10-Year Treasury at 4.02%: Fixed Income Strategy for December

The stabilization of the 10-year Treasury at 4.02% signals a crucial juncture for fixed income allocations, demanding portfolio managers re-evaluate duration exposure and credit spreads ahead of the Federal Reserve’s December policy meeting and potential 2025 easing cycle.

The yield on the benchmark 10-year US Treasury note holding steady at 4.02% as December approaches has redefined the landscape for fixed income investors, moving from a period of extreme volatility to one requiring calculated strategic planning.

The Significance of 4.02% in the Fixed Income Market

The 4.02% mark on the 10-year Treasury is not merely a number; it represents a critical pivot point following the aggressive rate hikes implemented by the Federal Reserve over the past two years. This yield level provides an attractive entry point for capital seeking safety and income, especially when compared to the sub-1% yields observed just four years ago. However, the current yield also reflects underlying economic uncertainty regarding inflation persistence and the potential timing of the Fed’s eventual pivot toward easing monetary policy.

Market participants are grappling with two primary forces: the structural demand for long-duration assets, particularly from pension funds and international buyers, and the short-term pressure exerted by the Federal Reserve’s restrictive stance. Analysis from Goldman Sachs suggests that maintaining yields above 4.00% is contingent on sustained real GDP growth above 2.0% through the first half of the following year. If growth decelerates, as predicted by the consensus forecast of 1.5% for Q1, the 4.02% level could quickly become a ceiling, driving bond prices higher and yields lower.

Duration Management in a High-Yield Environment

Duration, a measure of a bond’s price sensitivity to interest rate changes, becomes paramount when yields hover around 4.02%. Investors who locked in higher yields earlier in the year face less risk than those entering the market now, although the current yield remains compelling. The consensus view among analysts at JPMorgan Chase is that strategic duration extension is warranted, provided investors maintain a clear exit strategy should economic data force the Fed to hold rates higher for longer than anticipated.

- Increased Volatility: The high sensitivity of long-duration bonds means that every 25-basis-point shift in the Fed Funds Rate can cause significant portfolio fluctuations.

- Convexity Advantage: Bonds with negative convexity offer less price appreciation when rates fall, but positive convexity bonds (often longer-dated Treasuries) provide superior returns if a rate cut cycle begins.

- Strategic Laddering: Implementing a bond ladder strategy allows investors to capture current high yields while maintaining liquidity and reducing overall portfolio duration risk.

The implication of the 4.02% yield is that the opportunity cost of holding cash has increased substantially, forcing institutional investors to reallocate capital into fixed income instruments, thereby creating a floor of demand that supports current prices. This rebalancing dynamic is a key factor sustaining the current yield environment.

December Planning: Navigating the Year-End Liquidity Crunch

December is traditionally marked by reduced market liquidity, often leading to exaggerated price movements. For fixed income managers, planning for year-end requires balancing the desire to capture the 4.02% yield with the risk associated with thinner trading volumes. The final Federal Open Market Committee (FOMC) meeting of the year provides the last major policy catalyst, potentially setting the tone for the first quarter.

The primary focus for December planning should be portfolio immunization against unexpected economic shocks. Data released by the US Bureau of Labor Statistics, showing core Consumer Price Index (CPI) inflation easing to 3.5% year-over-year in October, suggests the Fed may adopt a more neutral tone. However, robust job growth, evidenced by the non-farm payroll report exceeding 200,000 additions in the last reading, complicates the narrative.

Credit Risk Versus Treasury Stability

With the 10-year Treasury yielding 4.02%, the risk-reward calculation for moving down the credit curve is shifting. High-yield corporate bonds, while offering higher coupons, demand careful scrutiny. The spread between investment-grade corporate bonds (rated BBB or higher) and the 10-year Treasury has narrowed, currently averaging around 120 basis points, according to ICE BofA data. This narrowing suggests that the market is pricing in a relatively benign economic outlook, reducing the premium demanded for credit risk.

