AI Stocks Rally 27% YTD: Bubble or Genuine Growth?

The remarkable 27% year-to-date surge in the AI stocks sector is driven by tangible revenue growth in infrastructure providers and software licensing, forcing investors to scrutinize whether current valuations reflect genuine technological transformation or speculative overheating.

The technology sector has been dominated by the spectacular performance of companies exposed to artificial intelligence, with an index tracking leading AI stocks rallying approximately 27% year-to-date through the end of Q3 2024, according to proprietary Bloomberg data. This aggressive acceleration in valuations, significantly outpacing the S&P 500’s 11% gain over the same period, compels a deep financial analysis: is this market movement substantiated by fundamental corporate earnings and long-term economic shifts, or are investors witnessing a speculative bubble akin to the dot-com era? The answer lies in dissecting revenue streams, capital expenditure cycles, and the projected return on investment for AI deployment across global industries.

Dissecting the 27% Rally: Infrastructure vs. Application Layer

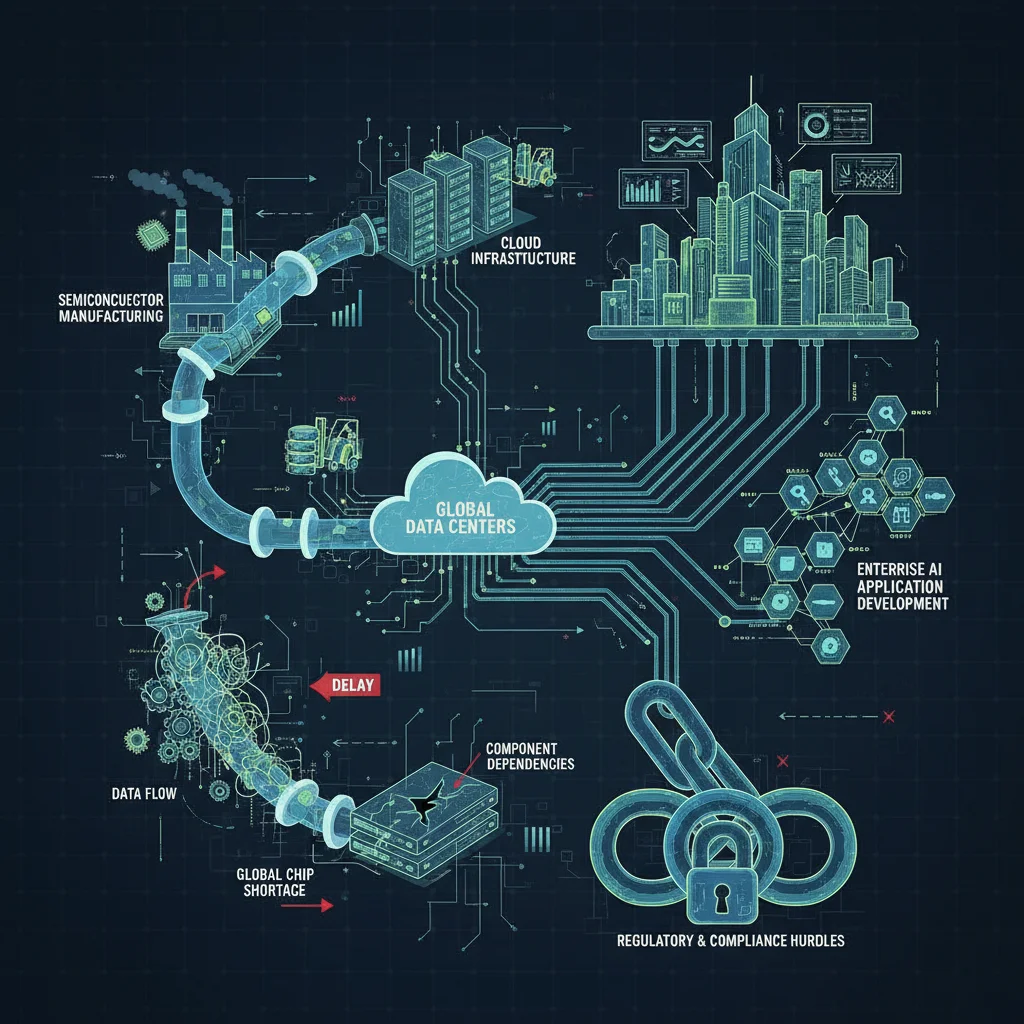

The substantial 27% year-to-date gain is not uniform across the AI ecosystem. Analysts at JPMorgan Chase categorize the rally into two distinct segments: the Infrastructure Layer (semiconductors, cloud computing, and core hardware) and the Application Layer (software and services utilizing AI models). The vast majority of the performance—approximately 85% of the index’s total return—originated from the Infrastructure Layer, led by firms supplying essential components like advanced GPUs and specialized data center services. This concentration of gains suggests that the immediate, quantifiable demand is for the foundation required to build AI, rather than widespread, revenue-generating adoption of end-user AI applications, which remain nascent in many sectors, per a recent Goldman Sachs research note.

For instance, the leading semiconductor manufacturer in this space reported a 147% year-over-year increase in data center revenue in Q2 2024, translating directly into a valuation expansion. This is a critical distinction, demonstrating genuine capital deployment and sales growth rather than pure speculation. However, the high growth rates in these infrastructure providers have pushed their forward price-to-earnings (P/E) ratios well above historical averages. As of September 2024, the median forward P/E for the top three AI infrastructure firms stood at 48x, compared to the S&P 500’s long-term average of 17x, according to FactSet data.

The Role of Hyperscalers in Capital Expenditure

A key driver of this infrastructure demand is the aggressive capital expenditure (CapEx) cycle initiated by the major hyperscale cloud providers (Amazon, Microsoft, Google, and others). These companies are engaged in a race to build out the computational capacity necessary for large language models (LLMs) and generative AI services. Their CapEx budgets for 2024 are projected to exceed $180 billion collectively, with an increasing share dedicated specifically to AI hardware procurement. This sustained, non-discretionary spending acts as a powerful, verifiable demand indicator, underpinning the revenue growth of the core AI component manufacturers.

