High-Yield Savings Accounts Offering 5% APY: Best Banks Compared

Driven by persistent inflation and the Federal Reserve’s sustained hawkish stance, several competitive financial institutions are currently offering consumers annual percentage yields exceeding 5.0% on high-yield savings accounts, demanding careful evaluation of fine print and stability.

In the most significant shift in consumer banking since the 2008 financial crisis, the era of near-zero returns on cash reserves has effectively ended. Following an aggressive series of rate hikes by the Federal Reserve aimed at curbing inflation, consumers are now presented with unprecedented opportunities to earn substantial returns on liquid assets. Securing a high-yield savings accounts 5% APY is no longer an anomaly but a tangible goal for optimizing cash management, making a detailed comparison of the best banks essential this month.

The macroeconomic drivers behind 5% APY offers

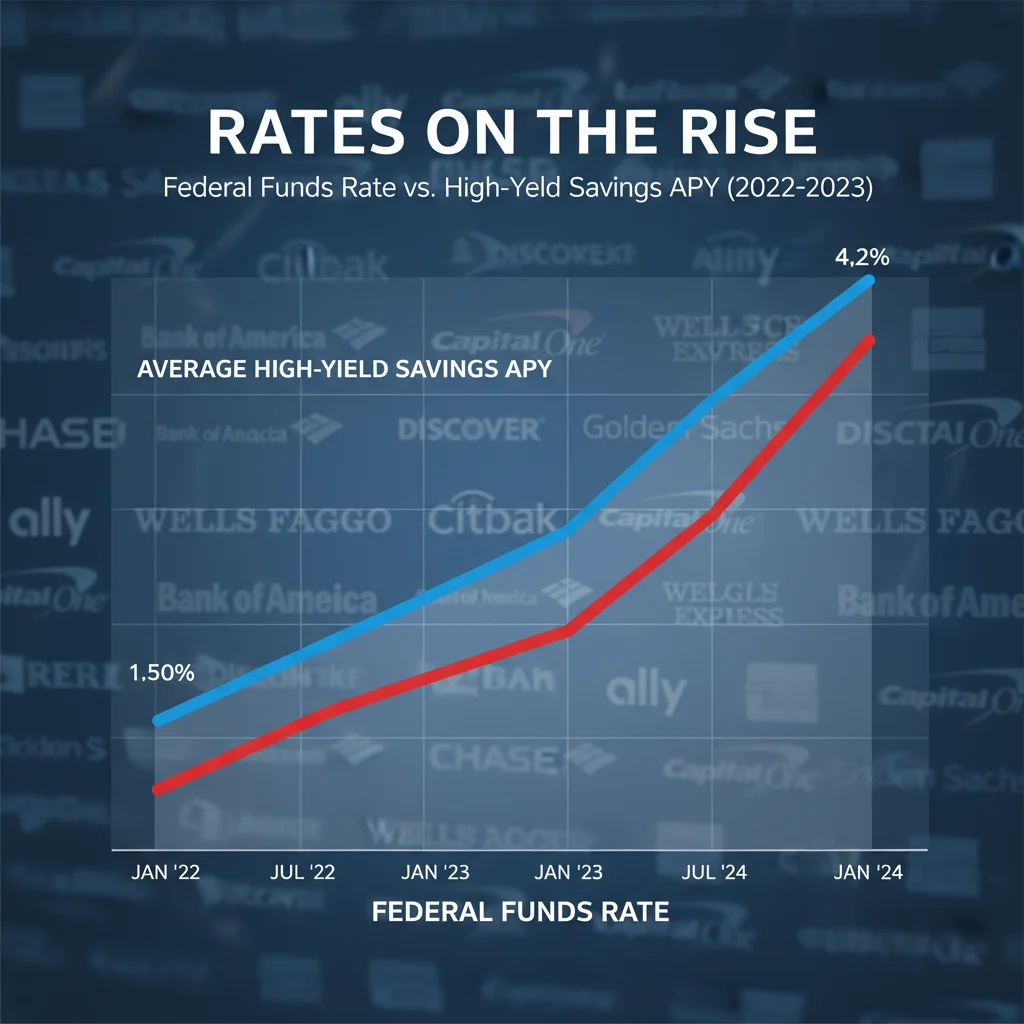

To understand why high-yield savings accounts 5% APY offers are prevalent, one must look directly at the Federal Reserve’s monetary policy. Since late 2022, the Federal Open Market Committee (FOMC) has consistently raised the target range for the federal funds rate. By mid-2024, this rate plateaued at a level not seen in over two decades, holding steady to ensure inflation, which peaked above 9% in 2022, moves sustainably toward the long-term 2% target. This elevated benchmark rate directly increases the cost of borrowing for banks and, crucially, the yield banks earn on their reserves held at the Fed.

When the federal funds rate is high, banks are willing to pay more to attract deposits, as these deposits serve as a cheaper source of funding than wholesale market borrowing. This competitive dynamic is most acute among challenger banks and online-only institutions, which operate with lower overhead costs than their traditional brick-and-mortar counterparts. Consequently, these institutions are often the first to pass on higher rates to consumers, resulting in the aggressive APY figures observed today. Data from the Federal Deposit Insurance Corporation (FDIC) shows that the average national savings rate remains below 0.50%, underscoring the vast disparity between traditional and high-yield accounts.

Federal Reserve Policy and Deposit Elasticity

