Retirement Savings Gap Widening: 58% of Americans Behind on 401k Goals

The finding that 58% of American workers are failing to meet their projected 401k retirement savings goals highlights severe structural pressures, including persistent cost-of-living increases and inadequate contribution rates, demanding immediate policy and personal financial adjustments.

The alarming statistic that Retirement Savings Gap Widening affects 58% of Americans who are behind on their 401k goals underscores a critical economic vulnerability facing the United States. This deficit, which represents a shortfall in projected funds required to maintain pre-retirement living standards, is compounding due to a confluence of macroeconomic factors, including elevated inflation, interest rate volatility, and shifting employer contribution models. The immediate implication is clear: a significant portion of the workforce faces a precarious financial future, placing potential future strain on public assistance programs and dampening consumer longevity spending.

The Macroeconomic Undercurrents Driving the Retirement Shortfall

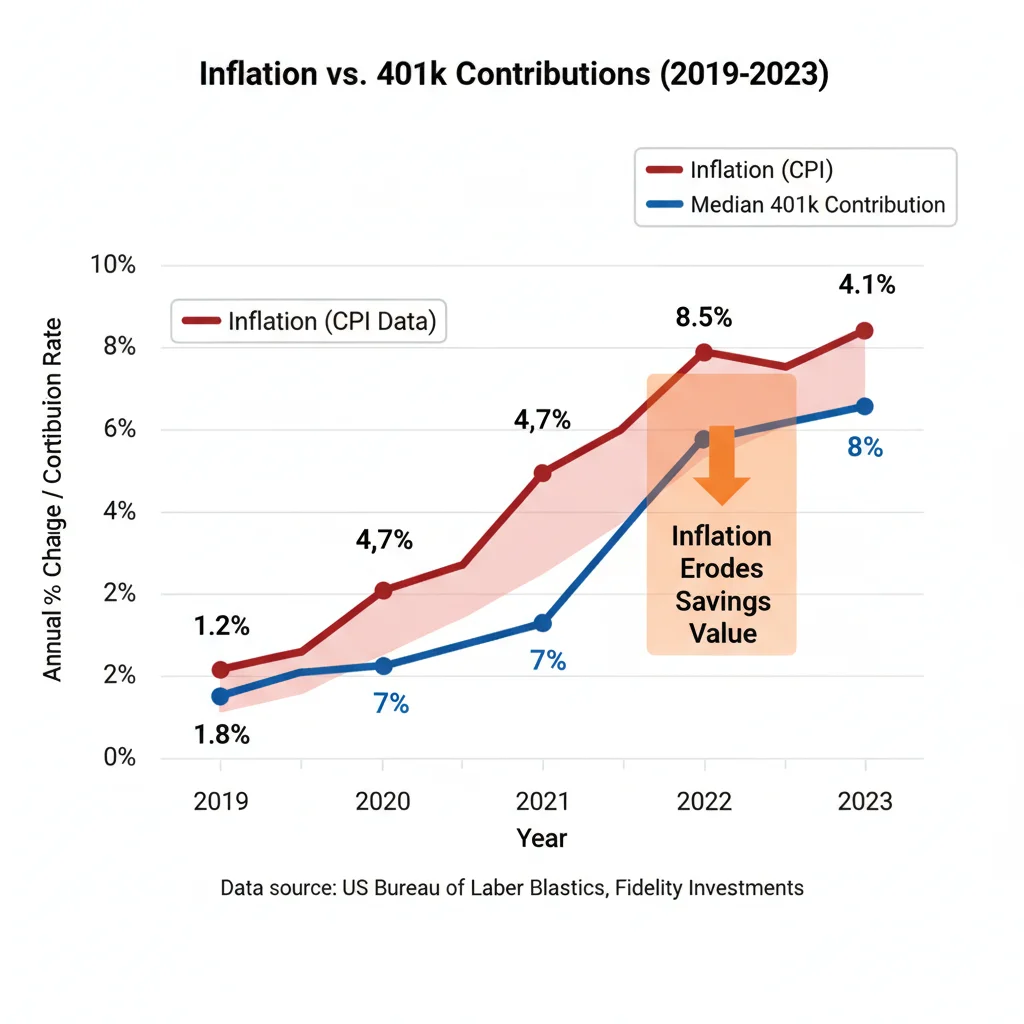

The current retirement savings crisis is not merely a failure of individual planning, but rather a structural phenomenon exacerbated by specific economic conditions prevailing since 2021. Elevated consumer price indices (CPI) have disproportionately affected discretionary income, curtailing the ability of median-income earners to maximize tax-advantaged retirement contributions. Data from the Bureau of Labor Statistics (BLS) indicates that while nominal wage growth has occurred, real wage growth, adjusted for inflation, has lagged in several key sectors, effectively reducing the purchasing power of savings and investment returns. This dynamic creates a challenging environment where the required savings rate to achieve retirement security must accelerate just to maintain parity with the rising cost of living.

Inflation and the Erosion of Real Savings Value

Inflation acts as a silent tax on fixed-income investments and savings accounts, severely impacting the long-term compounding effects necessary for a successful 401k portfolio. When inflation peaked above 9% in mid-2022, the real return on conservative investments, such as Treasury bonds or money market funds, turned sharply negative. For workers nearing retirement, this erosion mandates a difficult choice: increase portfolio risk or significantly raise contribution percentages, options often constrained by current household budgets.

- Real Wage Stagnation: Despite average hourly earnings rising 4.1% year-over-year as of Q3 2024, high core CPI (excluding food and energy) above 3.5% means many workers are not experiencing a true increase in disposable income available for saving.

- Increased Cost of Debt Servicing: The Federal Reserve’s campaign of rate hikes has increased the cost of mortgages and consumer debt, diverting funds that would otherwise be allocated to 401k contributions or supplemental retirement accounts.

