Remote Work Still Reshaping Housing: Tech Migration Trends

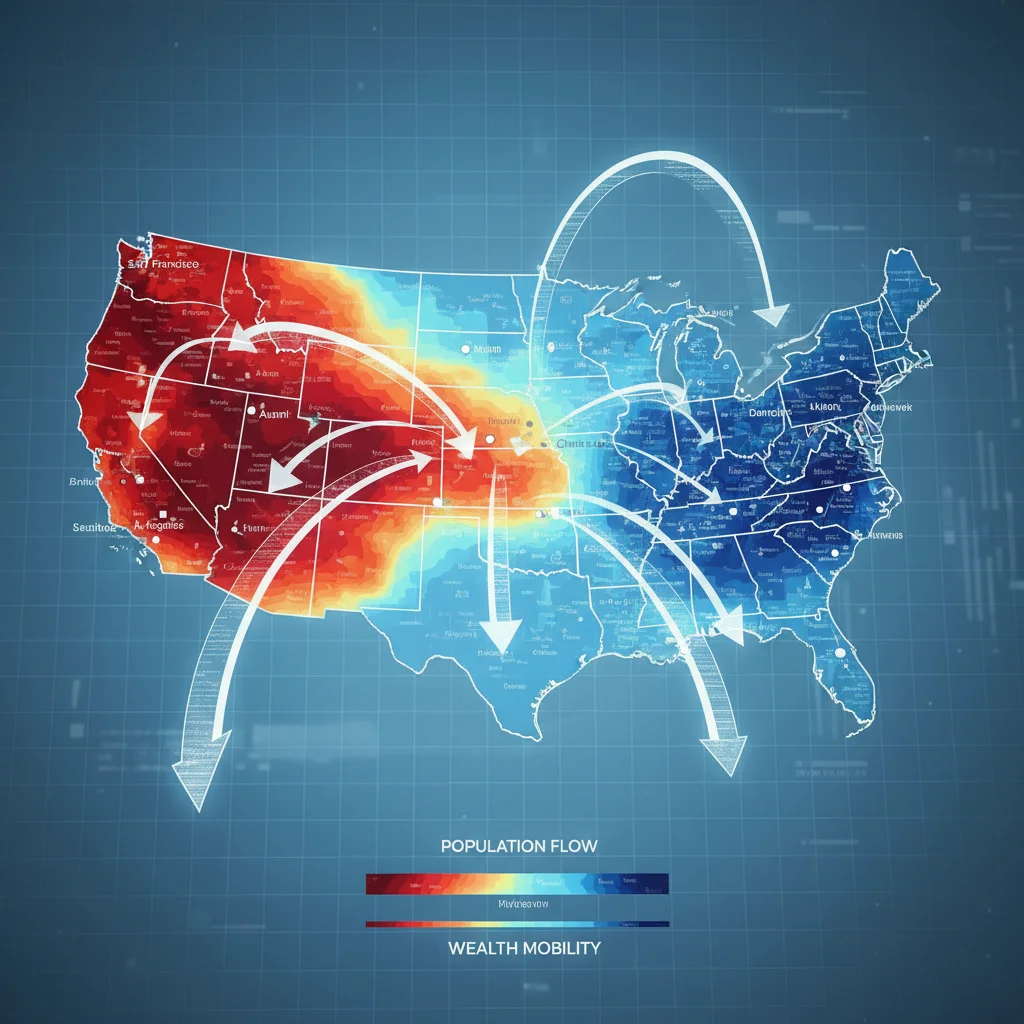

The sustained ability of high-earning tech professionals to work autonomously is driving a permanent geographical reallocation of wealth, intensifying demand and increasing median home values by double-digits in emerging secondary markets across the US Sun Belt and Mountain West.

The economic shockwave initiated by the rapid adoption of remote work during the pandemic has evolved from a temporary anomaly into a fundamental, structural shift in U.S. economic geography. The phenomenon of Remote Work Housing Reshaping continues to exert significant pressure on residential real estate, particularly as high-salaried technology workers leverage newfound mobility to seek lower costs of living and improved quality of life outside traditional coastal hubs. This ongoing migration represents not just a lifestyle choice but a material reallocation of consumer purchasing power that is reshaping local economies and creating new investment frontiers, demanding close scrutiny from investors and policymakers.

