S&P 500 Earnings Growth at 8.5%: Q4 2025 Sector Leadership Analysis

With the S&P 500 projected to achieve 8.5% earnings growth in Q4 2025, market attention is shifting to sectors like Information Technology and Healthcare, which possess the structural tailwinds and pricing power necessary to significantly outperform broader index expectations.

The expectation that the S&P 500 Earnings Growth at 8.5%: Which Sectors Will Lead in Q4 2025 is set against a backdrop of moderating inflation, stabilizing interest rates, and sustained corporate spending, signaling a mature phase in the economic expansion where sector divergence becomes critically important for alpha generation.

The Macroeconomic Framework Supporting 8.5% Growth

The projected 8.5% earnings growth for the S&P 500 in Q4 2025, according to institutional estimates, represents a significant acceleration from the low single-digit growth observed in the preceding quarters, driven primarily by easing input costs and robust consumer demand, particularly in high-income demographics. This forecast assumes a soft landing scenario for the U.S. economy, where the Federal Reserve successfully navigates high inflation without triggering a recession, maintaining the unemployment rate below 4.5% throughout the year. The ‘so what’ for investors is that this aggregate growth masks substantial dispersion at the sector level; understanding the drivers of this 8.5% average is essential for positioning portfolios.

Economic indicators support the optimistic earnings outlook. Manufacturing Purchasing Managers’ Index (PMI) data, cited by the Institute for Supply Management (ISM), has consistently remained above the 50-point expansion threshold, indicating healthy industrial activity and corporate willingness to invest in capital expenditures. Furthermore, corporate profit margins, while pressured by wage inflation, are expected to stabilize as companies realize productivity gains from investments made in automation and artificial intelligence (AI) infrastructure over the past 18 months. The consensus forecast from major financial houses, including Goldman Sachs and Morgan Stanley, points toward revenue growth averaging 5.5% for the index, meaning margin expansion must account for the remaining 3.0% of the earnings growth contribution.

Interest Rate Normalization and Corporate Debt

A key factor underpinning profitability in 2025 is the expected path of the Federal Funds Rate. Assuming the Fed concludes its rate hiking cycle and perhaps implements moderate cuts by late 2025, the cost of capital for corporations will ease, particularly benefiting sectors with high debt loads or frequent financing needs. However, the impact is uneven. Companies that proactively refinanced debt during the low-rate environment of 2020-2022 are insulated, while those facing near-term debt maturities in 2025 and 2026 will still contend with significantly higher borrowing costs than the previous decade.

- Cost of Capital: A 100 basis point reduction in the 10-year Treasury yield, projected by some analysts, could boost aggregate S&P 500 earnings by approximately 1.2% through reduced interest expense alone.

- Dollar Strength: A depreciating U.S. dollar, often associated with Fed easing, would provide a translation tailwind for multinational corporations, particularly those in Technology and Materials, which derive significant revenue abroad.

- Wage Inflation: While easing, labor costs remain elevated. Companies must demonstrate pricing power or operational efficiency to offset sticky wage growth, a challenge particularly acute for consumer-facing sectors.

The 8.5% target is achievable, but contingent upon geopolitical stability and the absence of supply chain shocks that plagued the 2021-2023 period. Any significant disruption to energy markets or persistent inflation spikes could quickly erode margin expectations, shifting the focus from growth-oriented sectors back to defensive plays like Utilities and Consumer Staples. Therefore, the macroeconomic stability baked into the 8.5% forecast is the foundation upon which sector leadership will be built.