- Target Retirement Date Shifts: Financial models, particularly those used by target-date funds, often underestimate persistent, elevated inflation, leading to projected shortfalls that require immediate corrective action, such as increasing equity exposure or delaying retirement.

Economists at Vanguard note that a sustained 1 percentage point increase in inflation can require an average worker to save an additional 3-5% of their annual income just to maintain the same projected standard of living in retirement. The compounding effect of this shortfall is what is driving the 58% figure, turning a manageable savings problem into a systemic national crisis.

Analyzing the 401k Participation and Contribution Gaps

While 401k plans remain the cornerstone of private-sector retirement savings, accessibility and utilization are unevenly distributed, contributing significantly to the savings gap. Data from the Investment Company Institute (ICI) shows that participation rates are high for higher earners but drop precipitously for those in lower-to-middle income brackets. Furthermore, simply participating is often insufficient; the critical factor is the contribution rate relative to the maximum allowable tax-advantaged limit ($23,000 for 2024, plus catch-up contributions).

The Median Contribution Lag

The median 401k contribution rate across all participants remains stubbornly low, hovering around 7-8% of pay, according to recent plan administrator reports. Financial planners generally recommend a total savings rate (including employer match) of 10-15% to ensure adequate retirement funding, especially for those who started saving later. The lag between the median contribution and the recommended threshold is a primary driver of the Retirement Savings Gap Widening phenomenon.

A significant element contributing to this lag is the inadequate utilization of employer matching programs. While many employers offer a match (e.g., 50 cents on the dollar up to 6% of salary), a substantial minority of eligible employees fail to contribute enough to capture the full match—effectively leaving free money on the table. This behavioral finance lapse is estimated to cost the average American worker tens of thousands of dollars in lost compounded returns over a 30-year career.

Behavioral Finance and the Inertia of Under-Saving

Behavioral economics research highlights the role of inertia in retirement savings decisions. Automatic enrollment in 401k plans has successfully boosted participation, but the default contribution rate is often set at a low level (e.g., 3%). Without active intervention or automatic escalation features, many employees remain stuck at this insufficient initial rate. The psychological hurdle of increasing a contribution percentage, even by a single point, often prevents workers from closing their savings deficit proactively.