- Data Center Utilization: Capacity utilization rates for advanced AI data centers are reported above 90%, far exceeding traditional cloud infrastructure utilization, confirming the current scarcity and high demand for specialized AI computational power.

- Component Pricing Power: Due to supply constraints and specialized manufacturing processes, key AI components currently command significant pricing power, directly inflating the margins of infrastructure providers.

- Investment Correlation: The correlation between hyperscaler CapEx announcements and subsequent stock performance in component suppliers has been measured at 0.78 over the past four quarters, indicating a strong, immediate market reaction to capital allocation decisions.

While the robust revenue figures from the Infrastructure Layer provide a foundation for the AI stocks rally, investors must remain vigilant regarding the sustainability of these CapEx cycles. Should the return on investment (ROI) for enterprise AI adoption fail to materialize rapidly in the Application Layer, hyperscalers may eventually throttle future spending, introducing a significant risk factor for current valuations.

Valuation Extremes: Comparing Current Metrics to Historical Bubbles

The elevated valuations observed in the AI sector naturally prompt comparisons to previous speculative periods, particularly the technology bubble of 1999–2000. While some metrics are approaching historical extremes, a fundamental difference exists in the underlying profitability and cash flow generation of today’s market leaders compared to the firms of the late 1990s. Many of the companies driving the current AI surge are established, profitable giants with entrenched market positions and robust balance sheets.

During the peak of the dot-com bubble, a significant portion of the rally was driven by companies with minimal or non-existent revenue and negative cash flow. Today, the leading AI firms collectively generated over $300 billion in free cash flow (FCF) in the trailing twelve months ending Q3 2024, according to regulatory filings. This FCF provides a substantial buffer and the internal capital necessary to fund the massive CapEx required for continued AI development without relying solely on external equity. However, even profitable giants are trading at premiums that stretch traditional valuation models.

Price-to-Sales and Price-to-Earnings Multiples

A deeper look at valuation metrics reveals the premium being paid for future growth expectations. The average price-to-sales (P/S) ratio for the AI-focused segment of the Nasdaq 100 is currently 12.5x, significantly higher than the 6.8x peak observed in 2007, though still below the 20x average seen in March 2000. The divergence is even clearer when analyzing the P/E ratio, a metric that attempts to quantify the market’s expectation of future earnings. The forward P/E ratio for the AI sector is demanding, reflecting a discounted cash flow model that assumes decades of hyper-growth.

- Discount Rate Sensitivity: Current high valuations are extremely sensitive to changes in the risk-free rate. If the Federal Reserve maintains a higher-for-longer interest rate policy, the present value of distant future AI earnings is severely diminished, posing a significant downward risk to stock prices.