Conversely, if recessionary fears resurface, the stability and liquidity of US Treasuries become indispensable. Analysts at BlackRock recommend maintaining a core allocation to government bonds, using the 4.02% yield as a baseline. Any incremental yield should be sought selectively in high-quality municipal bonds or short-duration investment-grade corporate debt, avoiding excessive exposure to cyclical sectors that are sensitive to economic contraction.

The Fed’s Dual Mandate and Yield Curve Dynamics

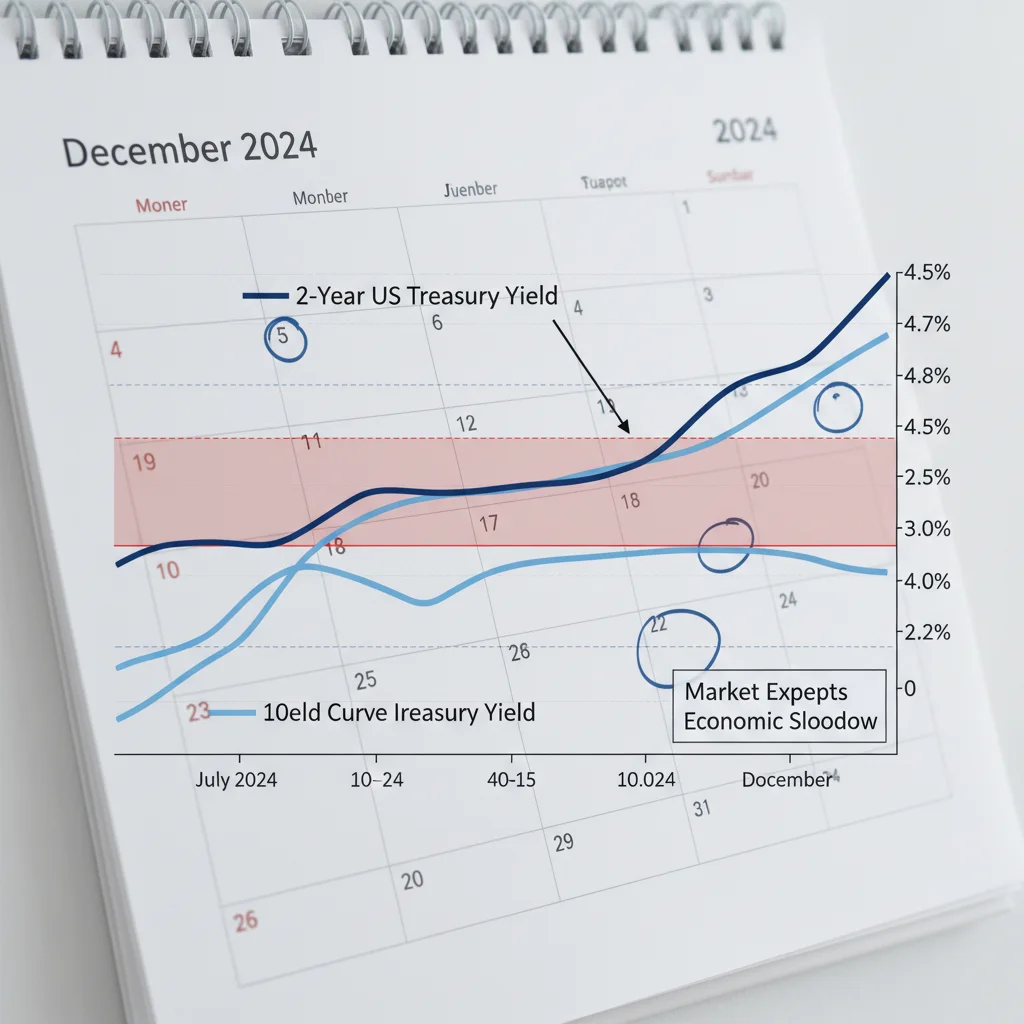

The Federal Reserve’s ongoing commitment to its dual mandate—maximum employment and price stability—directly impacts the 10-year Treasury fixed income outlook. While inflation appears to be moderating, the Fed has continuously emphasized that interest rates must remain restrictive until there is clear evidence that inflation is sustainably moving toward the 2.0% target. This hawkish rhetoric helps anchor the short end of the curve, keeping the 2-year Treasury yield above the 10-year yield, maintaining the inverted yield curve.

