S&P 500’s 17.19% Gain: REIT Implications and Market Outlook

The S&P 500’s robust 17.19% year-to-date return, driven largely by technology sector strength, presents a challenge for Real Estate Investment Trusts (REITs) by increasing the opportunity cost of capital and intensifying pressure from elevated interest rates.

The S&P 500 Gains 17.19% YTD: What This Means for Real Estate Investment Trusts is a critical question for investors navigating the current market cycle. As of the end of the third quarter, the benchmark S&P 500 index has delivered an impressive 17.19% total return, fueled primarily by momentum in the technology and communication services sectors, often referred to as the ‘Magnificent Seven.’ This robust performance in the broader equity market creates a complex financial environment for Real Estate Investment Trusts (REITs), which typically function as high-yield, lower-volatility alternatives to traditional stocks. The primary implication is a heightened opportunity cost for capital, forcing REITs to compete harder for investor dollars against high-flying growth equities while simultaneously battling the headwinds of a restrictive monetary policy environment established by the Federal Reserve.

The opportunity cost of capital: S&P 500 vs. REIT yields

The 17.19% year-to-date gain in the S&P 500 index has fundamentally shifted the capital allocation calculus for institutional and retail investors. When the broad equity market delivers double-digit returns, the traditional appeal of REITs—which centers on stable income generation and moderate capital appreciation—is diminished. REITs, by their nature, are required to distribute at least 90% of their taxable income to shareholders, resulting in higher dividend yields compared to the average S&P 500 stock. However, capital appreciation often lags during periods of aggressive tech-led growth.

Historically, investors sought REITs for diversification and yield when equity growth was muted or when inflation protection was paramount. According to Nareit data, the average equity REIT dividend yield stood near 4.5% as of Q3, significantly higher than the S&P 500’s approximately 1.5% dividend yield. Yet, the 17.19% capital gain provided by the S&P 500 dwarfs the typical total return profile of many REIT subsectors, creating a significant performance gap that investors must justify. This disparity places downward pressure on REIT valuations, particularly those with slower growth prospects or higher leverage.

Competitive pressure from equity markets

The strong equity market performance means that capital flows naturally gravitate toward high-growth areas. This dynamic affects REITs in two primary ways: valuation compression and increased cost of equity financing. Companies with high growth rates, regardless of sector, tend to command premium valuations. When the S&P 500 is soaring, investors demand greater risk-adjusted returns from REITs to compensate for what is perceived as lower growth potential relative to large-cap technology.

- Valuation Compression: Faster earnings growth in the S&P 500 leads to lower relative Price-to-FFO (Funds From Operations) multiples for many REITs, particularly those in cyclical real estate sectors like retail or office.

- Equity Financing Challenges: When REIT stock prices are depressed, issuing new equity to fund acquisitions or development becomes dilutive, effectively increasing the cost of capital and slowing external growth strategies.

- Investor Sentiment Shift: The focus shifts from ‘income generation’ to ‘total return,’ favoring indices that demonstrate massive capital gains, leading to net outflows from slower-moving, yield-focused funds.

The result is a market where REITs must demonstrate exceptionally strong operational performance and clear pathways to accretive external growth to maintain investor interest against the backdrop of a booming S&P 500. Analysts at Morgan Stanley noted in a recent report that only specialized REITs with structural tailwinds, such as data centers and industrial logistics, are effectively bridging this performance gap.