The Great Geographic Reallocation of Tech Wealth

The concentration of high-paying jobs, particularly in the technology sector, historically anchored housing demand and price appreciation in a handful of expensive coastal metropolitan statistical areas (MSAs), such as San Francisco, San Jose, and Seattle. However, the widespread acceptance of permanent remote or hybrid work models has effectively decoupled labor location from company headquarters for a significant portion of the workforce. This decoupling has initiated a profound geographic reallocation of wealth, as workers earning six-figure salaries in Silicon Valley or Manhattan transplant their purchasing power to previously more affordable markets.

Data from the U.S. Census Bureau and analysis by the Federal Reserve Bank of Dallas confirm this trend. Between 2020 and 2023, primary tech hubs experienced net outflows of high-income earners, while emerging metros in the Sun Belt—notably Austin, Texas; Miami, Florida; and Raleigh, North Carolina—saw substantial net inflows. The average income of movers into these Sun Belt metros frequently exceeded the established average income of the resident population, exerting immediate inflationary pressure on local housing and service economies. This is quantified by the fact that the median household income of those relocating to Boise, Idaho, for example, was reported to be 20% higher than the local median income in 2022, according to proprietary relocation data.

Identifying Emerging High-Growth Housing Markets

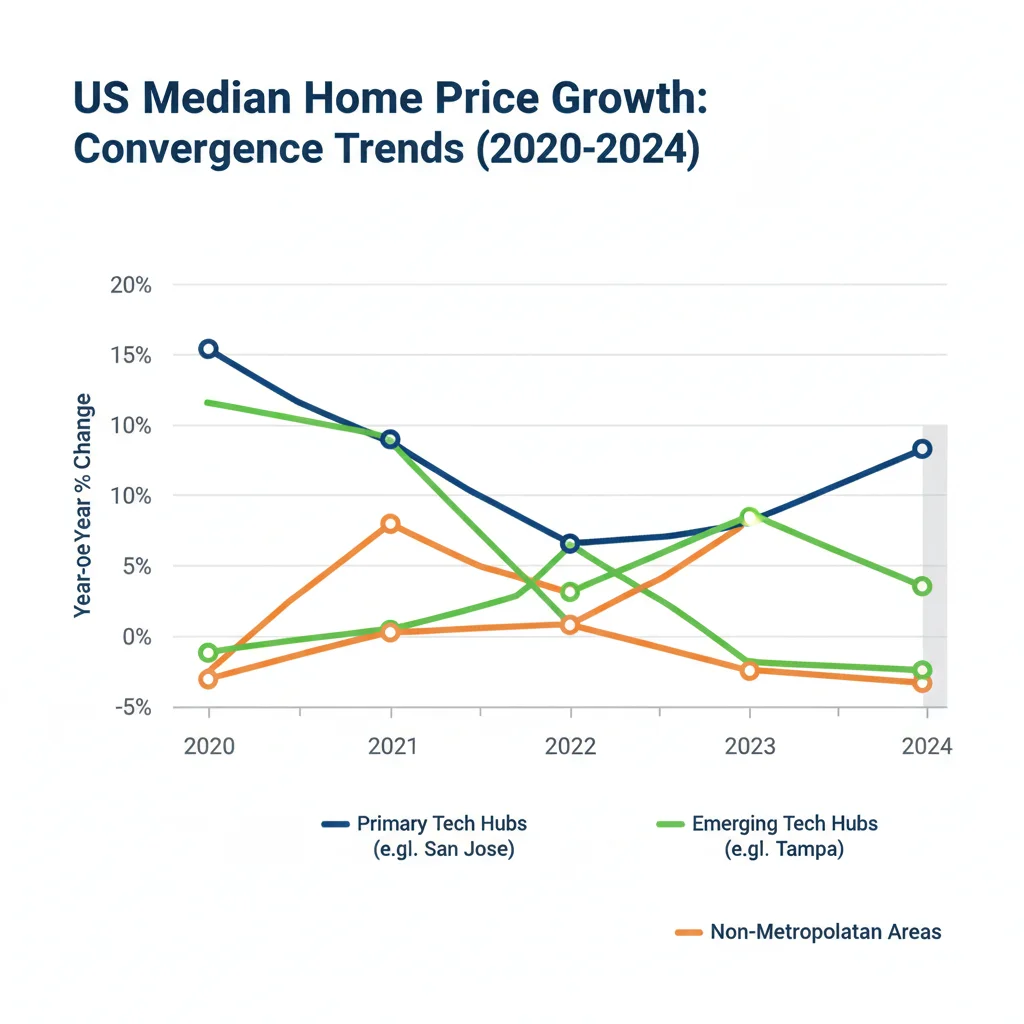

The destinations of migrating tech talent share several characteristics: lower state income taxes (or none at all), relative housing affordability compared to coastal origins, and robust infrastructure for connectivity. Analyzing housing price performance reveals the impact:

- Austin, Texas: Median home prices surged over 40% between Q1 2020 and Q4 2022, fueled almost entirely by external demand, before moderating with rising interest rates.

- Raleigh-Durham, North Carolina (The Triangle): This area benefits from established university systems and a growing biotech cluster, seeing sustained single-family housing appreciation, with permits up 15% year-over-year in 2023, according to the National Association of Home Builders (NAHB).

- Boise, Idaho: Experienced some of the nation’s steepest price increases during the peak migration period, shifting its housing market dynamics permanently toward a higher cost basis.

The long-term implication is the convergence of housing costs. While these emerging markets remain cheaper than San Francisco, the rapid appreciation means the arbitrage opportunity that initially drove migration is shrinking. This suggests that the second wave of remote migration may target even smaller, tertiary cities or exurban areas within the established growth corridors.

The Economic Fallout in Traditional Tech Hubs