- Default Bias: Studies by the Pension Research Council show that employees tend to stick with the default contribution rate, indicating that increasing the default rate from 3% to 6% could significantly reduce the 58% shortfall.

- Financial Literacy Gap: A lack of understanding regarding compounding interest and the true cost of retirement longevity means many workers underestimate their future needs, leading to conservative contribution targets in their early careers.

- Competing Financial Priorities: High student loan debt (averaging over $30,000 per borrower) and increasing housing costs frequently take precedence over maximizing 401k contributions, particularly among younger workers.

To combat this, leading financial institutions are advocating for mandatory annual contribution escalations within 401k plans, coupled with sophisticated financial wellness programs that emphasize the long-term cost of short-term under-saving. The goal is to move the median contribution rate closer to the 10% mark, which analysts believe is the minimum sustainable level for most middle-income households.

The Role of Market Volatility and Investment Strategy in Portfolio Performance

Market performance plays a crucial, though sometimes overstated, role in the retirement savings narrative. While strong bull markets, such as those seen between 2010 and 2021, can mask inadequate contributions, volatility exposes underlying weaknesses, particularly for those with overly conservative or poorly diversified portfolios. The recent periods of significant market drawdown, characterized by a bear market in 2022 and subsequent uneven recovery, have disproportionately impacted savers close to retirement who lacked adequate bond exposure or cash reserves.