Information Technology: The AI Catalyst and Margin Expansion

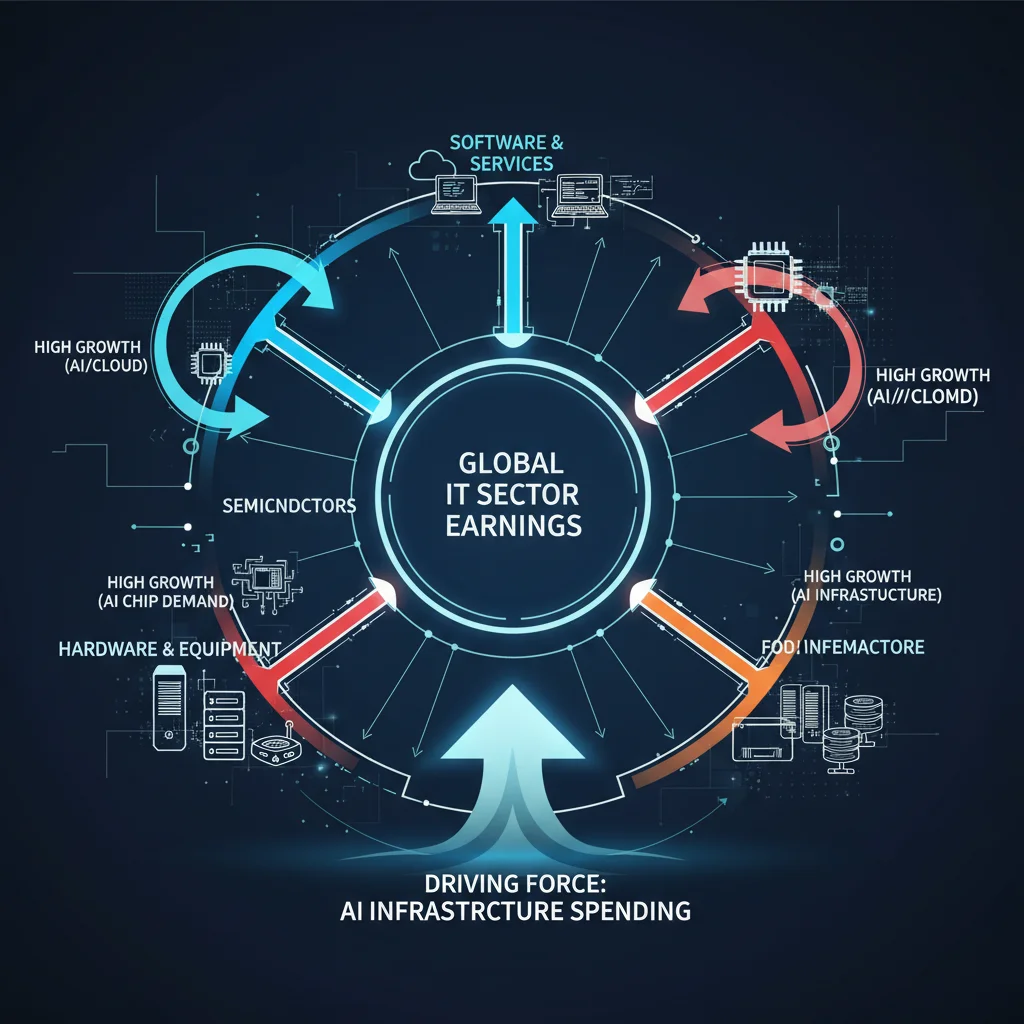

Information Technology (IT) is universally anticipated to be the primary engine of earnings growth in Q4 2025, potentially exceeding the aggregate 8.5% S&P 500 target by a wide margin. The sector’s projected outperformance is fundamentally tied to the accelerating investment cycle in artificial intelligence (AI), cloud computing, and advanced semiconductor manufacturing. This is not merely a cyclical rebound but a structural shift driving multi-year demand for specialized hardware and high-margin software services.

Specific data points highlight this trend: capital expenditures by the five largest hyperscale cloud providers are forecast to grow by over 15% year-over-year in 2025, primarily directed toward building out AI data centers. This directly benefits semiconductor producers specializing in graphic processing units (GPUs) and related networking hardware. Analysts at Bank of America estimate that the IT sector could deliver earnings growth closer to 15% to 18% in Q4 2025, provided the semiconductor supply chain remains optimized.

Semiconductors and Software Services Dominance

Within the Technology sector, the divergence between sub-industries is pronounced. Semiconductor companies, particularly those enabling AI training and inference, are expected to experience the highest revenue growth rates. According to data from the Semiconductor Industry Association (SIA), global chip sales are projected to accelerate in 2025, following a period of inventory correction. This renewed demand, coupled with high average selling prices (ASPs) for advanced chips, translates directly into exceptional profitability.

- Software Performance: Enterprise software companies focused on B2B applications (SaaS) benefit from sticky revenue models and high renewal rates, enabling them to maintain operating margins often exceeding 30%.

- Hardware Lag: Traditional hardware segments, such as personal computing and legacy servers, may lag, with growth rates closer to the S&P 500 average, underscoring the importance of selective exposure within the sector.

- R&D Investment: High R&D spending in the IT sector (often 10-15% of revenue) is crucial, as sustained innovation is the primary source of competitive advantage and future earnings power.