While the focus is often on the booming destinations, the impact of outflow on the traditional tech hubs—San Francisco, San Jose, and increasingly, parts of New York and Boston—is equally critical for economic analysis. These cities face a dual challenge: declining residential occupancy/demand in certain segments, particularly rental markets near downtown cores, coupled with persistent high commercial real estate vacancies.

The residential market response has been nuanced. In San Francisco, for instance, rental prices dropped dramatically in 2020 and 2021 as young professionals left, with some segments recording declines exceeding 20%, per Zillow data. However, for-sale home prices, while temporarily softening, have shown remarkable resilience, largely due to supply constraints and the concentration of high net worth individuals who remain. The cost of owning the median home in the San Jose MSA remains among the highest in the nation, supported by the highest-tier earners who must remain for hybrid roles or preference.

Shifting Investment Thesis for Coastal Real Estate

For institutional investors, the thesis for coastal real estate has shifted from guaranteed rapid appreciation to a focus on ultra-luxury and specific, highly desirable neighborhoods that cater to the remaining top-tier executives. The office market, however, remains severely impaired. Commercial real estate vacancy rates in downtown San Francisco exceeded 30% in late 2023, according to CBRE, leading to significant write-downs and defaults among owners of older Class B and C office buildings. This commercial distress imposes fiscal strains on city budgets reliant on property taxes.

The analysis from Moody’s Analytics suggests that the value compression in commercial properties in these primary tech hubs could persist for years, acting as a drag on local economic recovery. Investors are now scrutinizing the potential for office-to-residential conversions, a complex and capital-intensive process that could eventually stabilize downtown cores but requires substantial public-sector support and zoning reform.

Macroeconomic Implications: Inflation and Supply Constraints

The movement of tech workers, characterized by high disposable income, is a potent inflationary force in the receiving markets. When a high-earning individual moves from a market where their salary is average (e.g., San Francisco) to one where it is exceptional (e.g., Tampa), their relative purchasing power increases, driving up local prices not just for housing, but for services, dining, and other consumer goods.

The primary macroeconomic concern stemming from Remote Work Housing Reshaping is the exacerbation of housing supply shortages across the country. Developers, constrained by labor costs, materials inflation, and high interest rates imposed by the Federal Reserve, have struggled to keep pace with the localized demand spikes. This mismatch is clearly visible in inventory data. In many Sun Belt markets, the months’ supply of housing has remained historically low, even as construction activity increases.