The inversion, where shorter-term debt offers higher yields than longer-term debt, has historically been a reliable predictor of economic recession. As of late November, the spread between the 2-year and 10-year Treasury stood at approximately -35 basis points. For fixed income investors, this inversion suggests that the market anticipates future rate cuts (which would lower long-term yields) due to expected economic weakness, even while the Fed is currently holding rates steady.

Implications of the Inverted Curve for Portfolio Construction

The inverted curve structure influences allocation decisions significantly. Investors are compensated more for holding short-term instruments, which inherently carry less duration risk. However, capitalizing on the potential capital appreciation that occurs when the yield curve normalizes (un-inverts) requires holding longer-duration assets, such as the 10-year Treasury at 4.02%.

- Short-Term Focus: Money market funds and ultra-short bond ETFs remain highly attractive due to their high current yield and minimal interest rate risk.

- Long-Term Play: Tactical overweighting of the 10-year or 30-year Treasuries is a bet on economic deceleration and subsequent Fed rate cuts in 2025.

- Breakeven Inflation: The 10-year breakeven inflation rate, currently around 2.3%, suggests the market expects the Fed to succeed in controlling inflation, making nominal Treasury bonds appealing.

Fixed income managers must decide whether the immediate yield benefit of short-term bonds offsets the potential long-term capital gains from extending duration. Given the 4.02% baseline, many strategists advise a barbell approach, balancing short-term liquidity with strategic long-term exposure, minimizing the middle part of the curve which often sees the most volatile repricing.

Municipal Bonds and Tax Efficiency at Current Yields

For high-net-worth investors in the United States, the 4.02% yield on the taxable 10-year Treasury creates a favorable comparison point for municipal bonds (munis). Municipal bonds, which offer tax-exempt income, become particularly compelling when their tax-equivalent yield surpasses the nominal Treasury yield.

If a muni bond yields 3.00% and an investor is in the highest federal tax bracket (37%), the tax-equivalent yield is approximately 4.76% (3.00% / (1 – 0.37)). This comparison clearly demonstrates the superior after-tax return offered by high-quality munis over the 10-year Treasury fixed income yield of 4.02%. The demand for munis typically spikes toward the end of the year as investors seek tax planning advantages.

Assessing Municipal Credit Quality

While the tax advantage is clear, credit quality remains crucial in the municipal market. General obligation bonds from states with strong fiscal positions (e.g., Texas, Florida) are often preferred over revenue bonds tied to specific, potentially volatile projects. According to Moody’s Investors Service data from Q3, state and local government finances remain robust, bolstered by pandemic-era federal aid and strong property tax receipts.

The current environment favors selective investment in A- or AA-rated municipal bonds that offer yields close to 80% of the corresponding Treasury yield. This ratio, known as the muni-to-Treasury ratio, indicates relative value. When the ratio is below 80%, munis are generally considered expensive; above 80%, they offer better value. With the 10-year Treasury at 4.02%, finding high-quality munis yielding 3.2% or more presents a significant opportunity for tax-aware investors.

Corporate Bonds: Seeking Alpha Beyond Government Debt

The decision to allocate capital to corporate bonds versus the 4.02% Treasury yield hinges on the perceived health of the corporate sector and the probability of default. Investment-grade corporate bonds (IG) offer a slight yield pickup, typically 100-150 basis points over the 10-year Treasury, compensating for the additional credit risk. This spread is relatively tight by historical standards, suggesting strong corporate fundamentals.

However, the tightening of corporate spreads means that investors are receiving less compensation for taking on default risk. If the economic slowdown predicted by the inverted yield curve materializes, these spreads could widen rapidly, leading to capital losses in corporate bond portfolios. Therefore, selectivity is key, emphasizing companies with low leverage ratios and strong free cash flow generation.