The correlation between the federal funds rate and savings APY is not instantaneous, but cumulative. As the Fed maintains its restrictive stance, banks face increasing pressure to capture market share. This phenomenon is particularly relevant to the elasticity of deposits. Institutions like Goldman Sachs’s Marcus and Discover Bank, which rely heavily on consumer deposits for funding, must offer rates competitive enough to pull funds away from Treasury Bills (T-Bills) or Money Market Funds (MMFs), which are also benefiting from the elevated rate environment. The current yield curve inversion, where short-term rates exceed long-term rates, further incentivizes holding cash in short-duration, high-liquidity instruments like HYSAs.

- Federal Funds Rate: The primary lever, dictating the baseline cost of money for banks, currently positioned at multi-decade highs.

- Inflation Targeting: The Fed’s commitment to 2% inflation keeps rates elevated, sustaining high APYs for the near term.

- Bank Funding Costs: High rates increase bank reliance on consumer deposits over wholesale market funding, driving up competition.

- T-Bill Competition: HYSAs must compete with short-term government securities, pushing APYs higher to attract risk-averse capital.

In essence, the availability of 5% APY HYSAs is a direct economic consequence of the central bank’s anti-inflationary fight. As long as the Fed holds rates steady or implements a gradual, measured reduction, these elevated yields are expected to persist, offering a valuable hedge against residual inflation for household savings.

Comparing the top contenders: banks offering 5% or more APY

While the term 5% APY is highly attractive, the devil is often in the details regarding minimum balance requirements, fee structures, and FDIC insurance coverage. The institutions consistently reaching or exceeding the 5.0% threshold are predominantly online banks or fintech partners utilizing bank charters, allowing them to minimize operational costs and maximize pass-through rates to depositors. Key differentiators include whether the rate is introductory, requires a direct deposit relationship, or is capped at a specific balance.

For instance, some prominent online banks currently offer APYs around 5.15%, but these rates might be contingent on maintaining a specific checking account relationship or meeting monthly transaction requirements. Other institutions, often credit unions or smaller regional banks, may offer rates as high as 5.25% or 5.30%, but frequently impose stricter balance caps, sometimes limiting the high yield to balances below $10,000 or $25,000. For large cash reserves, consistency and the maximum balance eligible for the advertised rate become paramount considerations.