The Role of Interest Rates and Mortgage Demand

The current high-interest-rate environment, a result of the Fed’s fight against inflation, has complicated the migration narrative. While higher rates have cooled overall transaction volumes nationwide, they have not fundamentally reversed the incentive for migration. For a tech worker selling a $1.8 million home in California and buying an $800,000 home in Arizona, the mortgage payment, even at a higher rate, often results in significant monthly savings and equity release, providing a powerful financial incentive that supersedes rate sensitivity for this specific demographic.

- Mortgage Affordability Index: Measures of affordability remain stretched nationally, but the relative advantage of moving is still compelling for those relocating from the highest-cost areas.

- Cash Buyers: A higher percentage of transactions in emerging tech markets are being conducted with cash or large down payments, reflecting the significant equity extracted from sales in the outgoing markets.

- Velocity of Price Growth: While the pace of appreciation has slowed from the 2021 peak, core price levels in migration destinations like Jacksonville, Florida, are holding firm, indicating structural rather than cyclical demand.

This dynamic creates a two-tiered housing market: one where high-net-worth mobile workers are relatively insulated from rate hikes, and another where local first-time buyers are increasingly marginalized by the resultant price inflation.

Infrastructure and Urban Planning Challenges in Receiving Cities

The rapid influx of high-income residents poses significant infrastructure and urban planning challenges for receiving cities. While the boost to the tax base is beneficial, delayed infrastructure development can negate the quality-of-life improvements sought by movers. Cities like Austin and Denver are grappling with increased traffic congestion, strained public utilities, and the urgent need for expanded public transportation systems—issues traditionally associated with the coastal megacities they are trying to avoid.

The long-term success of these emerging markets hinges on their ability to scale public services and infrastructure at the pace of population growth. Failure to do so risks creating a new generation of high-cost, high-congestion urban centers, potentially triggering a third wave of migration to even more remote areas.

Municipal Bond Market Implications

The financial implications extend to the municipal bond market. Cities experiencing rapid growth, such as Nashville, Tennessee, often see improved credit ratings due to expanding tax bases and strong demographic trends, making it cheaper for them to issue debt to finance infrastructure projects. Conversely, coastal cities experiencing stagnation or decline in their commercial property tax base may face increased fiscal scrutiny, potentially affecting their long-term borrowing costs and ability to maintain existing infrastructure.

Analysts at S&P Global Ratings have noted that the divergence in municipal fiscal health based on remote work migration patterns is a key factor in future credit assessments. Investors in municipal bonds must now incorporate geographic migration trends as a core component of their due diligence, moving beyond traditional localized economic indicators to assess regional mobility.

The Future of Hybrid Work and Corporate Mandates

The sustainability of the Remote Work Housing Reshaping trend depends critically on the long-term work policies adopted by major tech employers. While some companies, like Meta and Salesforce, have embraced flexible models, others, including Amazon and Google, have instituted stricter return-to-office (RTO) mandates, often requiring employees to be physically present three days a week.

These RTO mandates do not necessarily reverse migration but modify it. Workers who moved hundreds of miles away are now faced with difficult choices: relocate back closer to the office, find a new fully remote job, or endure long-distance commuting. This has created a demand for housing in ‘donut’ rings—exurban areas surrounding the traditional hubs that offer a compromise between affordability and proximity for a two- or three-day commute.

Impact on Rental Markets and Multifamily Investments

The hybrid model has a distinct impact on rental markets. Demand for larger, high-quality rental units in suburban areas has surged, reflecting the need for dedicated home office space, a trend confirmed by Q3 2023 data from Fannie Mae. Conversely, demand for small, expensive studio apartments in dense downtown areas remains suppressed compared to pre-2020 levels, particularly in cities focused on finance and technology.

Multifamily investors are adjusting their portfolios accordingly, prioritizing properties in high-growth Sun Belt metros and focusing on unit mix and amenities that support remote work, such as high-speed internet infrastructure and co-working spaces within the complex. The yield compression observed in premier coastal multifamily assets is leading capital toward secondary markets where demographic tailwinds are stronger and cap rates remain more attractive, albeit with increased competition.

Investment Strategies in the New Housing Geography

For sophisticated real estate investors, the migratory patterns driven by remote work require a re-evaluation of traditional geographic diversification. The risk profile of emerging markets is changing; what was once considered a high-risk, high-reward secondary market is quickly maturing into a core investment location due to sustained demographic and economic growth.