The risk profile for Technology remains tied to valuation and interest rate sensitivity. While growth is robust, valuations are stretched relative to historical averages. Should inflation prove stickier than expected, compelling the Fed to maintain higher rates for longer, the discounted present value of future earnings for high-growth tech stocks would suffer, potentially capping overall sector returns despite strong fundamental performance. Investors are therefore monitoring the 10-year Treasury yield closely as a barometer for tech stock sentiment.

Healthcare: Defensive Growth and Innovation Tailwinds

The Healthcare sector offers a compelling blend of defensive resilience and structural growth, positioning it as a likely second-place leader in earnings performance for Q4 2025. Unlike cyclical sectors that rely heavily on discretionary consumer spending or industrial CapEx, Healthcare derives its stability from non-discretionary demand driven by aging demographics and sustained innovation in pharmaceuticals and medical devices. Estimates suggest the Healthcare sector could achieve earnings growth between 9.5% and 12.0%, comfortably above the 8.5% index average.

The primary catalysts are twofold: the successful launch and commercialization of recent blockbuster drugs, particularly in oncology and immunology, and the continued recovery in elective medical procedures previously deferred during pandemic-related disruptions. Pharmaceutical companies benefit from strong patent protection and pricing power, enabling margin expansion even amidst modest inflation. Furthermore, managed care organizations (MCOs) are expected to demonstrate strong profitability, leveraging efficient medical cost management and increased enrollment figures in government programs.

Biotechnology and Medical Device Dynamics

Within Healthcare, the Biotechnology and Medical Devices sub-sectors are showing the most dynamic growth. Biotechnology firms, fueled by venture capital and strategic partnerships, are advancing pipelines focused on gene therapies and personalized medicine, which command premium pricing. The regulatory environment, particularly the FDA approval pace, remains a critical determinant of short-term earnings volatility, but the long-term trend favors innovation.

Medical device manufacturers, in particular, are seeing a resurgence. As hospital systems normalize staffing levels and clear backlogs, demand for high-tech surgical equipment and implants has soared. Companies focused on minimally invasive procedures are reporting strong order books and improving supply chain stability, allowing them to capitalize on pent-up demand. This recovery is a key factor differentiating Healthcare’s Q4 2025 outlook from earlier, more challenging periods.

- Demographic Shift: The increasing proportion of the population aged 65 and over ensures a reliable baseline demand for medical services and pharmaceuticals, insulating the sector from broader economic cycles.

- M&A Activity: Mergers and acquisitions (M&A) are expected to accelerate in 2025, driven by large pharmaceutical companies seeking to acquire innovative biotech pipelines, providing a further boost to earnings through synergies and portfolio optimization.

- Policy Risk: Legislative efforts regarding drug pricing controls remain a persistent headwind, although current projections assume moderate rather than aggressive policy changes.

The defensive nature of Healthcare means it typically outperforms during periods of economic uncertainty, but its current growth trajectory suggests it can also lead during expansionary phases, making it a crucial component for investors seeking both stability and above-average earnings growth in the Q4 2025 framework.

Industrials and Materials: Cyclical Rebound and Infrastructure Spending

The Industrials and Materials sectors are positioned for a significant cyclical rebound, albeit one that is highly sensitive to global trade volumes and large-scale government infrastructure spending. While these sectors may not match the explosive growth rates of Technology, their projected earnings growth, estimated around 7.0% to 9.0%, places them firmly around the S&P 500 average of 8.5% and signifies a strong recovery from previous supply chain constraints.

Industrial companies benefit from two primary tailwinds: the continued execution of the U.S. infrastructure plan, which provides multi-year visibility on demand for construction, engineering, and heavy equipment; and the re-shoring of manufacturing capacity, driving investment in factory automation and specialized machinery. Materials companies, which supply the raw inputs like chemicals, metals, and construction materials, benefit directly from this increased industrial activity, leading to higher volumes and improved capacity utilization.

Global Demand and Supply Chain Normalization

A crucial determinant for these sectors is the normalization of global supply chains and the recovery of demand from international markets, particularly Europe and Asia. For large multi-national industrial conglomerates, foreign exchange fluctuations and overseas economic health significantly impact their bottom lines. Data from major shipping indices indicate falling freight costs and improved transit times, which directly lowers the operating expenses for these companies, allowing for margin recapture.

The challenge for Industrials lies in labor availability and persistent input price volatility, especially for commodities tied to energy prices. While raw material costs have eased from their 2022 peaks, any renewed geopolitical tensions could quickly reverse this trend. Furthermore, the ability of industrial companies to pass on increased labor costs through higher prices without dampening demand will be a key performance indicator heading into Q4 2025.