De-risking Dilemmas for Near-Retirees

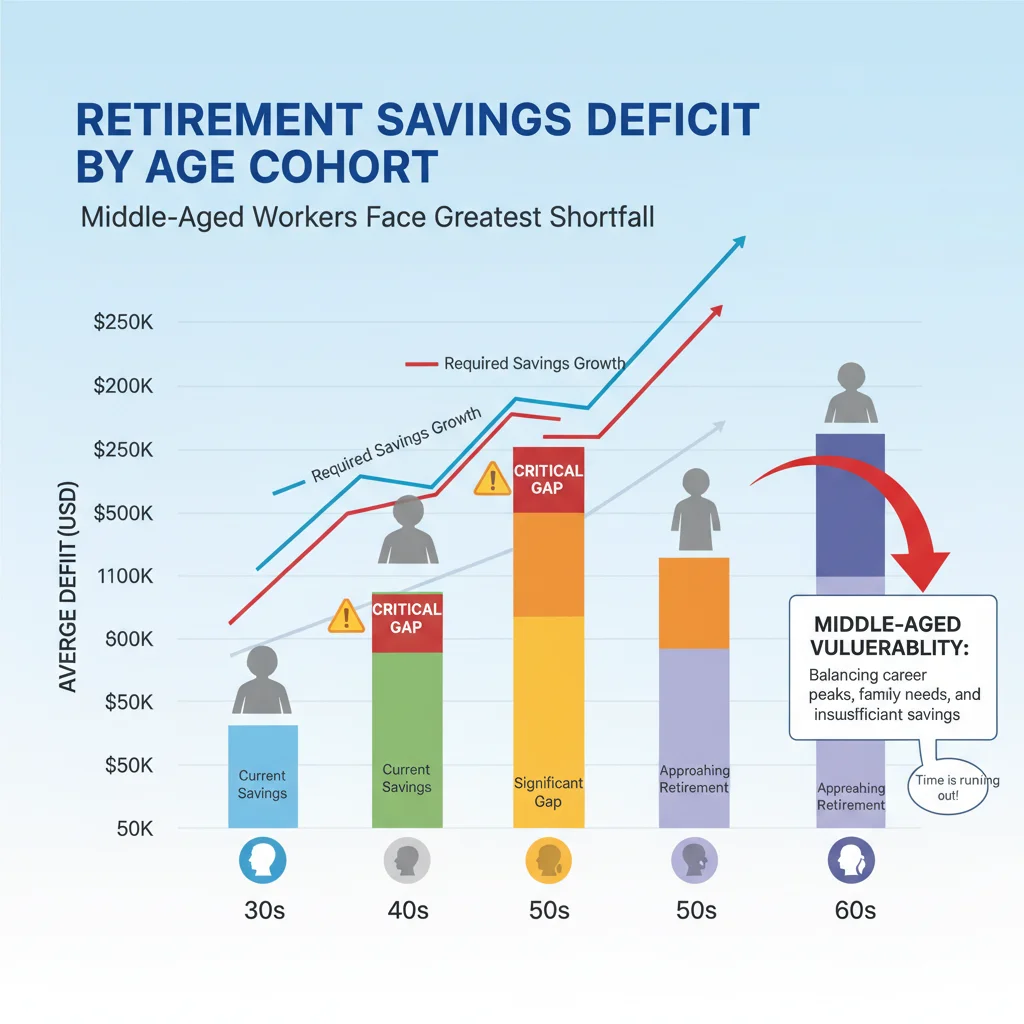

For the segment of the 58% who are within ten years of retirement, the challenge is acute. They need aggressive growth to close the deficit, yet they face the immediate risk of a market downturn wiping out critical gains. This creates a critical investment dilemma: prioritize growth or preserve capital. Analysts at Goldman Sachs suggest that many near-retirees are over-allocated to equities relative to their risk tolerance, a consequence of trying to catch up on years of under-saving.

Conversely, many younger investors, paralyzed by recent market swings, are under-allocated to high-growth assets. This is a crucial mistake, as time horizon is their most valuable asset. The long-term compounding effect of equity exposure is essential for overcoming the initial savings deficit. Addressing the Retirement Savings Gap Widening requires sophisticated risk management tailored to individual time horizons, moving beyond generic allocation advice.

The Impact of High Fees and Low Diversification

Hidden costs, such as high expense ratios in actively managed mutual funds within 401k menus, can silently shave off significant retirement wealth. A difference of just 0.5% in annual fees can reduce a retiree’s total portfolio value by 10% to 15% over a 30-year period. Plan sponsors are under increasing scrutiny from the Department of Labor (DOL) to ensure that fee structures are competitive and transparent, but participant awareness remains low.

- Fee Drag Quantification: A worker saving $10,000 annually over 30 years at 7% growth will lose over $50,000 in potential returns if their fund expense ratio is 1.0% instead of 0.2%.

- Lack of Global Diversification: Many 401k plans tilt heavily toward U.S. large-cap equities, leaving participants exposed to concentration risk and missing out on potential returns from emerging markets or international developed markets.

- Alternative Asset Access: The inability of standard 401k plans to easily access true inflation hedges, such as certain real estate investment trusts (REITs) or commodities, limits the ability of savers to protect their capital during inflationary cycles.

Socioeconomic Disparities and the Uneven Distribution of the Shortfall

The figure that 58% of Americans are behind on their goals masks significant disparities based on income, race, and gender. The retirement crisis is not uniformly distributed; it disproportionately affects those already facing structural barriers to wealth accumulation. This uneven distribution exacerbates social inequality and carries broader economic risks related to future poverty rates among the elderly population.

The Gender and Race Gap in Retirement Wealth

Women, on average, retire with significantly less savings than men, primarily due to factors such as the gender wage gap, time taken out of the workforce for caregiving, and longer life expectancy. Similarly, systemic inequalities have resulted in lower rates of 401k participation and lower median balances for minority groups. Federal Reserve data consistently shows that median retirement account balances for Black and Hispanic households are substantially lower than those for white households, reflecting historical barriers to economic mobility and higher rates of financial fragility.

Addressing the Retirement Savings Gap Widening requires targeted policy interventions that go beyond standard tax incentives. These include enhancing access to state-sponsored retirement plans for workers whose employers do not offer 401k access, and providing subsidized financial education focused on communities most affected by the deficit. The economic consensus is that closing this gap is vital for long-term fiscal stability.

The Gig Economy and Lack of Employer-Sponsored Plans

The proliferation of the gig economy and contingent work arrangements means a growing segment of the workforce lacks access to traditional employer-sponsored 401k plans with matching contributions. While self-employed individuals can utilize SEP-IRAs or Solo 401k plans, the administrative burden and lack of automatic payroll deductions often result in lower savings rates compared to traditional W-2 employees. This structural shift in the labor market is a major contributing factor to the rising 58% figure.