Key factors in evaluating high-yield accounts

Financial journalists emphasize that APY alone should not be the sole metric for selection. The stability and regulatory structure of the institution are equally critical, especially when dealing with large sums of cash. All reputable HYSAs should offer FDIC insurance, covering deposits up to $250,000 per depositor, per institution, in the event of bank failure. Beyond this, assessing the bank’s operational history and customer service metrics (often reported by financial data firms like JD Power) provides a more holistic view of reliability.

- Introductory vs. Standard Rates: Determine if the 5%+ APY is a temporary promotional offer that will revert to a lower rate after a defined period (e.g., six months).

- Balance Tiers: Investigate if the high yield applies to the entire balance or only up to a certain limit (e.g., 5.10% on balances up to $50,000, then 0.50% thereafter).

- Fee Structure: Ensure there are no monthly maintenance fees, excessive wire transfer fees, or penalties for falling below a minimum balance, which could erode the high yield.

- Customer Service Access: Evaluate the availability of phone support, chat services, and branch access, if required, for handling complex transactions or resolving disputes.

Choosing the right HYSA involves a detailed risk-reward assessment. While a 5.25% APY is marginally better than 5.00%, the difference may be negligible if the higher-rate account imposes severe withdrawal limits or requires costly monthly fees. Transparency regarding variable rates is also crucial; HYSAs are subject to interest rate fluctuations, and depositors must track the bank’s history of adjusting rates promptly following Fed decisions.

The crucial role of FDIC insurance and bank stability

The stability of the banking sector became a central discussion point following the regional banking turmoil of early 2023. This event underscored the fundamental importance of FDIC insurance, particularly for depositors chasing the highest yields offered by smaller or newer financial institutions. The standard FDIC limit of $250,000 per depositor, per insured bank, is the cornerstone of trust in the US banking system. Any cash holdings above this threshold carry systemic risk unless properly structured across multiple institutions.

When comparing banks offering high-yield savings accounts 5% APY, depositors must verify that the underlying entity is a legitimate FDIC-insured bank. Some fintech platforms act as intermediaries, spreading deposits across multiple partner banks to offer higher total coverage, often referred to as intra-network deposit placement. While this strategy offers extended insurance coverage, it adds layers of complexity and requires careful due diligence regarding the underlying institutional stability of the network participants. The financial strength of the issuing bank, measured by metrics like the common equity tier 1 (CET1) ratio, should be considered, although FDIC insurance mitigates direct loss risk up to the limit.

Evaluating institutional risk and deposit protection

For deposits exceeding the $250,000 limit, diversification is the key risk management strategy. By placing funds in multiple distinct FDIC-insured institutions, a depositor can effectively multiply their coverage. Market analysts often recommend using online banks for HYSAs due to their streamlined structure, but caution against placing undue reliance on institutions with overly concentrated asset bases or significant exposure to niche sectors like commercial real estate, which has faced recent headwinds.

- FDIC Limit: $250,000 standard coverage is non-negotiable for safety; amounts above this require strategic segmentation.

- Fintech Partnerships: Verify the specific bank charter backing the fintech offer and confirm the deposit sweep mechanism for extended coverage.

- Bank Health Metrics: While not a substitute for FDIC insurance, review banks’ regulatory filings (Call Reports) for capital adequacy and asset quality.

- Withdrawal Liquidity: Confirm the bank’s policies on large withdrawals; some online banks have daily limits, which could impact immediate access to substantial funds.

Ultimately, the pursuit of the highest APY must be balanced against the absolute security of the principal. The fractional percentage gain from a 5.25% account over a 5.00% account is immaterial if the underlying institution lacks robust regulatory oversight or if the depositor’s funds exceed the federally insured limit without proper segmentation. Trustworthiness, in the financial sector, is often more valuable than a marginal yield advantage.

