Bitcoin Drop Below $86k: Crypto Volatility and Portfolio Risk Management

The sudden 6% correction in Bitcoin, momentarily breaching the $86,000 support level, serves as a sharp reminder of crypto market sensitivity and the critical need for sophisticated risk management frameworks within any diversified asset portfolio.

The recent market action saw Bitcoin (BTC) dip sharply, registering a 6% decline in a 24-hour period before stabilizing slightly above the $85,000 psychological mark. This move, which pushed the cryptocurrency below the critical $86,000 level, immediately intensified focus on the pervasive issue of crypto volatility portfolio risk. For investors who entered the market during the previous bull cycle, this sudden downturn underscores the necessity of robust strategies designed to mitigate rapid capital depreciation inherent in digital assets.

Understanding the Drivers Behind the Bitcoin Correction

To accurately assess the implications of the 6% drop, it is essential to analyze the contemporaneous macroeconomic and structural factors driving the selling pressure. Unlike traditional assets, which often react to earnings reports or Federal Reserve policy shifts, Bitcoin’s price movements are frequently influenced by a complex interplay of on-chain metrics, regulatory speculation, and broader liquidity trends.

Initial analysis suggests the downturn was exacerbated by significant outflows from spot Bitcoin Exchange-Traded Funds (ETFs) in the U.S., coupled with large-scale liquidations of leveraged long positions. Data compiled by Glassnode indicates that over $450 million in long positions were liquidated globally following the sharp price correction. This cascade effect amplified the initial selling pressure, a common characteristic of highly leveraged markets.

The Impact of ETF Flows and Institutional Sentiment

The introduction of spot Bitcoin ETFs in early 2024 significantly altered market dynamics, providing traditional finance access to the asset. However, this accessibility also ties BTC more closely to institutional sentiment. When net outflows occur—as seen in the days leading up to the dip—it signals a cooling of institutional demand and can trigger broader market pessimism.

- Net Outflows: According to Bloomberg data, the three largest U.S. Bitcoin ETFs collectively registered over $150 million in outflows during the peak selling period, reversing a multi-week trend of consistent inflows.

- Rate Environment Sensitivity: Analysts at JPMorgan Chase note that the delay in expected Federal Reserve rate cuts has increased the opportunity cost of holding non-yielding assets like Bitcoin, contributing to the rotation out of riskier assets.

- Regulatory Uncertainty: Ongoing global regulatory reviews, particularly regarding stablecoins and decentralized finance (DeFi) protocols, introduce systemic uncertainty that frequently translates into price weakness across the crypto ecosystem.

The immediate consequence of the correction is a recalibration of short-term expectations. While the long-term bullish narrative often remains intact among proponents, the speed and magnitude of the decline force a pragmatic reassessment of short-term support levels and risk tolerance thresholds for investors holding significant digital asset exposure.