The persistent shadow of elevated interest rates

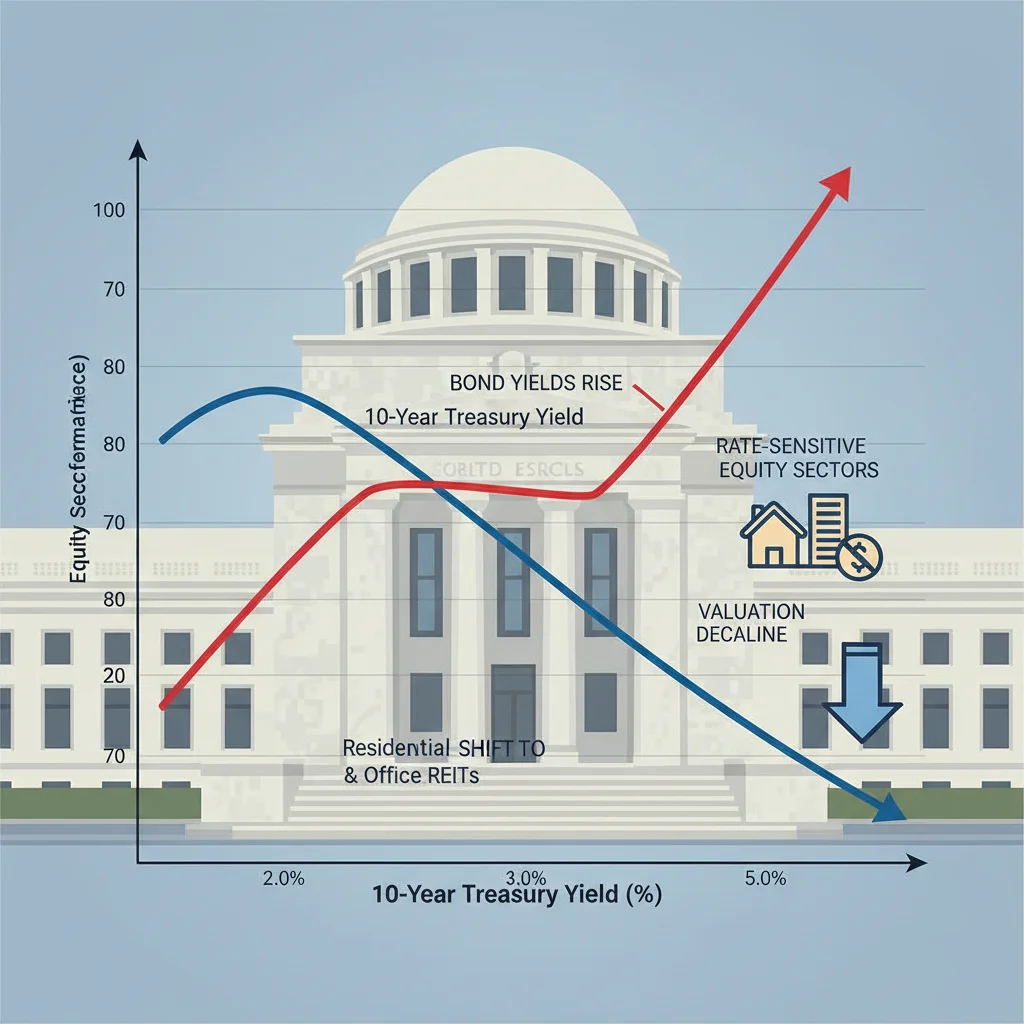

While the S&P 500’s gains reflect corporate profitability and technological innovation, REITs remain fundamentally tied to the interest rate environment established by the Federal Reserve. The correlation between the S&P 500’s performance and interest rates is often complex, but for REITs, the relationship is more direct and typically negative. Elevated short-term rates, currently held near the 5.25% to 5.50% range following multiple hikes, translate directly into higher borrowing costs for real estate companies that rely heavily on debt to finance property acquisitions and development.

This interest rate regime creates a dual headwind. First, higher debt service costs erode FFO margins. Second, rising rates increase the yield offered by competing fixed-income assets, most notably the 10-year Treasury note. When the 10-year Treasury yields exceed 4.5%, the appeal of REIT dividends—which often carry greater operational risk than government bonds—is reduced, leading to a de-rating of REIT stock prices.

Refinancing risk and debt maturity walls

Many REITs face what analysts term a ‘debt maturity wall’ over the next 18 to 36 months, requiring them to refinance existing debt at significantly higher prevailing rates. For example, a REIT that previously secured 10-year debt at 3.5% now faces refinancing at rates exceeding 6.0%. This substantial increase in the cost of debt service is a material drag on future FFO projections. According to data compiled by Fitch Ratings, REIT refinancing volumes are expected to increase substantially in 2025 and 2026, creating a period of heightened financial stress for less well-capitalized trusts.