Understanding the fine print: tiers, caps, and withdrawal limits

High-yield savings accounts are highly competitive products, and banks frequently employ structural mechanisms—tiers, caps, and limits—to manage their balance sheet and funding costs. These mechanisms dictate the true effective yield a depositor receives. A common practice is the use of tiered APY structures. For example, a bank might advertise 5.10% APY, but upon closer inspection, this rate may only apply to the first $50,000 deposited, with any amount exceeding that cap earning a nominal rate, perhaps 0.40%.

This tiered approach requires depositors with substantial cash holdings to calculate their blended APY. If $200,000 is placed in an account where only the first $50,000 earns 5.10%, the effective yield on the total balance drops significantly. Furthermore, some HYSAs impose strict caps on the maximum balance eligible for the high rate, often targeted at smaller, retail depositors rather than institutional or high-net-worth clients. Understanding these limitations is critical for maximizing returns, especially for those utilizing HYSAs as a safe harbor for emergency funds or short-term capital needs.

The implications of Regulation D and modern withdrawal rules

Historically, Regulation D limited the number of convenient transfers and withdrawals from savings accounts to six per month. While the Federal Reserve officially suspended the enforcement of this limit in 2020 due to the pandemic, many financial institutions still voluntarily maintain some form of transaction limit to manage liquidity and differentiate their savings products from transaction-heavy checking accounts. Depositors must confirm the specific policy of the chosen institution; exceeding internal limits can result in fees or, in extreme cases, the bank converting the HYSA into a checking account with a drastically reduced APY.

- Blended APY Calculation: Essential for large balances; depositors must model the return based on the bank’s specific tier structure.

- Transaction Fees: Scrutinize fees for excessive transfers, cashier’s checks, and outgoing wire transfers, which can negate yield gains.

- Lock-in Periods: Unlike Certificates of Deposit (CDs), HYSAs should offer full liquidity. Beware of any account that imposes penalties or temporary lock-in periods for withdrawals.

- Rate Volatility Disclosure: Banks must clearly disclose that the APY is variable and subject to change based on market conditions and Fed policy.

The optimal HYSA choice is tailored to the individual depositor’s needs: a small saver might prioritize the highest absolute rate regardless of caps, whereas a large saver must prioritize consistency and the maximum balance eligible for the advertised yield across multiple accounts. Due diligence on the fine print is non-negotiable in this high-rate environment.

Online banking efficiency versus traditional bank convenience

The landscape of high-yield savings accounts 5% APY is heavily dominated by online-only banks. This structural dominance is not accidental; it is driven by a fundamental economic advantage. Online banks, lacking the extensive network of physical branches, tellers, and real estate overhead, can operate with significantly lower non-interest expenses. This cost saving is the primary mechanism by which they can afford to offer APYs that are 10 to 15 times higher than the national average offered by legacy institutions like Chase or Bank of America.

However, this efficiency comes with a trade-off in convenience. Traditional banks offer the ability to deposit cash physically, interact with a teller for complex transactions, and access safety deposit boxes. Online banks rely entirely on digital transfers (ACH), mobile check deposits, and potentially third-party ATM networks. For the modern consumer, who primarily interacts with financial institutions digitally, this trade-off is often acceptable, given the substantial difference in yield. The current environment forces a clear decision: prioritize high liquidity and high returns via digital channels, or prioritize physical access and comprehensive services at the expense of yield.

Technological integration and ease of money movement

The quality of the digital interface and the speed of money movement are crucial metrics for online HYSAs. Top-tier online banks offer rapid ACH transfers (often 1-2 business days, sometimes instant for small transfers), seamless integration with external checking accounts, and robust mobile applications for account management. Poor technological infrastructure, including slow transfer times or frequent app downtime, can severely undermine the benefit of a high APY, especially if funds are needed urgently.

- ACH Speed: Evaluate the average time required for funds to move between the HYSA and the primary checking account; delays can impact budgeting.

- Mobile Functionality: Assess the ease of mobile check deposit, statement access, and security features like biometric login.