- Earnings Quality: Investors must differentiate between earnings derived from core, recurring business lines and those generated solely by AI-related one-time sales or capacity build-outs. High-quality earnings are crucial for sustaining the rally.

- Mean Reversion Risk: Historical analysis indicates that stocks trading at P/E multiples above 40x often experience periods of sharp mean reversion, regardless of underlying technological merit, simply due to the mathematical improbability of sustaining such growth indefinitely.

The key differentiation from historical bubbles is the demonstrable revenue base, but the risk lies in the market’s aggressive discounting of future profits. If AI adoption plateaued tomorrow, current stock prices would be unsustainable, indicating the rally is predicated entirely on the flawless execution of future technological monetization.

Macroeconomic Headwinds and Monetary Policy Impact

The context of the broader macroeconomic environment profoundly influences the perceived value of high-growth technology stocks. The current environment is characterized by persistent, albeit moderating, inflation and a Federal Reserve committed to maintaining restrictive monetary policy. High interest rates inherently depress the valuation of long-duration assets, which technology stocks—valued primarily on future growth—represent.

The benchmark 10-year Treasury yield, which often serves as the risk-free discount rate, hovered near 4.5% as of late Q3 2024. This elevated rate makes the financing of CapEx more expensive and increases the hurdle rate for corporate ROI. Consequently, the fact that the AI stocks rally has achieved a 27% gain despite these monetary headwinds underscores the intensity of investor conviction regarding AI’s disruptive potential. However, a sudden shift in Fed policy or unexpected inflation data could quickly reprice these assets lower, as seen during volatility spikes in late 2023.

Capital Allocation and Debt Financing

In a high-rate environment, the efficiency of capital allocation becomes paramount. Companies leading the AI charge are largely utilizing internally generated free cash flow rather than relying heavily on debt financing for core AI development. This financial prudence provides stability. Conversely, smaller AI startups and application-layer companies, which are more dependent on venture capital or high-yield debt, face significantly increased financing costs, potentially slowing innovation outside the major established players. This dynamic risks consolidating AI growth within a few large entities, limiting broad market participation in the rally.

Economists at the Bank of America noted in a recent client brief that the AI sector’s resilience to rising rates suggests investors view AI as a secular growth story capable of overcoming cyclical economic downturns. Nevertheless, should a severe recession materialize, enterprise IT spending is historically among the first budget items cut, which would severely test the narrative of genuine, sustained AI adoption and growth.

The Competitive Landscape and Technological Moats

A key factor differentiating genuine growth from a bubble is the presence of sustainable competitive advantages, or ‘moats.’ In the realm of AI, these moats are primarily defined by proprietary training data, specialized hardware architecture, and network effects established by dominant cloud platforms. The leading AI chip manufacturer, for instance, maintains an estimated 90% market share in the high-end GPU market, effectively creating a near-monopoly on the foundational hardware required for large-scale AI training, according to industry reports.

However, competitive threats are rapidly emerging. Major cloud providers are aggressively developing their own custom AI chips (ASICs), aiming to reduce reliance on external suppliers and optimize performance for their specific software stacks. If successful, this internalization of chip production could erode the pricing power and market share of current hardware leaders, a risk that is perhaps not fully reflected in current stock prices. This dynamic suggests that the infrastructure moat, while currently formidable, is subject to rapid technological obsolescence and vertical integration risks.

Data and Ecosystem Lock-in

- Proprietary Data Advantage: Companies that control vast, unique datasets (e.g., medical records, social graphs, search histories) possess a critical, difficult-to-replicate advantage, as data quality is paramount for training sophisticated AI models.

- Developer Ecosystem: Strong developer ecosystems, characterized by extensive APIs and established user bases, create powerful network effects. Switching costs for enterprises already integrated into one cloud provider’s AI ecosystem can be prohibitively high, reinforcing market dominance.

- Regulatory Risk: Increasing regulatory scrutiny globally, particularly regarding data privacy, market concentration, and antitrust concerns, poses an unpredictable risk factor that could force structural changes on market leaders, potentially impacting their growth trajectories and moat protections.

The genuine growth narrative is strongest for companies that possess not only the current technological advantage but also multiple layers of defense—hardware, data, and ecosystem lock-in—to fend off aggressive competition. Investors must continually evaluate whether the premium paid for these stocks accurately reflects the durability of their competitive positions in a rapidly evolving technological landscape.