The sector’s projected earnings growth is therefore heavily reliant on sustained economic expansion and strong corporate capital expenditure cycles. Should the economy enter a mild contraction, Industrials would be among the first sectors to see their earnings forecasts revised downward, highlighting their cyclical sensitivity compared to the defensive nature of Healthcare.

Energy and Financials: Navigating Volatility and Regulatory Shifts

The Energy and Financials sectors present a more mixed picture, characterized by high sensitivity to external factors—commodity prices for Energy and interest rate policy for Financials. Energy earnings are projected to stabilize after a period of exceptional post-2022 growth, with Q4 2025 expectations hovering modestly below the 8.5% average, likely in the 5.0% to 7.0% range, assuming crude oil prices settle between $75 and $85 per barrel.

The focus in the Energy sector has shifted from pure commodity price leverage to capital discipline and shareholder returns. Companies are prioritizing debt reduction and share buybacks over aggressive production expansion. This disciplined approach provides a floor for earnings, even if prices moderate. Integrated oil companies are also investing heavily in renewable and transition energy projects, though the earnings contribution from these segments remains minor relative to traditional fossil fuels in the 2025 timeframe.

Financial Sector Net Interest Margin Outlook

Financials, particularly large commercial banks, are intensely focused on net interest margin (NIM). The sector performed well during the rate hiking cycle but faces potential headwinds as rates stabilize or decline. A flat yield curve compresses NIMs, challenging profitability. However, strong loan growth, particularly in commercial and industrial lending, and robust investment banking activity (driven by expected M&A acceleration in 2025) provide offsetting positives.

- Regional Bank Health: The stability of regional banks is critical. While large national institutions are generally robust, regional lenders still contend with commercial real estate (CRE) exposure, which could necessitate higher loan loss provisions, impacting overall sector earnings.

- Insurance Strength: Property and casualty insurers are expected to benefit from higher reinvestment yields on their fixed-income portfolios, providing a solid earnings base.

- Capital Markets: A buoyant equity market and increased corporate fundraising activities significantly boost revenues for investment banks and asset managers, offsetting potential NIM compression in traditional lending.

The consensus view places Financials’ earnings growth near the 6.0% to 8.0% range for Q4 2025, highly dependent on the Federal Reserve’s precise rate trajectory. A rapid shift to deep rate cuts could dampen NIMs, while a prolonged pause at elevated levels could maintain profitability through higher loan yields, albeit at the risk of slower economic growth.

The Importance of Pricing Power in a Moderating Environment

As the U.S. economy moves past the peak inflationary pressures, the ability of companies to maintain or increase prices without sacrificing market share—known as pricing power—becomes the single most important differentiating factor for sector earnings performance. In a world of 8.5% aggregate growth, the leaders are those who can expand margins, not just revenues.

Technology and Healthcare companies possess superior structural pricing power. Technology firms, especially those selling specialized software or proprietary hardware (like AI chips), face inelastic demand. Customers cannot easily switch providers without significant cost or performance degradation. Similarly, pharmaceutical companies, protected by patents, control the supply of life-saving treatments, insulating them from typical competitive pressures.

Consumer Discretionary vs. Consumer Staples

In contrast, the Consumer Discretionary sector faces greater challenges. While high-end luxury goods producers maintain pricing power, mass-market retailers and automotive manufacturers are highly sensitive to consumer confidence and promotional activity. If the economic expansion slows, consumers quickly trade down, forcing margin compression. Consumer Staples, while defensive, often struggle to achieve significant earnings growth because their products are highly substitutable and demand is relatively fixed.

- Operating Leverage: Companies with high fixed costs and low variable costs (common in Software and certain Industrials) can translate small increases in revenue into large increases in operating income.

- Input Cost Management: Successful firms are those that have locked in supply contracts or diversified sourcing, reducing exposure to volatile commodity markets.

- Product Differentiation: Investment in R&D and brand strength allows companies to justify premium pricing, a characteristic strongly evident in the leading growth sectors.

The sectors most likely to lead the S&P 500’s 8.5% earnings growth in Q4 2025 are those that derive their competitive advantage from intellectual property or regulatory barriers, ensuring they can dictate pricing terms rather than respond to them. This structural advantage is why Technology and Healthcare consistently feature at the top of institutional forecasts.

Risk Factors and Contingency Scenarios for Q4 2025

While the baseline forecast of 8.5% S&P 500 earnings growth is robust, seasoned financial analysis requires acknowledging the key downside risks that could derail this trajectory. The three primary threats are a premature economic slowdown, persistent geopolitical instability, and a corporate credit crunch resulting from prolonged high interest rates.