- Erosion of Net Asset Value (NAV): Higher discount rates used due to increased risk-free rates (Treasuries) reduce the calculated Net Asset Value (NAV) of real estate portfolios, placing pressure on stock prices to trade below NAV.

- Increased Operating Costs: Variable-rate debt holders experience immediate pressure on FFO due to floating rate payments, forcing some trusts to cut capital expenditures or even dividends to maintain financial stability.

- Acquisition Slowdown: The spread between capitalization rates (property yields) and the cost of debt has narrowed or inverted in some markets, making it difficult for REITs to execute accretive acquisitions, thus stifling external growth.

The interplay between the S&P 500’s strong performance and the restrictive Federal Reserve policy means that the market is rewarding companies that require less leverage (tech) and penalizing those that inherently rely on it (real estate). This divergence underscores the importance of balance sheet strength and staggered debt maturity schedules for mitigating risk in the current environment.

Sector divergence within the REIT universe

It is crucial to recognize that the term ‘REITs’ covers a vast spectrum of real estate asset classes, each reacting differently to macroeconomic pressures and the S&P 500’s robust rally. The 17.19% gain in the S&P 500 has not been uniformly mirrored across the FTSE Nareit All Equity REITs Index; instead, performance has been highly segmented, reflecting structural shifts in the economy catalyzed by the pandemic and technological acceleration.

Outperforming sectors: Data centers and industrial logistics

Sectors closely aligned with the technology trends driving the S&P 500—namely AI, cloud computing, and e-commerce—have shown resilience and, in some cases, outperformance. Data center REITs, such as Equinix and Digital Realty Trust, benefit directly from the massive capital expenditure cycles of the tech giants. Their underlying cash flows are secured by long-term leases with hyper-scale clients, providing predictable, inflation-linked rental growth independent of traditional real estate cycles. Similarly, industrial REITs, dominated by logistics and warehousing (e.g., Prologis), continue to see strong demand and rental growth due to the ongoing optimization of global supply chains and the relentless expansion of e-commerce.

This structural demand allows these specialized REITs to maintain higher FFO growth rates, justifying valuations closer to those of growth stocks and making them more competitive against the S&P 500’s momentum.

Underperforming sectors: Office and regional retail

Conversely, traditional real estate sectors face significant structural challenges that amplify the negative effects of high interest rates and the competition from the S&P 500. The office sector, struggling with persistent remote work trends, continues to see declining occupancy and rising capital expenditure requirements for tenant improvements. Regional retail centers are also under pressure from e-commerce penetration, even as necessity-based retail shows resilience.

- Office Vacancy Rates: According to CBRE, the national office vacancy rate recently peaked at multi-decade highs, directly impacting the ability of office REITs to maintain or increase rental rates.

- Capital Expenditure Burden: Older office buildings require significant investment to meet modern tenant demands (e.g., ESG standards), diverting capital that could otherwise be distributed as FFO.

- Market Perception: Investors view these sectors as secularly challenged, leading to substantial discounts in their valuation multiples compared to the broader REIT index and the S&P 500.

The stark divergence means that tracking the aggregate REIT index performance provides an incomplete picture. The 17.19% S&P 500 gain has exacerbated the ‘haves’ and ‘have-nots’ within the real estate space, rewarding those trusts with modern, technology-aligned assets and penalizing those burdened by obsolete or cyclically sensitive properties.

Capital flows and the search for yield premium

Amid the S&P 500’s strong performance, capital allocators are rigorously evaluating the required yield premium for holding REITs. The risk-free rate, proxied by the 10-year Treasury yield, serves as the baseline for all investments. As the 10-year yield hovers around 4.6%, investors expect a substantial spread over this rate for the inherent liquidity and operational risks associated with real estate.