Quantifying Crypto Volatility: A Necessary Metric for Risk Assessment

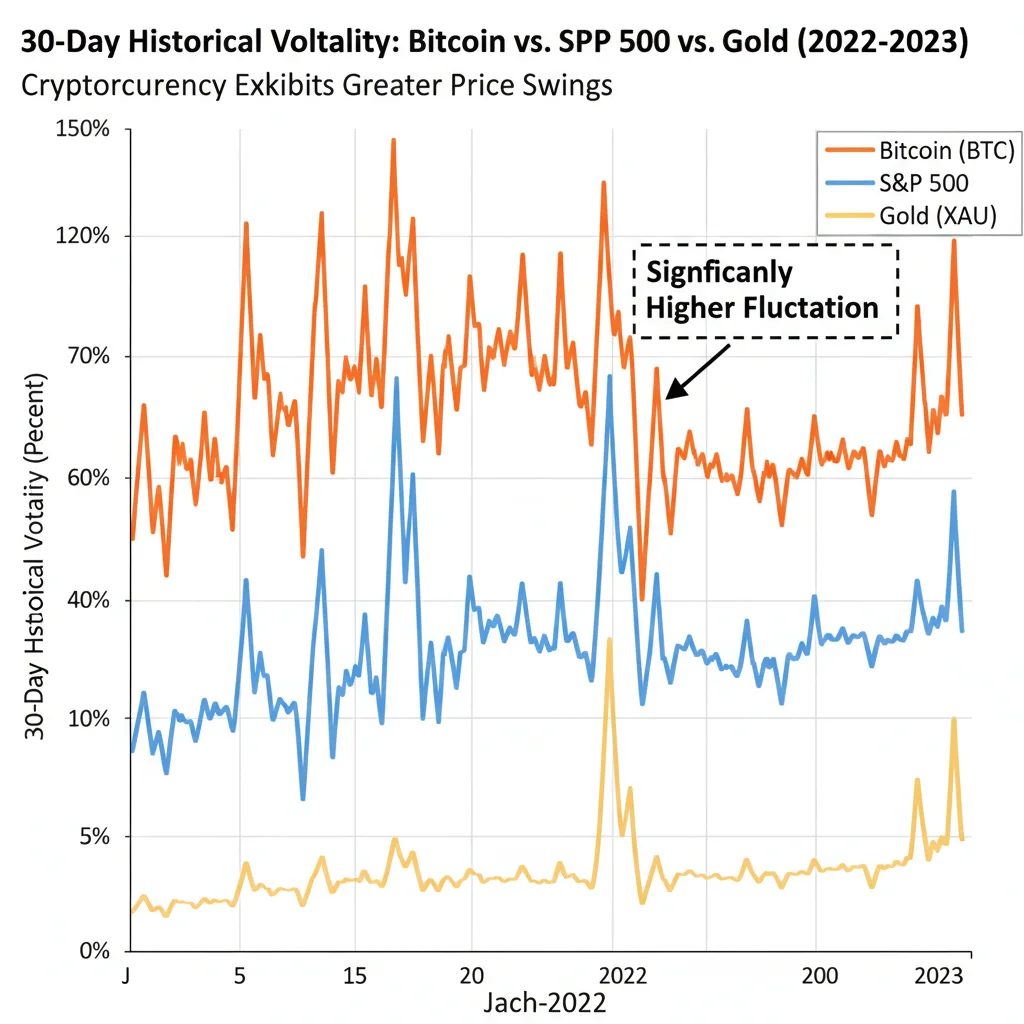

Volatility is not merely a descriptive term in finance; it is a quantifiable risk metric. For Bitcoin and other major cryptocurrencies, historical volatility metrics consistently dwarf those of traditional asset classes, making precise quantification crucial for effective portfolio management. The 6% drop is a microcosm of this high-risk environment.

Historically, Bitcoin’s 30-day annualized volatility has frequently exceeded 70%, compared to the S&P 500’s typical range of 15% to 25%. This disparity highlights the fundamental challenge in integrating digital assets into standard investment portfolios. The recent move below $86,000 demonstrates that high volatility is not an exception but a structural feature of the crypto market, driven by lower liquidity relative to global equity markets and the concentrated ownership structure.

Implementing Volatility-Adjusted Position Sizing

One of the primary techniques for managing high volatility is through dynamic position sizing, often referred to as volatility targeting. Instead of allocating a fixed dollar amount, investors allocate based on the risk contribution of the asset to the overall portfolio. If Bitcoin’s volatility spikes, its proportional weighting is reduced to maintain a consistent portfolio risk level.

For example, a traditional risk parity model might dictate that a 5% allocation in Bitcoin carries the same portfolio risk as a 30% allocation in investment-grade bonds. When volatility increases 20%, the effective position size must be reduced proportionally to neutralize the heightened risk exposure. Institutional managers, such as those at Bridgewater Associates, emphasize that risk management must focus on the volatility-adjusted capital at risk (VaR) rather than simple market capitalization.

The market’s reaction to the $86,000 breach confirms that technical support levels are primarily psychological anchors in high-volatility environments. True risk management relies on quantitative measures of expected drawdown and correlation, not solely on chart patterns. This approach advocates for using options and futures markets to hedge tail risk, rather than relying exclusively on spot market stop-loss orders which can be prone to slippage during rapid declines.