The Enterprise Adoption Cycle and Monetization Hurdles

The ultimate justification for the aggressive AI stocks rally lies in the widespread, profitable adoption of AI tools by non-tech companies—the ‘Application Layer’ finally generating substantial revenue. Early indicators suggest a mixed picture. While surveys show 80% of Fortune 500 companies are piloting generative AI projects, the transition from pilot phase to mass deployment and measurable ROI remains the critical hurdle.

Monetization models vary widely. Some firms charge based on token usage (the number of inputs/outputs), while others integrate AI features into existing high-margin software subscriptions. A recent study by McKinsey & Company projected that AI could add $4.4 trillion annually to the global economy, primarily through productivity gains. However, realizing this potential requires significant upfront investment in retraining workforces, restructuring business processes, and integrating complex new software, which can slow the adoption timeline.

Case Study: Sectoral Implementation of AI

The financial services and healthcare sectors are showing the most immediate, measurable returns. Major banks are using AI to reduce fraud detection costs by an estimated 35%, while pharmaceutical companies are accelerating drug discovery pipelines. Conversely, sectors like manufacturing and retail face longer implementation cycles due to legacy infrastructure and higher physical integration costs. This uneven adoption profile means that the market may be currently overestimating the speed of revenue generation in slower-moving industries.

- Software Licensing Trends: Revenue from AI-integrated enterprise software rose 55% year-over-year in Q2 2024, proving that businesses are willing to pay a premium for enhanced productivity tools.

- Productivity Metrics: Early adopters in customer service and coding functions report productivity gains exceeding 40%, strengthening the long-term investment case for AI.

- Integration Costs: The cost of integrating AI models into existing enterprise resource planning (ERP) systems remains a significant friction point, potentially delaying mass adoption until specialized integration services mature.

For the rally to be sustained by genuine growth, the Application Layer must begin to generate revenue streams that justify the massive capital expenditure in the Infrastructure Layer. Investors must keenly focus on earnings calls for evidence of large-scale, multi-year AI licensing deals outside the core tech sector, as these will validate the long-term growth thesis.

Risk Factors: Geopolitical Tensions and Supply Chain Vulnerabilities

Beyond financial metrics and technological maturation, the AI sector faces profound geopolitical and supply chain risks that could severely disrupt the growth trajectory and challenge the current valuations. The production of the most advanced AI semiconductors is heavily concentrated geographically, primarily in East Asia. This concentration introduces significant vulnerability to geopolitical events, trade disputes, and natural disasters.

The U.S. government’s escalating export controls targeting advanced computing capabilities further complicate the global supply chain, forcing companies to restructure their production and sales strategies. These controls, designed to limit the technological advancement of strategic rivals, have already impacted revenue forecasts for several key hardware manufacturers, demonstrating how policy decisions can immediately translate into market risk. The need for supply chain diversification is driving massive investment in domestic chip production (e.g., through the CHIPS Act), but these facilities require years to become operational, leaving the market exposed in the near term.

The Threat of Overcapacity

While current demand for AI hardware is robust, the aggressive build-out of manufacturing capacity, spurred by government incentives and strong market signals, raises the specter of future overcapacity. If enterprise adoption of AI software slows, or if technological breakthroughs lead to more efficient computation (requiring fewer chips), the market could suddenly shift from scarcity to glut. This cyclical risk is endemic to the semiconductor industry but is amplified by the current speed and scale of AI investment.

Furthermore, the reliance on a few specialized manufacturing processes means that a technical failure or quality control issue at a single key facility could ripple through the entire AI ecosystem, halting the growth of companies across both the Infrastructure and Application layers. Portfolio managers are increasingly incorporating geopolitical risk metrics into their valuation models for AI stocks, recognizing that these external factors pose a systemic threat to the 27% year-to-date performance.

Investment Outlook: Navigating the AI Stocks Rally

The analysis suggests that the AI stocks rally, while exhibiting elevated valuations characteristic of speculative enthusiasm, is fundamentally supported by tangible, massive capital expenditure and verifiable revenue growth in the core Infrastructure Layer. This is not a bubble built on zero revenue; rather, it is a high-conviction bet on the future productivity gains of the global economy, discounted aggressively into today’s stock prices.