A key strategy involves identifying the ‘next tier’ of receiving cities—those adjacent to established remote work magnets but still offering a significant cost discount. Examples include Chattanooga, Tennessee (near Nashville/Atlanta), and Spokane, Washington (near Seattle/Boise). These areas benefit from the ripple effect of the initial migration, often attracting small technology firms and ancillary service providers following the talent pool.

Diversification and Risk Mitigation

Prudent investors are balancing exposure between high-quality, resilient core assets in primary markets (offering stability and defense against market downturns) and growth-oriented acquisitions in the Sun Belt (offering superior appreciation potential). Key risk factors to monitor include:

- Local Policy Risk: Changes in property tax laws or zoning regulations in rapidly growing areas attempting to manage the boom.

- Infrastructure Strain: The capacity of local governments to manage growth without significant service degradation.

- Corporate RTO Reversals: A sudden, widespread reversal of remote work policies could dampen demand in migratory destinations.

- Affordability Crisis: The potential for local wage growth to lag behind housing price appreciation, leading to social and economic instability.

The long-term trajectory suggests that the economic activity generated by high-earning mobile tech workers will solidify the financial standing of these new regional powerhouses, making them durable investment opportunities for the foreseeable future, provided supply can eventually catch up to demand. The migration is not a one-time event; it is a multi-year demographic and economic restructuring that will continue to dictate housing market performance and real estate investment.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| Income Arbitrage Effect | High-earning tech workers retain coastal salaries while spending in lower-cost markets, resulting in accelerated localized inflation and housing price growth in Sun Belt metros. |

| Primary Hub CRE Vacancy | Office vacancy rates above 30% in San Francisco and similar hubs signal long-term commercial real estate value compression and municipal fiscal risk due to reduced property tax revenues. |

| Hybrid Work Model Dominance | RTO mandates drive demand for larger, high-quality multifamily rentals in exurban ‘donut’ rings around primary hubs, shifting investment from dense downtown core properties. |

| Geographic Investment Diversification | Investors are increasingly targeting secondary and tertiary cities adjacent to established growth centers (e.g., Spokane, Chattanooga) to capture ripple effects of continued tech migration. |

Frequently Asked Questions about Remote Work Housing Reshaping

Cities in the Mountain West and Sun Belt, including Austin, Texas; Boise, Idaho; and Tampa, Florida, experienced initial peak appreciation rates sometimes exceeding 30% year-over-year. This was driven by the arbitrage of high remote salaries applied to relatively lower regional housing costs, rapidly closing the affordability gap.

Primary tech hubs like San Francisco face acute challenges, with office vacancy rates surpassing 30% in some districts. This depresses commercial property values, leading to potential loan defaults and reduced property tax revenue, creating fiscal stress for metropolitan governments reliant on these taxes.

Hybrid models increase demand for larger, amenity-rich multifamily units and single-family rentals in suburban and exurban areas surrounding major employment centers. Investors are focusing on properties offering high-speed connectivity and dedicated remote workspace amenities, shifting capital away from dense urban core apartments.

No, the high-interest-rate environment slows overall transaction volume but does not stop the migration. Tech workers often sell expensive coastal properties, realizing significant equity that insulates them from higher borrowing costs, making the move financially beneficial despite elevated mortgage rates compared to local buyers.

The primary risk is the failure of local infrastructure and public services to keep pace with rapid population and wealth growth. If traffic and quality of life deteriorate, the cities lose their core appeal, potentially triggering a reversal or stagnation in demand, despite favorable tax structures.

The Bottom Line

The structural changes driven by Remote Work Housing Reshaping are far from complete. What began as a pandemic-induced flight has solidified into a permanent feature of U.S. economic geography, characterized by the redistribution of high-value labor and consumer demand. Investors must recognize that the housing market arbitrage that fueled the initial surge is diminishing as prices in receiving metros converge upwards. This convergence mandates a shift in investment strategy from simply chasing initial growth to analyzing the long-term sustainability of these new economies, specifically focusing on local government capacity to manage infrastructure, control localized inflation, and maintain an attractive regulatory environment. The enduring mobility of tech talent ensures that geographic location risk remains a central consideration in both residential and commercial real estate valuation for the foreseeable future, requiring continuous monitoring of corporate RTO mandates and local economic indicators.