If the Federal Reserve is forced to maintain the Federal Funds Rate above 5.0% deep into 2025 due to a resurgence of core inflation, the resulting tightening of financial conditions could severely impact corporate investment and consumer spending, leading to a recessionary environment. In this scenario, the 8.5% forecast would likely be halved, and defensive sectors like Utilities and Consumer Staples would outperform the high-growth sectors, as investors prioritize capital preservation over growth.

The Geopolitical Wildcard

Geopolitical tensions, particularly concerning energy supply routes or trade relations, represent an unquantifiable but significant risk. A sudden increase in the price of WTI crude oil above $100 per barrel, for instance, would instantly act as a tax on the global economy, raising transportation costs and crimping disposable income, thereby pressuring corporate margins across nearly all sectors except Energy.

Furthermore, the U.S. dollar’s trajectory is crucial. A sharp appreciation of the dollar, often triggered by a flight to safety during global crises, would negatively affect the translation of international earnings for the roughly 40% of S&P 500 revenues earned outside the United States. Analysts at Bridgewater Associates emphasize that portfolio construction should account for a 20% probability of a significant negative economic shock, suggesting diversification beyond U.S. mega-cap growth stocks is prudent.

The key takeaway for market participants is the necessity of stress-testing the 8.5% assumption. Investors may consider hedging cyclical positions with exposure to sectors that perform well during downturns, such as certain segments of Healthcare and Utilities, to protect against potential earnings disappointment in Q4 2025. The current market environment demands agility and a clear understanding of sector-specific sensitivities to macroeconomic variables.

| Key Sector Forecast | Q4 2025 Earnings Outlook and Implication |

|---|---|

| Information Technology (IT) | Projected growth of 15-18%, significantly exceeding the 8.5% index average, driven by sustained AI infrastructure spending and high-margin software services. |

| Healthcare | Expected growth of 9.5-12.0%, benefiting from defensive demand, aging demographics, and strong pharmaceutical pipelines, offering stable, above-average returns. |

| Energy | Growth stabilizing at 5.0-7.0%. Performance is moderated by disciplined capital expenditure and sensitivity to settling commodity prices, focusing on shareholder returns. |

| Financials | Growth expected near 6.0-8.0%, contingent on the yield curve steepness; robust investment banking activity is helping to offset potential Net Interest Margin (NIM) pressure. |

Frequently Asked Questions about S&P 500 Earnings Growth in Q4 2025

The growth is primarily driven by the Information Technology sector’s massive capital expenditure cycle related to AI and cloud computing, coupled with margin stabilization across cyclical sectors due to easing input costs. Macroeconomic stability further underpins this forecast.

Sectors like Technology, with high future growth assumptions, are more sensitive to interest rates, as higher rates reduce the present value of future cash flows. Healthcare, being more defensive, is relatively insulated from moderate rate fluctuations.

The 8.5% forecast suggests a preference for ‘growth cyclicals’ like Technology and select Industrials, which benefit from expansion. However, a balanced approach including defensive giants in Healthcare provides necessary portfolio resilience against unexpected economic shocks.

Key metrics include corporate capital expenditure figures, particularly in technology; semiconductor average selling prices (ASPs); and Net Interest Margins (NIMs) for large financial institutions. These are leading indicators of sector profitability.

The most significant risk is a policy error by the Federal Reserve, leading to persistent high inflation or an unexpected recession. Geopolitical instability causing energy price spikes is another major factor that could rapidly compress corporate margins and reduce growth.

The Bottom Line

The projected 8.5% earnings growth for the S&P 500 in Q4 2025 is an aggregate figure underpinned by strong, secular trends in the Information Technology and Healthcare sectors. Technology, fueled by the relentless demand for AI infrastructure and high-margin software, is set to be the primary outperformer, potentially delivering double-digit growth. Healthcare provides the necessary ballast, offering reliable, non-discretionary growth driven by demographics and innovation, making it a critical component for risk-adjusted returns.

For market participants, the focus must shift from broad index investing to granular, sector-specific analysis. While cyclical sectors like Industrials and Materials are poised for a strong rebound, their performance remains contingent on global economic stability and continued capital expenditure. The risk environment, defined by the path of interest rates and geopolitical events, necessitates careful monitoring. Investors should track corporate guidance on pricing power and R&D investment—the ultimate determinants of which companies will successfully translate revenue into superior earnings growth and lead the market into 2026, ensuring that the 8.5% forecast is not just met, but potentially exceeded by the highest-quality firms.