- Integration Ecosystem: Consider how well the HYSA integrates with budgeting software (e.g., Mint, YNAB) and payment services (e.g., Zelle, PayPal).

- Multi-Factor Authentication (MFA): Security features are paramount; ensure the bank offers robust MFA beyond simple password protection.

Financial analysts suggest that the future of competitive savings will remain digital. As tech-forward banks continue to innovate their platforms and reduce reliance on legacy systems, the gap in APY between online and traditional banks is likely to widen further, making the choice for yield-focused depositors increasingly clear.

Tax implications and maximizing after-tax yield

While earning 5% or more on savings is highly desirable, the interest earned from HYSAs is considered ordinary income and is fully taxable at the federal and state level. This fact is significant for high-income earners whose marginal tax rates can significantly reduce the effective, after-tax return. For instance, a taxpayer in the 32% federal bracket and a 5% state tax bracket faces a combined marginal rate of 37%. A 5.00% APY, after taxes, yields an effective return of only 3.15%. This calculation is critical in determining whether alternative, tax-advantaged savings vehicles might be more appropriate.

For cash reserves designated for short-term needs (1-3 years), the HYSA remains the most liquid option. However, for long-term savings or funds held by high-income individuals, comparing the HYSA yield against tax-exempt alternatives is necessary. Municipal bonds, while offering lower nominal yields (e.g., 3.5% tax-exempt), can provide a superior after-tax return depending on the investor’s tax domicile and bracket. Analysts often stress that the decision should be based on the net yield, not the gross headline APY.

Comparing HYSAs with short-term Treasury Bills

One direct competitor to the HYSA is the short-term Treasury Bill (T-Bill), particularly 4-week or 8-week maturities. T-Bills currently offer yields comparable to, or slightly exceeding, the best HYSAs. Crucially, T-Bill interest is exempt from state and local income taxes, offering a distinct advantage in states with high income tax rates such as California or New York. The decision between an HYSA and a T-Bill often boils down to liquidity and tax efficiency.

- Taxable vs. Tax-Exempt: HYSA interest is fully taxable; T-Bill interest is federally taxable but exempt at the state level.

- Form 1099-INT: Banks issue this form detailing all interest income above $10, requiring accurate reporting to the IRS.

- Marginal Tax Rate Impact: Higher earners must model their effective return carefully, considering the erosion of the headline APY by combined federal and state taxes.

- Alternative Vehicles: Consider tax-advantaged accounts like Roth IRAs or 529 plans if the savings goal is long-term, despite the liquidity trade-off.

Prudent financial management dictates maximizing the after-tax yield. While HYSAs offer unparalleled liquidity and ease of access, high-net-worth individuals or those residing in high-tax states may find that the tax exemption offered by T-Bills provides a more profitable ultimate return on their cash equivalents.

Future outlook: sustainability of 5% APY and rate forecasts

The central question for depositors securing a high-yield savings accounts 5% APY today is the sustainability of this rate. The APY of an HYSA is intrinsically linked to the Federal Reserve’s monetary policy. If the Fed begins a significant rate-cutting cycle—driven by a successful reduction of inflation or, conversely, a severe economic downturn—HYSA yields will decline rapidly. Historically, banks adjust their deposit rates downward much faster than they increase them.

Economists generally project that the Fed will likely maintain rates at current elevated levels through the majority of the current year, providing a stable foundation for high deposit rates. However, market expectations for rate cuts in the following year remain dynamic, fluctuating based on incoming economic data, particularly the Consumer Price Index (CPI) and employment figures. If inflation consistently falls toward the 2% target, a gradual reduction in the federal funds rate is anticipated, which would inevitably pressure HYSA yields down to the 4% or even 3% range over time.