Strategic Portfolio Diversification Against Systemic Crypto Risk

The core principle of portfolio risk management remains diversification, especially when dealing with high-beta assets like Bitcoin. The goal is not merely to hold different assets but to hold assets with low correlation to the primary risk factor. In the context of the recent drop, effective diversification strategies must address two levels of risk: crypto-specific risk and systemic market risk.

While the broader crypto market—including Ethereum (ETH) and Solana (SOL)—often moves in tandem with Bitcoin, certain asset classes demonstrate historical decorrelation. Gold, often viewed as a hedge against inflation and monetary instability, has shown intermittent low correlation with BTC, although this relationship is not guaranteed. Furthermore, high-quality fixed income securities and certain alternative investments can serve as ballast during sharp cryptocurrency corrections.

The Role of Low-Correlation Assets

When Bitcoin suffers a 6% single-day drop, the impact on a well-diversified portfolio should be minimal. If an investor allocates 3% of their portfolio to BTC, a 6% drop results in only an 18 basis point decline in the total portfolio value (0.03 * 0.06 = 0.0018). This mathematical reality is the foundation of prudent allocation.

- Traditional Hedges: U.S. Treasury Inflation-Protected Securities (TIPS) and high-grade corporate bonds often exhibit negative correlation during risk-off events, providing essential stability.

- Alternative Digital Assets: While most altcoins are highly correlated, investments in specific decentralized autonomous organizations (DAOs) or utility tokens with predictable cash flows (where applicable) might offer minimal diversification benefits, though this requires specialized due diligence.

- Managed Futures and Trend Following: Commodity Trading Advisors (CTAs) utilizing managed futures strategies have historically demonstrated low correlation with both equity and digital asset markets, acting as a potential dampener during periods of extreme volatility.

A key finding from a recent analysis by institutional asset manager Fidelity suggests that for a standard 60/40 equity/bond portfolio, an optimal allocation to Bitcoin for maximizing the Sharpe ratio (risk-adjusted return) often sits between 1% and 5%. Exceeding this range significantly increases the portfolio’s overall volatility without commensurately increasing expected returns, making it a crucial consideration following market events like the move below $86,000.

The Mechanics of Drawdown Management and Stop-Loss Strategies

Managing drawdowns—the peak-to-trough decline during a specific period—is paramount in volatile environments. The recent 6% drop is a small drawdown, but it serves as a stress test for pre-defined risk protocols. Effective drawdown management requires both technical discipline and an understanding of market microstructure.

Many retail investors rely on fixed stop-loss orders (e.g., selling if the price hits $85,000). While simple, this approach is often flawed in high-volatility, low-liquidity environments where rapid price movements can cause significant slippage, meaning the execution price is far worse than the specified stop price. Sophisticated investors employ dynamic or trailing stop strategies, often combined with volatility filters.

Advanced Risk Metrics: Conditional Value-at-Risk (CVaR)

Beyond the standard Value-at-Risk (VaR), which estimates the maximum loss expected over a period at a given confidence level (e.g., 95%), advanced strategies utilize Conditional Value-at-Risk (CVaR). CVaR measures the expected loss, assuming the VaR threshold has already been breached. For crypto assets, where tail events (extreme, low-probability losses) are more frequent, CVaR provides a more realistic assessment of potential capital destruction than VaR.

The drop below $86,000 should prompt investors to recalculate their CVaR metrics, especially if they are employing leverage. Leverage dramatically increases the convexity of losses, meaning a small percentage move against the position can lead to disproportionately large losses or margin calls. Prudent management dictates maintaining substantial collateral buffers, often exceeding 50% of the leveraged position value, to withstand sudden 6-10% market moves.

Furthermore, professional traders often employ time-based exit strategies rather than solely price-based ones. If a position fails to move in the expected direction within a pre-defined time horizon, the trade is closed, regardless of the current P&L. This approach minimizes the risk of capital being tied up in underperforming assets during periods of market uncertainty, providing liquidity for potential re-entry at more favorable levels.