The policy response, such as the SECURE Act and subsequent legislation, has attempted to facilitate easier access to pooled employer plans (PEPs), but adoption remains slow. Until portable, universal retirement savings mechanisms are widely implemented, the gap for non-traditional workers will continue to expand, placing greater stress on their financial independence in retirement.

Strategies for Closing the Individual Retirement Savings Gap

For the 58% of Americans facing a shortfall, the strategy must pivot from passive saving to aggressive, optimized contribution and investment planning. This involves a rigorous analysis of current spending habits, maximizing tax-advantaged accounts, and making calculated adjustments to portfolio risk and asset allocation. Financial advisors emphasize that time is the most critical resource, and even small, immediate increases in contribution rates can yield substantial results over decades.

Maximizing Tax-Advantaged Contributions

The most direct method to mitigate the deficit is to increase the contribution percentage, ideally up to the maximum annual limit. For individuals aged 50 and over, utilizing the annual catch-up contribution ($7,500 in 2024) is non-negotiable for rapid deficit reduction. Beyond the 401k, investors should prioritize Roth IRAs or traditional IRAs, particularly if their employer plan offers limited investment choices or high fees.

- Health Savings Accounts (HSAs): For those with high-deductible health plans, HSAs offer a triple tax advantage (contributions, growth, and withdrawals for qualified medical expenses are tax-free) and function as an excellent supplemental retirement vehicle.

- Backdoor Roth Contributions: High-income earners who exceed the direct Roth IRA contribution limit should explore the ‘backdoor’ strategy to maximize tax-free growth potential in retirement.

- Asset Location Strategy: Strategically placing high-growth, high-turnover assets (like REITs or actively managed funds) in tax-advantaged accounts and low-turnover, tax-efficient assets (like broad-market index funds) in taxable brokerage accounts can optimize overall portfolio efficiency.

Revising Portfolio Risk and Asset Allocation

Many savers behind on their goals need to reassess their equity allocation. While conventional wisdom suggests reducing equity exposure closer to retirement, those with significant deficits may need to maintain a higher-than-average allocation (e.g., 60-70% equities a decade before retirement), provided they have a robust emergency fund to ride out short-term volatility. This aggressive stance must be balanced with adequate diversification across sectors and geographies to mitigate idiosyncratic risk.

Furthermore, the persistent threat of inflation means traditional bond allocations may offer insufficient protection. Analysts at BlackRock recommend exploring inflation-linked instruments, such as Treasury Inflation-Protected Securities (TIPS), or real assets, to maintain the real purchasing power of the fixed-income portion of the portfolio, directly addressing the core factor causing the Retirement Savings Gap Widening.

The Future Regulatory Landscape and Policy Solutions

Policymakers are increasingly recognizing the systemic risk posed by the widespread retirement deficit. Legislative efforts, such as the SECURE Act and subsequent legislation, aim to address structural flaws by expanding coverage, simplifying administrative requirements for small businesses, and facilitating emergency savings access. However, substantial gaps remain, requiring further regulatory action to ensure universal access and adequate default contribution levels.

Mandatory Auto-Enrollment and Escalation

One of the most impactful policy changes being debated is the implementation of mandatory auto-enrollment and auto-escalation for all private-sector employers above a certain size threshold. This would leverage behavioral economics to overcome inertia, automatically placing workers into 401k plans at a starting rate (e.g., 6%) and increasing contributions annually until a target rate (e.g., 10-15%) is reached. Critics argue this imposes burdens on small businesses, but proponents cite evidence showing minimal compliance costs relative to the benefit of national savings stability.

The long-term economic stability of the U.S. relies heavily on a solvent retired population. The current trajectory, where 58% are behind, suggests future demands on Social Security and Medicaid will be higher than projected, placing fiscal pressure on future generations. Therefore, regulatory solutions that standardize and simplify savings must be prioritized over voluntary incentives alone.