High-Yield Market Considerations

The high-yield (junk) bond market offers enticing yields, often exceeding 7.5%, but comes with significantly elevated default risk. With the 10-year Treasury fixed income offering a guaranteed 4.02%, the incremental yield demanded from high-yield debt must be carefully justified. Data from Fitch Ratings indicates that the trailing 12-month default rate for high-yield issuers remains low, around 1.5%, but projections suggest a rise to 3.0%-3.5% in the event of a mild recession.

For investors considering high-yield exposure in December, diversification across non-cyclical sectors, such as healthcare and essential services, is prudent. The focus should be on short-to-intermediate duration high-yield funds, minimizing exposure to long-dated debt that combines both significant duration risk and high credit risk. The current environment favors maintaining credit quality over chasing marginal yield, especially when the risk-free rate is already providing 4.02%.

International Fixed Income and Currency Hedging

The competitiveness of the 4.02% US 10-year Treasury yield must be viewed in the context of global fixed income markets. German Bunds and Japanese Government Bonds (JGBs) offer significantly lower yields, making US Treasuries highly attractive to international investors. This sustained global demand acts as a stabilizing force for US yields, preventing a sharp, uncontrolled spike.

However, US-based investors exploring international fixed income must factor in currency risk. Sovereign debt from emerging markets, such as Brazil or Mexico, offers nominal yields well above 7.0%, but the volatility of their local currencies against the US Dollar (USD) can erode these gains quickly. Strategic currency hedging becomes a necessity, often achieved through forward contracts or currency ETFs, to isolate the pure fixed income return.

The Role of Hedging in Portfolio Returns

When comparing a 4.02% USD yield to a 5.5% Euro-denominated bond, the cost of hedging the Euro exposure back to USD must be subtracted from the foreign yield. Current interest rate differentials often make the cost of hedging high, sometimes negating the entire yield differential. Therefore, for most US-centric fixed income portfolios, the domestic 10-year Treasury at 4.02% offers a superior risk-adjusted return profile compared to unhedged or fully hedged international sovereign debt, unless a strong conviction exists regarding foreign currency appreciation.

The sustained strength of the USD, driven by the Federal Reserve’s restrictive policy, reinforces the attractiveness of domestic fixed income assets. Economists at the Bank for International Settlements (BIS) noted that capital flows into US bonds accelerated in Q3, driven by this positive yield differential and perceived safety, cementing the Treasury’s role as the global risk-free benchmark.

Risk Mitigation Strategies for the 4.02% Yield Environment

Successfully navigating the current fixed income environment requires a robust risk mitigation framework focused on scenario analysis. The two primary risks facing bond investors are a rapid deceleration of inflation leading to aggressive rate cuts (favorable for duration) or, conversely, a resurgence of inflation forcing the Fed to hike rates further (unfavorable for duration).

A key strategy is the use of Treasury Inflation-Protected Securities (TIPS). TIPS offer protection against unexpected inflation by adjusting the principal value based on the CPI. While the real yield (nominal yield minus inflation expectations) on TIPS has fluctuated, the current 10-year real yield near 1.75% provides a solid hedge against inflation surprises, complementing the nominal 4.02% exposure.

Implementing Portfolio Stress Tests

Fixed income managers should regularly stress-test their portfolios against specific interest rate scenarios. For example, modeling the impact of a 50-basis-point yield shock (up or down) on the portfolio’s Net Asset Value (NAV) provides quantitative insight into vulnerability. If a portfolio has a modified duration of 6.0, a 50-basis-point increase in yields would result in approximately a 3.0% decline in portfolio value.

- Scenario 1 (Soft Landing): Yields stabilize, Fed holds rates. Strategy: Maintain current duration, selectively add corporate credit.

- Scenario 2 (Hard Landing/Recession): Fed cuts rates aggressively. Strategy: Extend duration beyond the 10-year mark to capture capital gains.

- Scenario 3 (Inflation Resurgence): Fed hikes further. Strategy: Shorten duration, increase allocation to floating-rate notes and TIPS.