Liquidity Provision and Market Microstructure in Crypto

The speed and severity of the recent 6% correction are intrinsically linked to the market microstructure of cryptocurrency exchanges. Unlike centralized equity markets governed by robust regulatory frameworks (like Regulation NMS in the U.S.), the crypto landscape is fragmented, and liquidity can evaporate rapidly during stress events.

Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. When large sell orders hit the market, as occurred during the move below $86,000, the available depth of the order book diminishes quickly, leading to wider bid-ask spreads and accelerated price discovery to the downside. This phenomenon, known as ‘market discontinuity,’ contributes heavily to the high crypto volatility portfolio risk.

Evaluating Exchange Risk and Counterparty Exposure

The choice of exchange and counterparty management are critical components of risk mitigation. The collapse of major centralized exchanges in prior years highlighted the importance of minimizing funds held on exchange platforms, a practice known as ‘cold storage’ or self-custody.

- Order Book Depth: Before executing large trades, institutional participants analyze the order book depth across multiple major exchanges (e.g., Coinbase, Binance, Kraken) to ensure sufficient liquidity exists to absorb the trade without triggering excessive price impact.

- Counterparty Risk: Due diligence on decentralized finance (DeFi) protocols is essential. Smart contract audits and collateralization ratios must be rigorously reviewed, as protocol failures or exploits represent a non-market risk unique to the digital asset space.

- Transaction Cost Analysis (TCA): The true cost of trading crypto includes not just the commission but also the market impact caused by the trade. TCA helps investors quantify this implicit cost, which can surge during volatile periods like the recent drop below $86,000.

The fragmentation of liquidity means that a seemingly small market event can have outsized price consequences. Investors must treat market execution with extreme caution, utilizing limit orders over market orders, especially when volatility indicators signal heightened risk, ensuring they control the price at which they transact rather than relying on rapid execution at any price.

Psychological Biases and Behavioral Finance in Crypto Investing

The high-stakes, 24/7 nature of cryptocurrency trading amplifies psychological biases, often leading investors to make suboptimal decisions during periods of stress, such as when Bitcoin drops 6% in a day. Behavioral finance provides a framework for understanding and mitigating these risks, which are often overlooked in purely quantitative models.

Two cognitive biases are particularly relevant during sharp downturns: loss aversion and herd behavior. Loss aversion—the tendency to feel the pain of a loss more strongly than the pleasure of an equivalent gain—often causes investors to panic sell at the bottom or hold onto losing positions too long, hoping for a recovery. Herd behavior, driven by social proof and fear of missing out (FOMO), pushes investors to follow the prevailing market trend, whether buying at the peak or selling during a crash.

Mitigating Emotional Decision-Making

Elite financial management mandates the separation of emotion from execution. The best defense against behavioral biases is the establishment and strict adherence to a pre-defined investment policy statement (IPS).

The IPS should clearly define:

- Maximum Allowable Drawdown: The absolute largest percentage loss the portfolio can sustain before mandatory de-risking occurs.

- Rebalancing Triggers: Specific thresholds (e.g., if BTC exceeds 8% of the portfolio, sell the excess) that dictate when assets must be sold or bought back to maintain target allocations, forcing a ‘buy low, sell high’ discipline.

- Liquidity Buffer Requirements: The minimum amount of stable cash or cash equivalents that must be maintained to cover potential margin calls or take advantage of sudden dips without being forced to liquidate other assets.

During the recent move below $86,000, investors who adhered to an objective IPS were better positioned to either execute pre-planned hedges or remain passive, avoiding the emotional impulse to sell into the sharp decline. Financial discipline, supported by quantitative rules, is arguably the most effective tool against the emotional toll of high crypto volatility portfolio risk.

Forward-Looking Risk Management: Regulation and Macro Factors

Looking ahead, effective risk management must incorporate anticipation of future regulatory changes and evolving macroeconomic conditions. The crypto market is maturing, and its correlation with traditional finance is increasing, meaning external factors like interest rate policy and global liquidity are becoming more dominant drivers of price action than in previous cycles.