Enhancing Financial Wellness and Education

Regulatory efforts are also focusing on improving the quality and accessibility of financial education provided through employer-sponsored plans. Moving beyond simple disclosure, the emphasis is shifting toward personalized financial coaching and tools that help participants understand their individual retirement savings gap and the specific steps required to close it. This focuses on translating complex financial metrics into actionable, budget-friendly strategies for the median American household.

The confluence of high consumer debt, inflation, and market volatility has created a challenging environment for retirement savers. While policy aims to address structural issues, immediate action by individuals—specifically increasing contribution rates and optimizing portfolio allocation—remains the most powerful tool against the expanding retirement shortfall. The Retirement Savings Gap Widening serves as a stark warning requiring immediate, data-driven financial discipline.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| 58% of Americans Behind | Indicates systemic under-saving, driven by real wage stagnation and high cost of living. Requires contribution rate increases. |

| Inflation Erosion (CPI > 3.5%) | Reduces the real return on conservative assets. Mandates greater equity exposure or inflation-protected securities (TIPS). |

| Median Contribution Rate (~7-8%) | Significantly below the recommended 10-15% threshold. Policy solutions favor mandatory auto-escalation features. |

| High Expense Ratios (> 0.5%) | Substantially reduces compounded returns over 30 years. Investors must prioritize low-cost index funds in 401k menus. |

Frequently Asked Questions about Retirement Savings Gap Widening

Immediately increase your 401k contribution rate by at least 1-2 percentage points, aiming for a total contribution of 10-15% including your employer match. Utilize catch-up contributions if you are over 50. Simultaneously, review your portfolio allocation to ensure adequate exposure to equities, which historically provide the necessary growth to close a savings deficit.

Inflation erodes the real purchasing power of future retirement funds. If inflation is 4% but your savings grow only 6%, your real return is just 2%. To counteract this, you need higher nominal returns, which often requires increasing equity exposure or investing in inflation-protected assets like TIPS, moving away from low-yield cash or traditional fixed income.

Generally, yes, if the debt interest rate (e.g., credit card debt at 20%) exceeds the expected long-term return on your 401k (e.g., 7-8%). However, always contribute enough to capture the full employer match, as this is an immediate 50-100% guaranteed return, then prioritize eliminating high-cost unsecured debt before maximizing retirement savings.

Target-date funds (TDFs) are often the default option and provide automatic diversification, but their glide paths can be too conservative for individuals with significant savings deficits. If you are far behind your goals, a TDF might transition to a bond-heavy allocation too soon, limiting necessary growth. Customizing your allocation beyond the default TDF may be required.

Yes, but their primary focus should be maximizing contribution percentages early on, leveraging their long time horizon. The 58% figure highlights the penalty of inertia. Young workers should immediately aim for 10% or more contribution, even if it feels difficult, to benefit maximally from compounding and mitigate future deficits caused by market or economic shocks.

The Bottom Line: Reorienting Financial Strategy in a High-Cost Environment

The data confirming that 58% of Americans are struggling to achieve their 401k goals is more than a statistical curiosity; it is a clear indicator of structural economic stress where inflation and debt service costs are outpacing real wage gains. This widening deficit places a heavy burden on individuals and foreshadows broader fiscal challenges for the nation as the retirement population grows. The era of relying solely on market appreciation to compensate for inadequate contribution rates is over. Financial expertise dictates a reorientation toward aggressive savings optimization, particularly maximizing tax-advantaged vehicles like the 401k and HSA, and a judicious increase in risk exposure for those with significant shortfalls and long time horizons.

Looking ahead, investors must monitor key economic indicators—specifically, the Federal Reserve’s future path on interest rates and the trajectory of core inflation—as these factors will determine the real rate of return on retirement assets. Furthermore, legislative developments regarding mandatory auto-enrollment and expanded access to portable retirement plans will shape the landscape for the next decade. For the individual, the imperative is immediate and clear: closing the Retirement Savings Gap Widening requires disciplined contribution increases and a transparent understanding of underlying investment costs and risks. Failure to adjust current savings behavior now will translate into significantly diminished financial security during retirement years, creating a compounding crisis that demands urgency.