Historically, REITs traded at a 150-250 basis point premium over the 10-year Treasury. When this premium compresses, REITs become less attractive. The S&P 500’s rally complicates this further: if the equity market is offering 17.19% total returns, the perceived safety and moderate yield of REITs must be weighed against the potential for massive capital gains elsewhere. This forces REIT management teams to focus intensely on operational efficiency and FFO growth to justify their valuations. Strong operational execution is now essential, not merely desirable.

The role of inflation hedging

One persistent argument for REIT investment, even against a surging S&P 500, is their inherent ability to hedge against inflation. Real estate leases often include embedded rent escalators tied to the Consumer Price Index (CPI), allowing REITs to pass through rising costs to tenants and maintain real asset values. Data from the Bureau of Labor Statistics (BLS) shows core CPI inflation persisting above the Federal Reserve’s long-term 2% target, hovering near 3.5% as of the latest reading. This sustained inflation provides a structural advantage to REITs, particularly those with short lease terms (e.g., self-storage, apartments) or contractual escalators (e.g., healthcare, infrastructure).

If the market perceives the S&P 500 rally as potentially overheating or believes that inflation will remain ‘sticky,’ investors may rotate back into REITs for defensive positioning. Analysts at Goldman Sachs noted that the inflation protection inherent in real estate provides a critical hedge that technology stocks, which rely heavily on multiple expansion, often lack in a prolonged inflationary environment.

Monetary policy expectations and future REIT performance

The trajectory of REIT performance relative to the S&P 500’s 17.19% surge is highly contingent upon future monetary policy decisions. The market consensus, as reflected by CME FedWatch Tool data, currently projects a pause in rate hikes followed by potential cuts in the latter half of the next calendar year. Any clear signal from the Federal Reserve regarding the end of the tightening cycle typically acts as a powerful catalyst for REIT stock prices, often leading to a significant rally.

The ‘Pivot Premium’ and cyclical REITs

Should the Federal Reserve begin easing policy, the cost of debt for REITs would decrease, improving FFO margins and making accretive acquisitions viable again. This scenario would disproportionately benefit cyclical and rate-sensitive REITs, such as residential and regional mall trusts, which have been heavily discounted due to high borrowing costs. The market often prices in these expectations well in advance, creating a ‘pivot premium’ for these trusts.

- Leverage Sensitivity: REITs with higher debt-to-EBITDA ratios stand to gain the most from interest rate cuts, as their interest expense burden is reduced significantly.

- Capital Reallocation: A decline in the risk-free rate (10-year Treasury) would immediately restore the yield premium for REIT dividends, attracting fixed-income oriented capital back into the sector.

- Valuation Rebound: Multiples for discounted sectors like office and retail could see a meaningful expansion, even if underlying operational issues (like remote work) persist, simply due to the improved financial structure.

Conversely, if the Federal Reserve is forced to maintain higher rates for longer—a scenario often referred to as ‘higher for longer’—the pressure on REIT balance sheets and valuations will intensify, further widening the performance gap against the S&P 500. This uncertainty demands a highly selective investment approach, favoring trusts with strong balance sheets and properties in high-demand sectors.

Investment strategies in a divergent market

The significant outperformance of the S&P 500, marked by its 17.19% YTD gain, requires investors to refine their approach to REIT allocation. The traditional ‘buy and hold’ strategy across the entire REIT index may underperform unless focused on specific subsectors demonstrating resilience against both high rates and strong equity competition. The focus must shift from general yield generation to growth-oriented FFO and asset quality.

Focusing on FFO growth and balance sheet strength

Investors should prioritize REITs that can demonstrate organic FFO growth exceeding 5% annually, irrespective of external acquisitions. This organic growth is typically driven by contractual rent escalators, high occupancy rates in supply-constrained markets, or successful property redevelopment. Furthermore, balance sheet health is paramount. Trusts with low leverage (net debt-to-EBITDA below 6.0x) and low exposure to near-term debt maturities are better insulated against the ‘higher for longer’ rate scenario and hold dry powder for opportunistic acquisitions should weaker players falter.

