. Prioritizing screenings and wellness checks is a financial strategy as much as a health one.

The shift in 2026 necessitates treating healthcare savings with the same rigor as retirement or college savings. The potential cost increase is too large to absorb without dedicated, tax-advantaged preparation.

The role of regulatory intervention and policy uncertainty

While the expiration of enhanced subsidies is currently the baseline assumption, the political environment remains volatile. Congress could choose to extend the subsidies again, mitigating or eliminating the projected 26% premium shock. However, financial planning cannot rely on hypothetical legislative action. The cost of extending the enhanced subsidies is substantial, estimated to be in the hundreds of billions over a decade, making it a contentious budget item.

Beyond subsidies, policymakers are also grappling with mechanisms to control underlying medical costs. Efforts include proposals to cap out-of-network charges, increase transparency in drug pricing, and strengthen antitrust enforcement against hospital mergers. Any successful regulatory measure aimed at reducing provider costs would eventually translate into lower premium growth, though typically with a lag of 12 to 24 months.

Monitoring legislative timelines and budgetary negotiations

Market participants and consumers should closely monitor congressional budgetary negotiations throughout 2025. Decisions regarding the extension of subsidies will likely be tied to broader fiscal legislation, potentially occurring late in the year, just before the 2026 open enrollment period begins. This timing creates significant uncertainty for both insurers (who must file rates months prior) and consumers.

- The 2025 Filing Window: Insurers will submit their 2026 rates based on the assumption that subsidies expire. If Congress acts later, retroactive adjustments or special enrollment periods may be necessary, adding complexity.

- State-Level Mandates: States continue to experiment with benefit mandates (e.g., minimum coverage for mental health or specific drug classes). While beneficial for patient access, these mandates increase plan costs, adding modest upward pressure to premiums irrespective of federal policy.

- Reinsurance Funding Stability: The stability of state-level reinsurance funds is contingent on local budgets. Financial stability in these programs is critical for maintaining premium moderation within those states.

The regulatory environment dictates the upper bound of premium costs. Analysts suggest that the probability of a full, permanent extension of the enhanced subsidies is less than 50% due to fiscal pressures, making the 26% increase a high-probability risk that must be addressed in household financial models.

Long-term structural shifts in healthcare consumption and delivery

The projected premium rise accelerates the need for structural changes in how Americans consume healthcare. The financial incentive to shop around for services, utilize telehealth, and engage in price comparison tools will intensify as out-of-pocket costs surge. The market is responding with innovative delivery models designed to bypass high-cost traditional settings.

For example, the growth of direct primary care (DPC) models, where consumers pay a monthly fee directly to a provider for comprehensive primary services, can significantly reduce the utilization of high-cost emergency room visits and specialists. Paired with a catastrophic high-deductible insurance plan, this hybrid approach offers a cost-effective alternative for managing routine care while insuring against major events.

The integration of technology and consumer accountability

Technology plays an increasing role in cost containment. AI-driven diagnostic tools, remote patient monitoring, and virtual health platforms reduce the need for expensive in-person visits and increase efficiency. Consumers who actively utilize these tools often see better health outcomes and lower long-term costs, a trend that carriers are beginning to reward through wellness incentives.

- Telehealth Utilization: Post-pandemic, telehealth accounts for approximately 15% to 20% of outpatient visits, offering a lower-cost alternative to traditional office visits, according to McKinsey Global Institute data. Continued adoption will exert modest downward pressure on utilization costs.

- Reference Pricing: More employers and state marketplaces are experimenting with reference pricing, setting a maximum reimbursement rate for specific non-emergency procedures. This encourages consumers to choose lower-cost providers within a network, fostering competition.

- Financial Literacy Imperative: The 2026 cost surge makes financial literacy regarding healthcare options—understanding co-pays, co-insurance, deductibles, and out-of-pocket maximums—no longer optional but essential for fiscal solvency.

The long-term movement in healthcare economics is towards greater consumer accountability for costs. The 26% premium increase acts as an accelerant, forcing consumers to become more sophisticated buyers of medical services rather than passive recipients of care.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Enhanced Subsidy Expiration (End of 2025) | Projected 26% effective premium increase for millions; reinstatement of the subsidy cliff for middle-income earners. |

| Medical Inflation Rate (Avg. 2024-2026) | Historically 2-3 percentage points above CPI; driven by labor costs, specialty drugs, and hospital consolidation, increasing base premium rates. |

| Adverse Selection Risk (Post-2025) | If healthy individuals drop coverage due to cost, the risk pool worsens, forcing carriers to raise rates further to meet MLR requirements. |

| HSA Contribution Limits | Maximizing HSA contributions is the primary tax-advantaged defense against rising out-of-pocket costs and higher deductibles in HDHPs. |

Frequently Asked Questions about ACA premium cost planning

You should estimate your 2026 premium by finding the full, unsubsidized cost of your current plan (available on your insurer’s rate filing documents) and subtracting only the standard pre-ARPA subsidy amount, based on 2020 income limits. This gives a realistic baseline for your out-of-pocket exposure without enhanced federal assistance.

The Health Savings Account (HSA) offers a triple tax advantage and is the most robust savings vehicle for long-term healthcare expenses, provided you enroll in a High-Deductible Health Plan (HDHP). Alternatively, Flexible Spending Arrangements (FSAs) allow pre-tax deductions for known, near-term medical expenses.

The effective 26% increase, primarily due to subsidy expiration, will be felt most acutely by those currently receiving the largest enhanced credits, typically middle-income earners enrolled in Silver plans, which are the benchmark for subsidy calculations. Bronze and Gold plans will also see base rate increases due to medical inflation.

Hospital consolidation reduces competition, enabling providers to negotiate higher reimbursement rates with insurers. These higher rates translate directly into increased expected claims costs for carriers, which are then passed on to consumers through higher premiums, contributing to the overall rate inflation.

Small businesses should explore shifting towards self-funded plans with stop-loss insurance or increasing the adoption of HDHPs paired with employer contributions to HSAs. These strategies help stabilize budget volatility and empower employees to manage their healthcare spending more efficiently.

The bottom line

The projected 26% surge in ACA premiums by 2026 is a financial certainty until Congress legislates otherwise. This increase is driven by the immutable economic reality of high medical inflation, compounded by the highly probable expiration of federal subsidies. For households, this mandates a defensive financial posture: immediate adoption of maximum HSA contributions, rigorous reassessment of health plan tiers (e.g., considering the trade-offs between Silver and Bronze plans), and aggressive budgeting for higher out-of-pocket maximums. Financial planners must integrate this increased baseline healthcare expenditure into retirement and long-term savings projections, as the cost of insuring health is rapidly consuming a larger share of disposable income. Ignoring this looming fiscal deadline is equivalent to ignoring a major interest rate hike or tax change. The time for proactive healthcare cost planning is now, using data-driven analysis to shield personal finances from the coming market shock.