The 4.02% yield level offers a rare opportunity to lock in significant income without taking undue credit risk. However, success depends on accurately anticipating the next move by the Federal Reserve and adjusting duration accordingly. December serves as the final window for strategic repositioning before the economic data for the new year begins to dictate policy direction.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| 10-Year Treasury Yield at 4.02% | Establishes an attractive risk-free baseline for fixed income returns, demanding strategic duration decisions. |

| Inverted Yield Curve (2s/10s spread) | Signals market expectation of future economic slowdown and subsequent Fed rate cuts, favoring long-duration capital gains. |

| Tight Corporate Credit Spreads | Reduced compensation for credit risk; mandates high selectivity in corporate bond allocations, favoring AA/A ratings. |

| December FOMC Meeting | Final major policy catalyst of the year; tone on future cuts will directly influence short-term yield volatility. |

Frequently Asked Questions about 10-Year Treasury at 4.02%: Fixed Income Strategy for December Planning

A higher prevailing yield generally depresses the market value of existing bonds with lower coupon rates. If your portfolio’s average yield is below 4.02%, its market price has likely declined, although the income stream remains constant. This emphasizes the importance of managing duration risk actively.

Given the 4.02% risk-free rate, prioritizing credit quality is generally advisable. Extend duration only if you strongly anticipate Federal Reserve rate cuts in the near term. Otherwise, maintain intermediate duration (3-5 years) to balance current income and interest rate sensitivity.

The primary risk is duration risk. If the Fed maintains restrictive rates well into the next year, the 10-year yield could spike higher, potentially moving toward 4.5%. This would lead to capital losses for investors holding long-duration bonds purchased at the 4.02% level.

Yes, especially for high-tax-bracket investors. A high-quality muni bond yielding 3.0% offers a tax-equivalent yield of 4.76% for investors in the 37% federal bracket, significantly surpassing the nominal 4.02% Treasury yield. Focus on highly rated general obligation bonds.

Reduced liquidity in December can amplify price volatility. Spreads for less frequently traded bonds may widen, making execution difficult. Fixed income managers often complete major reallocations before mid-December to avoid adverse pricing conditions near year-end closures.

The Bottom Line

The stabilization of the 10-year Treasury yield near 4.02% provides fixed income investors with a compelling, if complex, entry point. This yield offers substantial income relative to historical norms but sits at a precarious nexus of inflation uncertainty, inverted yield curve warnings, and anticipated Federal Reserve policy shifts. December planning mandates a defensive posture, prioritizing high credit quality and maintaining adequate liquidity, while selectively extending duration to capitalize on potential capital gains should the economic slowdown materialize and force rate cuts in the first half of the coming year. Investors must monitor core inflation data and the Fed’s forward guidance, recognizing that the current yield baseline demands agility and disciplined risk management rather than passive allocation.

The market consensus, while leaning toward a soft landing, acknowledges the high probability of volatility surrounding the 4.02% level. Therefore, a barbell strategy—heavy on short-term high-yield funds and strategic long-term Treasuries—offers the best means of capturing current income while positioning for potential shifts in the interest rate cycle. The era of zero interest rate policy is definitively over, and the 4.02% rate serves as the new benchmark against which all fixed income returns must be measured.

Furthermore, portfolio diversification should extend beyond traditional US debt. While the 4.02% yield is globally competitive, strategic allocation to inflation-protected securities (TIPS) and high-quality municipal debt ensures both real return preservation and tax efficiency, critical components of a robust fixed income strategy entering the new fiscal year. The ultimate success of positioning around the 10-year Treasury fixed income hinge on correctly interpreting the forward path of the Federal Funds Rate, making the December FOMC minutes the single most important document for year-end review.

Final considerations for managers include reviewing counterparty risk, especially in the corporate bond sector, and ensuring that all duration exposure aligns with the fund’s mandate. The current yield environment rewards precision; broad-brush allocations are likely to underperform highly targeted, data-driven strategies that leverage the attractive risk-free rate while mitigating the inherent risks of a late-cycle economy. The 4.02% yield is an invitation to invest, but one that requires caution and expertise.