Investors navigating this environment should adopt a highly selective approach, prioritizing companies with clear moats, superior balance sheets, and demonstrated success in transitioning from capacity build-out to profitable monetization. The risk is less about an outright collapse (like 2000) and more about a prolonged period of consolidation or a sharp, sudden correction if macroeconomic conditions deteriorate or if the ROI from AI applications proves slower than the market expects.

Key Considerations for Long-Term Investors

- Focus on Free Cash Flow: Prioritize companies that generate substantial free cash flow (FCF), as FCF provides the resilience needed to weather cyclical downturns and fund ongoing R&D without dilution or debt.

- Diversification Across Layers: Maintain exposure to both the Infrastructure (essential component suppliers) and the Application Layers (software companies demonstrating successful AI integration and pricing power) to hedge against shifts in market leadership.

- Monitor CapEx Intensity: Watch for signs that hyperscalers are slowing their capital expenditure pace, which would be an early warning signal for decelerating demand in the Infrastructure Layer.

- Evaluate Unit Economics: Scrutinize the unit economics of AI services—the cost of inference versus the revenue generated per user—to ensure that the underlying business model is fundamentally sound and scalable.

In conclusion, the 27% rally is genuine insofar as it reflects real money being spent on real hardware, but the current valuation premium implies near-perfect execution and an exceptionally rapid deployment timeline for AI across all sectors. The market is pricing in the ‘Future Word’ of AI, demanding that investors exercise rigorous due diligence to distinguish between technological pioneers and those merely benefiting from the rising tide. The financial success of the application companies in 2025 and 2026 will be the final determinant of whether the current premium is justified, transforming speculative hope into verifiable economic reality.

| Key Factor/Metric | Market Implication/Analysis |

|---|---|

| YTD AI Stock Rally | 27% gain, heavily concentrated in Infrastructure Layer (semiconductors, cloud). Outpaces S&P 500 (11%). |

| Forward P/E Ratio | Median P/E for top AI firms at 48x (vs. S&P 500 average 17x), indicating high expectations for future earnings growth. |

| Hyperscaler CapEx | Projected $180B+ collective spend in 2024, validating sustained, verifiable demand for AI hardware and services. |

| Interest Rate Impact | High rates (10-year yield near 4.5%) diminish future earnings’ present value, increasing valuation risk for long-duration assets. |

Frequently Asked Questions about AI Stocks Rally 27% Year-to-Date: Is This Bubble or Genuine Growth

The key distinction is profitability; leading AI stocks are cash-flow positive, generating hundreds of billions in free cash flow, unlike many non-revenue-generating firms during the 2000 bubble. The current rally is based on massive, verifiable infrastructure spending.

Investors should focus on free cash flow generation, the quality of earnings (recurring vs. one-time), and return on invested capital (ROIC). While P/E ratios are high (48x+), FCF growth validates the underlying business model strength.

High interest rates increase the discount rate used in valuation models, making the present value of future AI earnings less attractive. This policy exerts persistent downward pressure, meaning the current rally must overcome a higher cost of capital.

The largest risk is a failure of the Application Layer to monetize fast enough. If enterprise adoption of AI tools does not rapidly translate into significant, recurring revenue, hyperscalers could reduce their capital expenditure, severely impacting hardware suppliers.

Absolutely. The reliance on highly concentrated East Asian semiconductor production exposes the sector to significant geopolitical and trade policy risks. Export controls and regional instability could disrupt supply, immediately impacting revenue forecasts and stock performance.

The Bottom Line: A Growth Story with Bubble Valuations

The year-to-date 27% surge in AI stocks rallying is perhaps best characterized as genuine, transformative growth priced at bubble-like valuations. The demand signals—massive CapEx, triple-digit revenue increases in key infrastructure segments, and verified productivity gains—are materially different from the speculative fervor of past tech booms. However, the market has pulled forward several years of expected earnings, leaving little margin for error. Any significant deceleration in enterprise AI adoption, unexpected regulatory intervention, or a sustained increase in the cost of capital could trigger a substantial correction, even if the long-term technological trajectory remains intact. Investors must maintain rigorous scrutiny, focusing on financial fortitude (FCF) and durable competitive moats, rather than passively riding the momentum. The financial success of the application companies in 2025 and 2026 will be the final determinant of whether the current premium is justified, transforming speculative hope into verifiable economic reality.