The market environment created by the S&P 500’s surge demands a nuanced understanding of real estate fundamentals. The success of a REIT is no longer merely about collecting rent; it is about managing capital structure efficiently in a high-rate world and possessing assets with secular demand drivers that can compete with the narrative of technology-led growth. Investors may consider overweighting specialized sectors like cell towers, industrial logistics, and high-quality residential properties in high-growth U.S. markets, while maintaining an underweight stance on cyclically challenged segments like non-prime office and regional retail, until clearer signs of interest rate normalization emerge.

Ultimately, the S&P 500’s rally serves as a benchmark of opportunity cost. For REITs to close the performance gap, they must either benefit from a Federal Reserve pivot that lowers their cost of capital or prove that their underlying real estate assets possess sufficient structural growth to justify their current valuations against a 17.19% return backdrop.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| S&P 500 YTD Gain (17.19%) | Increases the opportunity cost of capital for REITs; requires REITs to deliver higher total returns to compete with broad equity markets. |

| Federal Funds Rate (5.25%-5.50%) | Elevated borrowing costs erode FFO margins and increase refinancing risk, especially for trusts with high leverage profiles. |

| REIT Sector Divergence | Technology-aligned sectors (Data Center, Industrial) outperform due to secular demand, while Office and Retail sectors face structural headwinds. |

| 10-Year Treasury Yield (~4.6%) | Compresses the required yield premium for REITs, reducing their relative attractiveness compared to risk-free fixed income assets. |

Frequently asked questions about S&P 500 gains and REIT performance

The 17.19% YTD S&P 500 gain increases the opportunity cost, leading investors to demand higher relative growth or yield from REITs. This pressure often results in lower Price-to-FFO multiples for REITs, particularly those with modest FFO growth projections, as capital chases higher returns elsewhere.

No. Sectors with strong, specialized demand drivers like data centers and cell towers are less rate-sensitive due to their structural growth and long-term contracts. Conversely, highly leveraged or cyclical sectors like office and certain residential trusts are much more vulnerable to rising borrowing costs and refinancing risk.

Investors should prioritize balance sheet strength, specifically the Net Debt-to-EBITDA ratio, aiming for figures below 6.0x. A strong balance sheet provides resilience against prolonged high interest rates and allows management to capitalize on market dislocations without resorting to dilutive equity raises.

Not necessarily. While the S&P 500 offers higher short-term capital gains, REITs provide essential inflation protection and diversification. High-quality real estate assets with CPI-linked leases remain valuable long-term holdings, especially if the Federal Reserve maintains rates ‘higher for longer’ to combat persistent inflation.

A Federal Reserve rate cut would be a significant positive catalyst. It would immediately lower the cost of debt for REITs, expanding FFO margins and reducing the attractiveness of competing fixed-income securities, potentially triggering a broad rally, especially in heavily discounted cyclical REIT sectors.

The bottom line: navigating the divergence

The S&P 500’s remarkable 17.19% year-to-date performance is a testament to the concentrated growth power of key U.S. technology firms, setting a high bar for all other asset classes, including Real Estate Investment Trusts. For REITs, this environment is defined by severe divergence: specialized trusts aligned with technology and demographic trends (data centers, industrial logistics, certain healthcare segments) continue to thrive, leveraging secular growth to justify strong valuations. Conversely, rate-sensitive and structurally challenged sectors, predominantly office and some retail segments, face compounding pressures from high interest rates and increased competition for capital. Institutional investors are not abandoning real estate, but they are applying rigorous scrutiny, prioritizing balance sheets with low leverage and FFO growth that can credibly exceed the cost of capital in a restrictive monetary policy regime. Moving forward, market participants must closely monitor the trajectory of the 10-year Treasury yield and any definitive signals from the Federal Reserve regarding future rate cuts; a pivot remains the most powerful potential catalyst to narrow the performance gap between the high-flying S&P 500 and the foundational, yield-focused REIT sector.