Expert consensus on rate trajectory

Analysts at major investment banks currently hold varied outlooks. JPMorgan Chase economists suggest a cautious approach, forecasting only minor rate adjustments in the near term, thus supporting the continuation of 5% APY offers. Conversely, some boutique economic research firms predict more aggressive cuts if unemployment rises unexpectedly, potentially signaling a faster decline in HYSA yields. The consensus, however, leans toward a prolonged period of higher-for-longer rates compared to the pre-2022 environment, meaning 3-4% could become the new baseline, even after cuts begin.

- Lagging Indicator: HYSA rates often lag the federal funds rate, but respond quickly to confirmed Fed cuts.

- Economic Indicators: Monitor CPI, Personal Consumption Expenditures (PCE) index, and initial jobless claims for signals of Fed policy shifts.

- Monetary Policy Transmission: The current tight policy ensures that banks must continue to offer high rates to compete with other short-term fixed-income products.

- Risk Management: Depositors should view the current 5% APY as a temporary, opportunistic gain rather than a permanent fixture of the interest rate landscape.

The strategic approach for depositors now is to lock in the highest possible yield while maximizing liquidity, preparing for the eventual decline. While the window for 5% APY accounts may eventually close, the current environment provides a powerful incentive for consumers to actively manage their cash and move away from low-yielding legacy accounts.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| Current Federal Funds Rate | Sustained high rates anchor HYSA APYs above 5.0%; a direct result of anti-inflationary policy. |

| APY Balance Tiers/Caps | High yields often capped (e.g., $50,000); large depositors must calculate the lower blended APY. |

| Taxable Interest Status | Interest is ordinary income; high marginal tax rates significantly reduce the effective after-tax return compared to T-Bills. |

| Online Bank Dominance | Lower operational costs allow online-only institutions to consistently offer superior APYs compared to traditional banks. |

Frequently Asked Questions about High-Yield Savings Accounts Offering 5% APY

Yes, any legitimate HYSA operating in the U.S., regardless of the yield, must be backed by an FDIC-insured partner bank, covering deposits up to the standard limit of $250,000 per depositor. Consumers must verify the FDIC status of the underlying institution, especially when using fintech platforms.

Historically, banks tend to reduce deposit APYs faster than they raise them following a Fed rate change. If the Fed implements a 25 basis point cut, most competitive HYSAs will likely adjust their rates downward within 30 to 60 days to manage their funding costs, maintaining a slight lag.

HYSAs offer perfect liquidity with federal insurance, making them ideal for emergency funds. MMFs, while offering comparable yields and often better tax treatment (especially for T-Bill MMFs), are investment products and are not FDIC insured, introducing a marginal, though historically low, level of market risk.

Prioritization depends on the fund’s purpose. For strictly emergency funds requiring immediate, unrestricted access, prioritize minimal restrictions. For long-term, passive cash reserves, prioritize the highest APY, ensuring the account meets minimum transaction needs without incurring excessive fees that negate the yield advantage.

You must calculate the weighted average. If $50,000 earns 5.10% and the remaining $50,000 earns 0.50%, the total interest earned is annualized, then divided by the total principal ($100,000) to find the lower blended APY. Always verify the tier breakpoints before depositing large sums.

The bottom line: maximizing cash returns in a high-rate environment

The current availability of high-yield savings accounts 5% APY represents a transient but significant opportunity for retail depositors to optimize their liquidity management. This environment, characterized by the Federal Reserve’s determined stance against inflation, mandates a strategic shift away from traditional, low-yielding accounts. The key to maximizing returns lies not merely in chasing the highest advertised APY, but in a meticulous due diligence process that assesses FDIC security, the bank’s fee structure, and the potential impact of balance caps and tax liabilities. For the majority of American households, securing a yield above 5.0% on insured cash provides a necessary hedge against inflation and a powerful means of compounding wealth safely. Market participants should remain vigilant, tracking the monthly CPI reports and FOMC statements, as these indicators will dictate the longevity of these elevated deposit rates. While the rates are high now, they are variable, demanding timely action to capture the current advantage before the inevitable monetary policy pivot occurs.