The U.S. regulatory environment, particularly regarding stablecoins and institutional custody standards, remains a significant forward risk. Clearer regulations could reduce uncertainty, potentially lowering the inherent risk premium (and thus volatility) associated with Bitcoin. Conversely, overly restrictive policies could trigger substantial institutional outflows and renewed selling pressure.

Macroeconomically, the Federal Reserve’s path remains paramount. Should inflation prove stickier than anticipated, forcing the Fed to maintain higher interest rates for longer, the appetite for high-risk, non-yielding assets like Bitcoin will likely diminish further. Conversely, a clear pivot toward monetary easing could reignite speculative fervor and drive prices higher, emphasizing the need for flexible, macro-sensitive risk controls.

The 6% drop below $86,000 is a reminder that the digital asset market is still fundamentally driven by cycles of fear and greed, but these cycles are increasingly influenced by the gravity of global finance. Portfolio managers must now model Bitcoin not just as an independent risk asset but as a high-beta proxy for global liquidity conditions, demanding a more comprehensive and integrated approach to risk management than ever before.

| Key Metric/Factor | Market Implication/Analysis |

|---|---|

| 6% Price Correction below $86,000 | Confirms high short-term crypto volatility portfolio risk; necessitates review of VaR and stop-loss protocols. |

| Annualized Volatility (>70%) | Requires volatility-adjusted position sizing (risk-parity models) to limit overall portfolio risk contribution. |

| ETF Net Outflows ($150M+) | Indicates cooling institutional demand; increased correlation with traditional finance sentiment and liquidity. |

| High Leverage Liquidations ($450M+) | Contributes to market discontinuity; highlights the danger of excessive leverage without substantial collateral buffers. |

Frequently Asked Questions about Crypto Volatility and Risk

The drop reinforces the need to maintain a modest, risk-adjusted allocation, typically between 1% and 5% of the total portfolio, depending on your risk tolerance. Use the volatility spike to rebalance back to your target allocation, selling high-performing assets to buy low-performing ones, adhering strictly to your investment policy statement.

The most effective strategy involves utilizing derivatives, such as selling Bitcoin futures or purchasing put options, to hedge spot market exposure. Alternatively, holding assets historically uncorrelated with crypto, such as short-term U.S. Treasury bonds or gold, provides a natural portfolio buffer during sharp downturns.

Yes, as institutional adoption grows, the correlation increases, reducing diversification benefits during systemic risk events. Investors must now look beyond simple equity correlation and focus on assets that perform well during liquidity crises or monetary policy shifts, such as certain commodities or managed futures funds.

Beyond price levels, monitor funding rates (for signs of excessive leverage), exchange net flows (to track institutional buying/selling pressure), and the 30-day historical volatility index. An increase in volatility suggests caution, while sustained positive net exchange flows often signal accumulation and potential stabilization.

Market fragmentation and rapid evaporation of order book depth on exchanges mean that large sell orders quickly push prices down, leading to accelerated declines. This low liquidity during stress events exacerbates volatility, making careful use of limit orders and multi-exchange liquidity analysis essential for institutional execution.

The Bottom Line

The recent dip in Bitcoin below the $86,000 mark emphatically reinforces that crypto volatility portfolio risk is a persistent, structural feature of the digital asset landscape, not a temporary anomaly. For sophisticated investors, this event should not be viewed as a crisis, but as a critical data point for stress-testing existing risk frameworks. Effective management requires moving beyond simple stop-loss orders and embracing quantitative techniques such as volatility-adjusted sizing, CVaR modeling, and rigorous adherence to a pre-defined investment policy. As the crypto market matures and integrates further with traditional finance, its sensitivity to macroeconomic factors—particularly Federal Reserve policy—will only increase. Monitoring institutional ETF flows and global liquidity conditions will be paramount for navigating future volatility, ensuring that digital asset exposure contributes positively to risk-adjusted returns rather than becoming a disproportionate source of portfolio drawdown.